Dear Survivor,

OK, Your Survival Guy just got back from a two- and half-week research trip in Paris. The six-hour head start in Paris-time compared to the east coast gave me plenty of time to gather my thoughts over a café crème and croissant. In a word, Paris is busy. But it’s not too crazy yet with the demanding Chinese customer still in lockdown. It feels like a soft open. Staffing shortages are rampant while customer demands are as high as ever, understandably acting like they’ve been locked up for a couple of years.

But it’s all relative. Because when you spend nine of your nights on the right bank, on Rue Saint-Honore, at Le Bristol Hotel—the definition of a Paris palace hotel—you’re treated like family. And that’s not to take away from the other palace hotels we stayed at, which are great for other reasons. The Bristol is the full package.

The Hotel Lutetia, for example, is on the left bank near the wonderful Bon Marche (calling it a shopping mall is the understatement of the century) and our favorite Sunday lunch at La Fontaine de Mars. At the Shangri-La, back on the right bank, you feel like you can reach out and touch the Eiffel Tower from your balcony, so I’m told. (Your Survival Guy didn’t have a balcony or view).

The Hotel Lutetia, for example, is on the left bank near the wonderful Bon Marche (calling it a shopping mall is the understatement of the century) and our favorite Sunday lunch at La Fontaine de Mars. At the Shangri-La, back on the right bank, you feel like you can reach out and touch the Eiffel Tower from your balcony, so I’m told. (Your Survival Guy didn’t have a balcony or view).

Service? Le Bristol is the best. Breakfast or lunch at Café Antonia is as easy as a knife through a poached egg or foie gras washed down with juice or Champagne. Dinners in the outside garden on a warm Parisian night are what inspire movie scenes where it’s light past ten. It is heavenly. And, of course, being on St. Honoré, you feel like you’re walking through the pages of a fashion magazine. Instead of turning pages, you just walk into fashion houses from Chanel to Hermes.

And about one’s attire? Your Survival Guy blends in with the crowd. This is when you can dress up and feel like you’re not overdressed. Bring the gym shorts and t-shirts for the gym, but leave them in the room when going out on the streets. And no one will ever fault you for trying to speak French. I’m good at what I call “taxicab French.” I can get to where I want to go. But a simple Merci beaucoup, bonjour or bonsoir madame/monsieur, and Oui go a long way.

Stick with Your Survival Guy. I’ll have plenty more insider tips to share with you from my Parisian trip. Tips, by the way, are appreciated but certainly not expected in Paris. Five or ten euros go a long way in showing your appreciation and getting on a first-name basis. Don’t worry if you don’t speak French. Money talks.

PARIS Survival Guy INTELLIGENCE: The Job Market’s Case of Long Covid

As I said above, Paris is open for business, but it feels more like a soft open, with staffing shortages being the main reason. In my conversations with locals, they tell me that in France, the government takes care of you when you’re not working. One even explained how Covid gave him the “opportunity” to spend more time with family, and he didn’t miss work one bit. Swell. He’s back to work now, but there are plenty of workers who aren’t and who may never return to their “old” jobs because they’ve simply found other things to do. Like what? I’m guessing there’s an army of day traders, especially here in the U.S., who will soon run out of cash or vote for another Biden term looking for free money. Not good.

Another anecdote from my conversation with a different gentleman in Paris is how bad the Covid situation was in other nearby countries, specifically Spain and Italy, where the government didn’t have the money to support its citizens. He said it was depressingly hard for them as his voice trailed off and we stood in silence. So, what does this mean? Well, look what’s happening here in America. For the kind of money available at the lowest levels of employment—minimum wage workers or part-timers—people simply don’t want to work. They’ve seen what it’s like not to work and to be paid handsomely for doing nothing. Thank you very little. There’s no point in working as far as they’re concerned.

All this remote working from home is creating an entitled class of worker and bitterness from those who can’t work from home (hello, teachers’ unions). Workers scooping ice cream for the summer are rare breeds today. Good luck finding someone to do that. A steppingstone job teaching one how to deal with customers face to face is an endangered species. Time to buy your own lawnmower. No one’s coming to do that work for you.

Your Survival Guy in Paris: Awakened from His Slumber, “Dad, I’m Going to London”

You know, it’s the little things in life that matter. At Le Bristol Hotel, it’s the ornate China used for your morning cappuccino. Or it’s the place setting that’s perfectly adjusted to make room for a late arrival to your party, whose alarm apparently never went off, making it “no inconvenience at all monsieur/madame.”

A visit by Madame Marshall inquiring about your dinner the night before and plans for the day makes one feel as special as the most beautiful café setting in all of Paris. Talking with Jean Marie in the lobby before heading out to the rough and tumble St. Honoré gives you the confidence that all will be fine once you return “home” later in the day.

When I think about my favorite memories from our trip, it’s the little things that come to mind. As an aside, what makes a palace hotel a palace hotel is a pool. My son and I hit ’em all. One of our favorites was the one at Hotel Lutetia. (Imagine a Roman bath without the Romans.) Near the hot tub was an ice-cold plunge pool. Imagine plunging into a champagne bucket, and you get the picture.

