President Barack Obama meets with Warren Buffett in the Oval Office, July 14, 2010. (Official White House Photo by Pete Souza)

Warren Buffett famously said, “Rule #1, don’t lose money. Rule #2: don’t forget rule #1.”

When I think of this, I’m reminded of Your Survival Guy’s efficient frontier. Worry more about how you invest than what you invest in.

Keeping within your proper comfort zone is up to you.

Action Line: If you need help finding your comfort zone, let’s talk.

P.S. Happy Efficient Frontier Friday!

“What do you do if the market crashes?” a new client asked me last week. “Good question,” I said. “I get that one a lot.” And it’s one of the reasons I’ve been writing to you, valued reader, on my efficient frontier study.

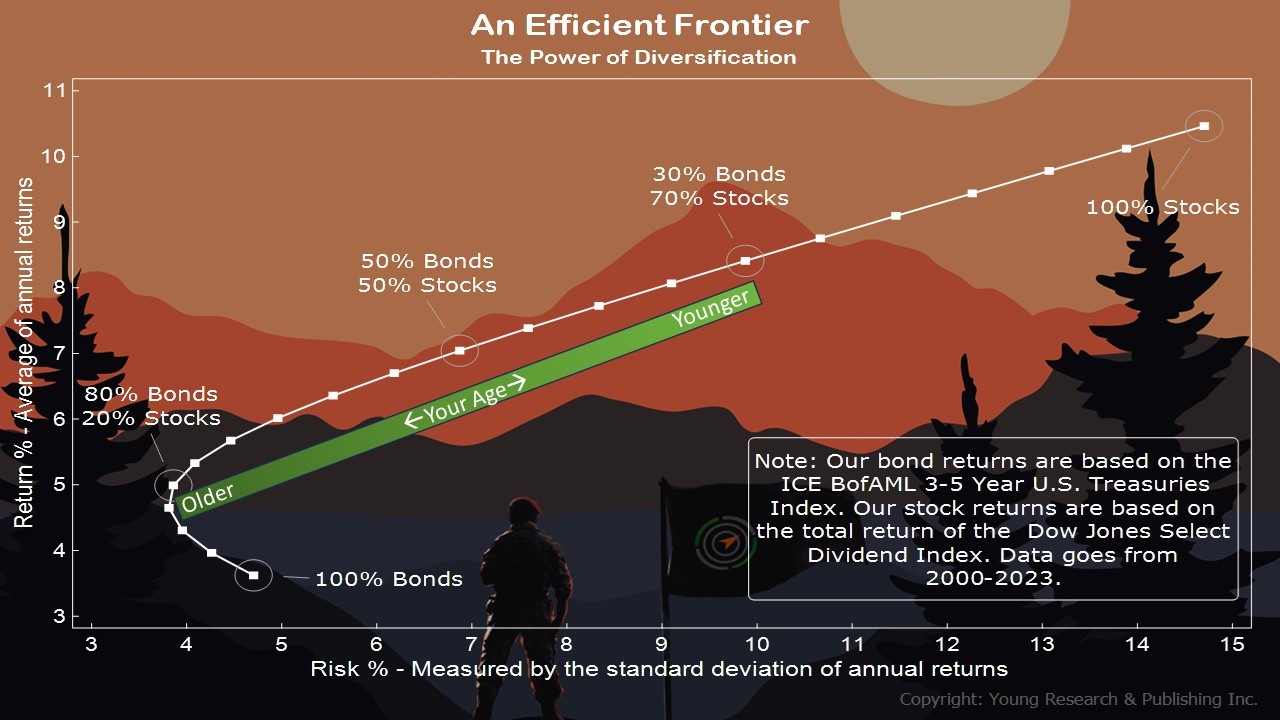

The efficient frontier is a visual expression of my phrase, “It’s not what you invest in, but how you invest that matters most.” In other words, in a diversified mix of stocks and bonds, what was the risk and reward?

How does Your Survival Guy get through tough markets? I listen to those who guide me with their decades of experience, like my father-in-law Dick Young and the late Jack Bogle, who said: “Don’t just do something, stand there.” Easier said than done, especially in your retirement life when you no longer receive a paycheck, and you feel like you’re on a tightrope crossing the Grand Canyon.

Figuring out how you’re going to survive after your working years is scary stuff. During your career, you were a hunter and a gatherer of sorts, working, working, working every day. Those skills, being aggressive for example, aren’t always the skills that bring investment success in retirement, where it’s the wisdom of what not to do that may prevail over the spinning, trading, and hunting.

Imagine sitting around a campfire in your retirement life after a most memorable day. Your kids and grandkids are gathered around, telling stories about the highlights from the day. As you begin to speak, everyone gets quiet. You didn’t sign up to be the “wise man” but whether you like it or not, what you say will be remembered.

Why not practice what you preach?

Putting your tribe in a position of strength from one generation to the next—passing on wealth requires, as my father-in-law says, an investment plan. One that centers on “diversification and patience built upon a foundation of value and compound interest.”

Look at the horizon, your efficient frontier. Do you see your path? Live the simple yet sophisticated life you so richly deserve. “Do. Or do not. There is no try,” a wise man once said. When you want to talk about what to do when the market crashes, I’m here.

P.P.S. The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Investors must consider the trade-offs between risk and reward in their portfolios. You can see on the chart above an efficient frontier line representing risk vs. reward for a portfolio allocated between different proportions of stocks and bonds using data back to 2000.

On the vertical axis is the return earned by the portfolios, and along the horizontal axis is a measure of how much risk was taken to earn those returns. As you can see by comparing the portfolio of 80% bonds and 20% stocks to the portfolio of just bonds, as portfolios take on a small number of stocks, the benefit of diversification lowers risk and increases reward. Anything above the line is unachievable because no portfolios earning those returns are available at the corresponding risk levels. And any portfolios that fall below the line can be outperformed with the same amount of risk or have their returns matched with less risk.

But to achieve higher returns along the line, investors adding more stocks to their portfolios are taking on ever greater amounts of risk. A portfolio of 100% stocks boasts a standard deviation of over 14%. Be aware of the risk in your portfolio and manage it wisely.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- “Survival Guy, It Was a Self-Preservation Move” - May 6, 2024

- The Oracle of Omaha’s Ugly Tax Prediction - May 6, 2024

- Bidenflation Is Breaking America’s Middle Class - May 6, 2024

- How to Bring “1+1=3” into Your Life and More - May 3, 2024

- Prior Planning, with Help from the Concierge - May 3, 2024