Dear Survivor,

One of my best business experiences was serving fish and chips and scooping ice cream at Oxford Creamery in Mattapoisett, MA, where I grew up.

I remember feeling anxious before each shift, knowing I’d be missing out on some fun with my friends, and knowing how slammed work would be. That was especially true on a Friday night when the fish and chips special (with fresh cod from the boats in New Bedford) was the best around.

With the line out the door, I had no time to think about missing out on fun with my friends. Waiting on a group of hungry customers fresh off the beach focuses the mind, so to speak.

Oxford was old school. No cash registers, no computer system, no credit cards. A place Kenny Chesney would love: no shoes, no shirt, no problems, as far as the customer was concerned.

“Gimme two fish and chips, a lobster roll, cheeseburger with lettuce, tomato, onions, mustard and relish, a plain hamburger, a hot dog with ketchup, two small fries, two coffee frappes, and three diet cokes,” said the customer.

“Small or large diet cokes?” I’d ask.

“Medium.”

“Sorry, we only have small and large.”

“Why?”

“Hey, Carol, what size soda you guys want?” he’d yell. “They only have small and large.”

“Why?”

“Just give me two smalls and a large.”

“OK, will that be all?” I said.

“Gimme a stuffed quahog too.”

And here’s what my order pad would look like:

- 2 F+C

- LR

- CB w (works)

- HB pl

- HD k

- 2 FF sm

- 2 CF Fr

- 3 DC lg

- 2 DC sm

- 1 DC lg

- Q

Adding up the tab in my head or on a piece of scrap paper, taking his cash, and counting it back like a bank teller with sticky hands, I’d walk back to the grill, stick the order in the slide above the grill and call out a few items as a heads up.

When the food orders slowed, then the ice cream orders picked up as the Little League teams and anyone else out for a drive came in. The door was locked at ten, music was turned up, floors were washed, and we were done at 11.

Today, thanks to government overreach, Covid has wiped out the sweat equity small businesses built up over years of serving customers. The lost equity was backfilled by government transfer payments resembling a town dump—full of smoldering, wasted dollars—that stinks to high heaven.

Who’s going to help the customers when everyone is paid to be one? Who’s going to learn life skills when it’s just as easy to stay home and play video games? We know the Feds have no idea places like Oxford even exist.

Thankfully, some states are doing more than just speaking up. They’re taking charge, trying to keep dirty money out of your life.

With a summer job, you learn a lot more than making money. You learn there’s nothing better than a CB w/FF sm/ CF fr after a Friday night shift at Oxford. TGIF

STUFF is BOILING OVER: Are You Paying Attention?

Listen up, are you paying attention? Stuff is boiling over around the world. It’s time you prepare accordingly. In talking with a client recently, we discussed whole life insurance. I don’t love it. I much prefer term life which we both agreed on (for me, I just want it until my kids are out of college). He said, “You know, that’s exactly what Peter Lynch used to recommend.”

You remember Peter Lynch, don’t you? Author of One Up on Wall Street and famed manager of the Fidelity Magellan fund? His name was legendary in the halls of Fidelity when I was working there (Fidelity #1). In thinking about Mr. Lynch, I read this interview he gave with PBS back in the mid-90s. He was talking about 1990—a year that ABSOLUTELY reminds me of today—one that he refers to as the scariest time ever to be a money manager.

Here’s part of the interview transcript:

Q: Was that the most scared you ever were in your career?

A: ’87 wasn’t that scary because I concentrate on fundamentals. I call up companies. I look at their balance sheet. I look at their business. I look at the environment. The decline was kinda scary and you’d tell yourself, “Will this infect the basic consumer? Will this drop make people stop buying cars, stop buying houses, stop buying appliances, stop going to restaurants?” And you worried about that.

The reality, the ’87 decline was nothing like 1990. Ninety, in my 30 years of watching stock very carefully, was by far the scariest period.

Q: What was so scary about 1990?

A: Well, 1990 was a situation where I think it’s almost exactly six years ago approximately now. In the summer of 1990, the market’s around 3000. Economy’s doing okay. And Saddam Hussein decides to walk in and invade Kuwait. So we have invasion of Kuwait and President Bush sends 500,000 troops to Saudi to protect Saudi Arabia. There’s a very big concern about, you know, “Are we going to have another Vietnam War?” A lot of serious military people said, “This is going to be a terrible war.” Iraq has the fourth largest army in the world. They really fought very well against Iran. These people are tough. This is going to be a long, awful thing. So people were very concerned about that, but, in addition, we had a very major banking crisis. All the major New York City banks, Bank America, the real cornerstone of this country were really in trouble. And this is a lot different than if W.T. Grant went under or Penn Central went under. Banking is really tight. And you had to hope that the banking system would hold together and that the Federal Reserve understood that Citicorp, Chase, Chemical, Manufacturers Hanover, Bank of America were very important to this country and that they would survive. And then we had a recession. Unlike ’87 you called companies, in 1990 you called companies and say, “Gee, our business is startin’ to slip. Inventories are startin’ to pile up. We’re not doing that well.” So you really at that point in time had to belief the whole thing would hold together, that we wouldn’t have a major war. You really had to have faith in the future of this country in 1990. In ’87, the fundamentals were terrific and it was — it was like one of those three for two sales at the K-Mart. Things were marked down. It was the same story.

When stuff is boiling over you need to take action to secure your finances. Don’t let inertia paralyze you into doing nothing. I’m here to help.

Time to Prepare: Big Time Summer Migration is On

Time to prepare. The summer migration is on, big time. The threat of gas shortages has everyone running on a full tank of 87 octane, preparing to cram two summers into one as if there’s a BOGO deal. Everyone’s going to the beach with loaded coolers and hot heads. Pay attention because nerves are frayed.

You’re telling me traffic on I-95N is crazy, hotel prices are up, and if you don’t have a reservation, good luck finding a room. The help wanted signs are everywhere as anxious patrons (that’s being too kind) wait impatiently to be served. Is there any wonder workers are taking the summer off with the Biden/Harris free money on tap and the country reopening thanks to the Trump vaccine?

Who wants to spend the summer in Cuomo/de Blasio’s NYC? Those doing remote work have moved on. Will big cities ever be the same? If it’s up to the teachers unions, they won’t. They’d prefer to Zoom from home too. The escape from the city will continue.

In The Wall Street Journal, Alistair MacDonald explains the damage that has been done to big cities by COVID shutdowns. He writes:

Dan Barker had barely finished rejoicing that London’s “mad umbrella shop” had survived the pandemic when his wife broke some bad news: The “mad sailor shop” had not.

Next month, Arthur Beale Ltd., a nearly 500-year-old business that sells maritime supplies from central London, is set to close a store famed for its elaborate window displays and eccentric interior. After surviving great fires, bubonic plague and Nazi bombing raids, successive Covid-19 lockdowns and a huge repair bill have sunk a store that was already listing from changing shopper habits, its owners said.

Up-anchor

London is emerging from its third lockdown, and locals are casting nervous glances to see which of their favorite stores have survived the pandemic. The fate of Arthur Beale is highlighting fears that Covid-19 may have changed their city forever.

Beautiful places are booming. Real estate prices are untethered. The law of supply is king. And unless you’ve been living in Joe’s basement, you’ve noticed the shortage. One realtor interviewed in the Sunday Boston Globe believes it will take three to four years to work through the pent-up demand. Then what?

The bottleneck at sawmills isn’t getting any better as mill owners hesitate to expand because (a) it’s too expensive, (b) the labor shortage, and (c) because they got burned in the last real estate crash. Baby Boomers flush with cash are bidding five to six figures over ask because “they want their dream home and because they can.”

And the stock market? It goes up until it doesn’t. Every. Single. Time. And today, market enthusiasts follow stocks closer than their favorite team (remember them?).

Make sure your woodshed is full. The good times don’t last forever. Time to prepare.

Are You The Intelligent Investor You Deserve to Be?

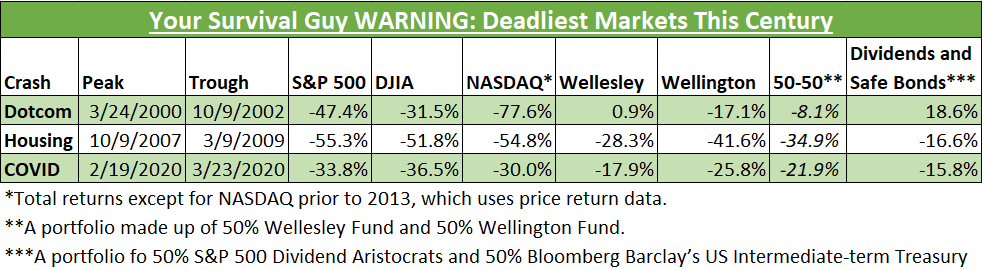

When it comes to your money, I want you to be a survivor. As you can see in my table, stocks have declined by over 30% three times already in this young century, and I’m talking about blue-chip stocks in the Dow Jones Industrial Average. When we look at the tech-laden NASDAQ and the S&P 500, declines have been far more precipitous—declines as high as 68% and 55% respectively. Moving forward, your job will be to survive the wreckage. I’m here to help.

In my table below, you’ll see the performance of the Vanguard Wellesley and Wellington funds during these tumultuous periods in history. The allocation of the former is roughly 60/40 bonds/stocks, while the latter is 40/60—an equal combination of the two is about 50/50 bonds stocks. (Note: I prefer buying individual stocks and bonds today to control dividend yields and maturity dates.)

Turning to Chapter 8, p. 94 of the fourth revised edition of The Intelligent Investor by Benjamin Graham copyright ©1973.

We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums. According to tradition the sound reason for increasing the percentage in common stocks would be the appearance of the “bargain price” levels created in a protracted bear market. Conversely, sound procedure would call for reducing the common-stock component below 50% when in the judgment of the investor the market level has become dangerously high.

These copybook maxims have always been easy to enunciate and always difficult to follow—because they go against that very human nature which produces that excesses of bull and bear markets. It is almost a contradiction in terms to suggest as a feasible policy for the average stockowner that he lighten his holdings when the market advances beyond a certain point and add to them after a corresponding decline. It is because the average man operates, and apparently must operate, in opposite fashion that we have had the great advances and collapses of the past; and —this writer believes—we are likely to have them in the future.

You NEVER want to be in the interest rate prediction business. Follow the guidelines illustrated above and chances are you’ll Survive & Thrive.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Twitter, Instagram, and Facebook.

P.S. Recently, clients were in town. The Mooring restaurant in Newport, RI, was packed. I looked to see if there was a graduation. No, just a nice day. Imagine what 4th of July, the official start of summer in Newport, is going to look like.

As an aside, I checked out Clarke Cooke House after my meeting to book a table for any Friday or Saturday night. No go. They’re booked well into June—as far out as Resy was accepting them. Better call direct.

How about the dining experience? Excellent. But, on a recent trip to Boston, we learned you need to guard your table like a hawk as servers swoop in to take your scraps and move you along before the 90-minute Covid seating restriction expires. Time’s a tickin’. And then, when dinner’s over, as if in a Fauci fairy tale 8:15pm is the new midnight. There’s nowhere to go.

The next night, Your Survival Guy, seated for dinner at 5:30 because it’s all they had, decided he wasn’t going to be pushed around anymore. That was until the manager decided to kick us to the street because we were way past the Covid time limit. With not a cab in sight or a striking Uber on my app, we walked back to the hotel.

Thinking about what’s here to stay and what’s not feels like a fool’s errand. Stock prices are high, real estate is booming, restaurant tabs are a fortune (as are hotel rooms), lumber prices are way up, and anything else you can imagine. But there’s no inflation, right?

Fear of missing out raises prices for “must have” starter, and “rare” vacation, homes, as well as for 1031 exchanges up against deadlines. Anecdotally, where cooler heads prevail, a successful business owner/client tells me he saw three projects canceled last week alone because the numbers didn’t work. Remember them?

Speaking of higher prices, tell that to the Boston Globe breathlessly reporting on the exciting (to them) approval of a wind farm off Martha’s Vineyard loaded with Biden government subsidies. Green light.

Green light, red light. Who knows which one is next? Secure your future where your money is treated with the respect it deserves. Your spot awaits. But only if you’re serious.

P.P.S. Amy Swearer reports in the Daily Signal on what Americans should know about the Second Amendment case (New York State Rifle & Pistol v. Corlett) the Supreme Court will soon hear. She writes (abridged):

1. This case is about the right to carry firearms in public.

New York State Rifle & Pistol Association v. Corlett provides the Supreme Court with the opportunity to address a very important question it so far has declined to answer: When the Second Amendment protects the right to bear arms, does it mean a right to bear a handgun in public for purposes of self-defense?

According to New York and a handful of other gun control-friendly states, the answer has been a resounding no. In these states, the right to “bear” arms has been effectively restricted to a right to possess and handle a gun in your home, and nothing more.

If you want to protect yourself with a firearm in public, the state considers it a privilege you can exercise only after showing “good cause” above and beyond a desire to protect yourself from crime in general.

In essence, law-abiding citizens in these states have no right to “bear” arms outside their homes.

The petitioners in the new case include two New York residents who have extensive experience and training with firearms. Both applied for and were denied carry permits for their firearms because they did not “face any special or unique danger to [their] life.”

2. ‘Good cause’ and ‘may issue’ requirements have racist roots.

For the first 70 or so years after the Constitution was ratified, Americans undeniably maintained a general right to bear arms in public, with perhaps some state authority to regulate the mode of carry.

A minority of states eventually prohibited or heavily regulated the act of carrying a concealed firearm in public. But no state completely eradicated an ordinary citizen’s ability to carry some type of firearm in public in some manner without first having to seek permission from the government.

Well, all white Americans enjoyed a right to bear arms in public.

Laws heavily regulating the public carry of firearms were, like all early forms of restrictive gun control, reserved for the subjugation of slaves and other individuals who were, at the time, legally considered as falling outside of “the People” of the United States.

Even after slavery was abolished and the 14th Amendment forbade race-based gun restrictions, many southern states looked to racially neutral but highly discretionary gun control laws to effectively disarm black citizens.

3. Public carry will not turn us into the ‘Wild West.’

Many gun control advocates insist that if the Supreme Court strikes down “good cause” requirements then the nation will be turned into a “Wild West” of gun violence.

In other words, the Second Amendment shouldn’t protect a right of ordinary citizens to bear arms in their own defense, because ordinary citizens largely are incapable of acting in a reasonable manner when armed in public.

Decades of plain data show just the opposite.

Between 1990 and 2000, 16 states changed their concealed carry laws from either “no issue” or “may issue” to “shall issue” permitting. During that time, national rates for violent crime, homicide by gun, and other gun crime plummeted.

Since 2000, the trend toward more permissible public carry laws not only continued (42 states and the District of Columbia are either “shall issue” or “permitless carry”), but public interest in obtaining permits skyrocketed. Over 19 million American adults now possess a concealed carry permit, up from roughly 3 million adults in 2000.

Even though the Supreme Court has gotten more conservative, there is no guarantee it will side with the Second Amendment advocates in this case. Get your guns and your training now.

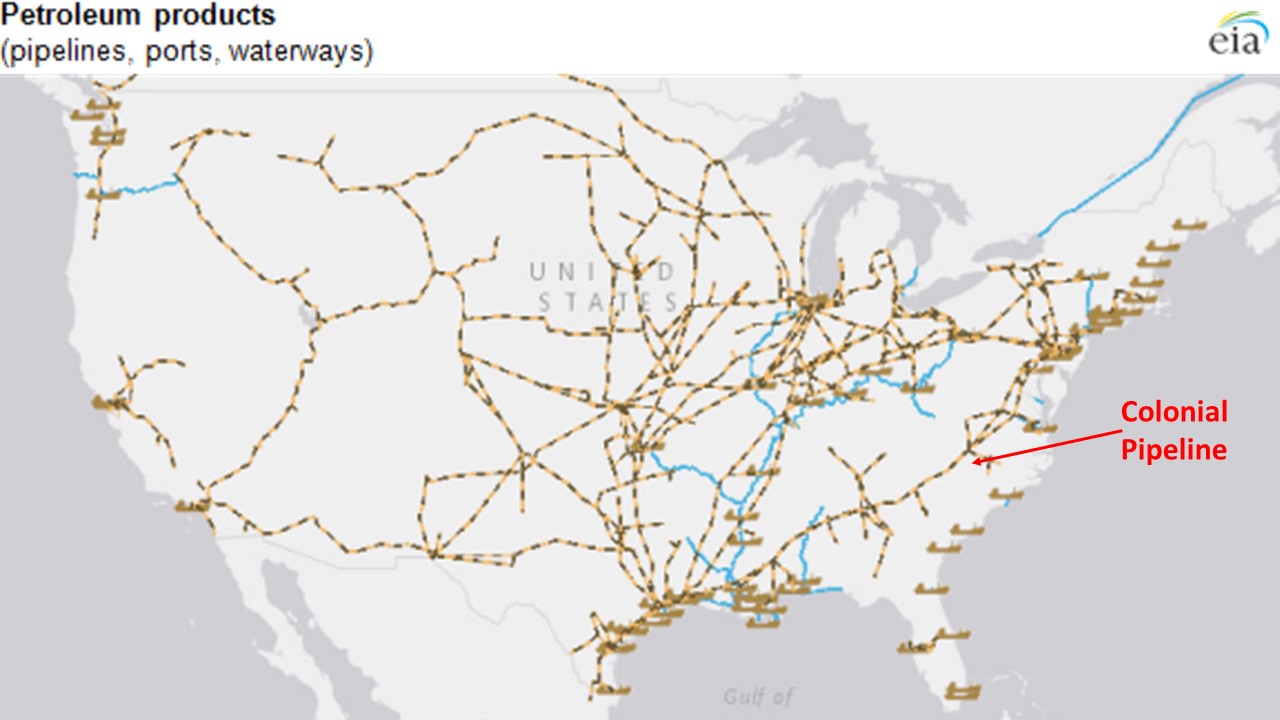

P.P.P.S. How could a group of hackers on the other side of the world bring down the gasoline supply for most of the Eastern Seaboard of the United States?

As you can see on the map below, there are very few refined product pipelines running up the very populated areas of the East Coast.

Years of environmentalists opposing new pipelines and new refineries and years of Big Labor opposing the repeal of Jones Act shipping restrictions have meant a lack of new supply of petroleum products to the East where they’re needed. If alternatives to the Colonial Pipeline had been allowed to flourish, a shutdown by hackers wouldn’t be so disastrous for America.

All those policies are used by progressives in an effort to keep oil in the ground. See the problem yet?

Hopefully you have enough fuel stored to get your family through any pending shortages. If not, you may want to fill up on the way home.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024