My son plunged right in and said after a few seconds fully submerged, with his head back out of the water: “Dad, it’s not that bad. Try it.”

“No way,” I said. “I’m fine in the hot tub. Not for me.”

Turns out he was right. Glad I did it.

Now, a trip wouldn’t be a trip without some drama, some lost patience, and a few surprises, like when Your Survival Guy was awakened from his slumber with a knock on his door at the Shangri-La.

“Dad, I need my passport,” my daughter said. “My friends are in the lobby; I’m going to go to London with them to see our other friend who lives there.”

“No way,” I said.

Turns out it was the highlight of her trip.

That’s life. Funny how we think we have the upper hand in negotiations. Oh, well. Life goes on. Sitting on the side of the bed, I had to laugh to myself reading the text: “Dad, are you awake?”

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Gab, MeWe, and Gettr.

P.S. When you spend a lifetime working and saving where hours turn into days, weeks, months, and years; you probably have something to show for it. Days do feel like years in times like these. Time stands still. But not all is lost especially if you’re with me. Imagine my headline as we round the corner into the midterm elections. Who’s to blame for that? Who did that?

Look, I’m Your Survival Guy. I’m Your Rich Man Poor Man and a Prudent Man to boot. I know from experience the pain of falling markets is much worse than the comfort of rising ones. That’s why I write to you daily about focusing on your risk exposure first and foremost, and at all times.

I understand how ugly investing can get. Working with live-fire screaming by overhead isn’t easy. It’s not supposed to be fun. It’s work. It’s a job. It’s not a game. I can point your thinking to two areas that can help you through the weekend. One is the wisdom of not needing markets, and the other is being a Prudent Man investor. You can read both below. But here’s the takeaway. The less you need markets, the better off you’ll be as a long-term investor because you’ll be…a long-term investor.

This market crack might last a while or maybe it won’t. That’s not my concern. My concern is being able to weather the storm and not be pushed around by panic-stricken lemmings. And when you’re a prudent man investor, you make sound investments before you leave the dock, so you don’t find yourself in the middle of the sea needing a different boat.

P.P.S. OK, some updates for you from Your Survival Guy to clear the decks.

- The new Grady White is in (engines too) and ready for delivery. It’s a Canyon 306 with twin Yamaha 300s. The name: Tom Sawyer. I’ll send you pics soon. Here’s how to buy a boat.

- Had lunch with clients recently here in Newport, RI overlooking the water on a beautiful June afternoon. We’ve been working together now for twenty years. Over that time, the relationship has expanded, through referrals, to six other relationships with their friends and family.

- What annoys me? Glad you asked. When investment managers are profiled, the setup is always the same. It goes like this: “So and so works for (put your favorite big company here) with billions (and sometimes trillions) of assets under management.” (Like managing all that money means something to you, the reader.) In reality, when these companies get that big, they get further away from their customers. You start hearing about things like ESG investing, stakeholder capitalism (meaning non-owners having a say), and more virtue signaling. How about simply being introduced as a fiduciary?

- Do you know what a fiduciary is? You should ask your adviser because not all Senior Vice Presidents, Managing Directors, and Financial Planners are, by law, fiduciaries. Many follow what’s called a “suitability” standard. What does that mean? If their firm offers a similar product with a higher fee than an outside option, for example, it’s still “suitable” to put you in their higher fee product. Doesn’t sound right, does it?

- Is this a good time to reevaluate your relationship with your current broker? Is your advisor your legally bound fiduciary? Adjusting your investment plan is an ongoing process of planning. Your plan is to have a plan so you can have the retirement you deserve. If you fail to plan, you plan to fail.

- We all know it’s the little things that matter. In the book Showtime: Magic, Kareem, Riley, and the Los Angeles Lakers Dynasty of the 1980s, by Jeff Pearlman, I like this profile on Kurt Rambis and how he got the fast break going after the other team scored. “Kurt became the best outlet passer and inbounder in the history of the game,” said Thibault. “Little skills often get overlooked in the NBA, because we value certain statistics. But what Kurt was able to do with the ball was astounding.”

P.P.P.S. All is not lost in a downward moving market, especially as interest rates rise. One way to think about your portfolio is to look at it over a period of, say, 15 years. What’s your 15-year plan? Can you survive another three years like this one? How about the last three years? They weren’t too bad.

Thinking over a 15-year period might not be as hard as you think. The last 15 included a real bruising time during the financial crisis (I hope you didn’t sell). Prices go up, and prices go down—dividends and interest rates do too, especially in times like these, and that’s a good thing. Today we’re seeing a great reset, if you will, with both rising.

If you can hang in there, and I know many of you are, then you simply need to be patient and be a collector of money, not a reckless speculator hanging on to prices for dear life. You probably didn’t do that with the price of your home where you raised your family. You didn’t say, “Well, kids, the house just lost ten percent of its value, and I’m thinking of selling. Pack your bags.” No, you were patient because you had to be.

You made the mortgage payments, kept your head down, and you worked at your profession. You focused on my number one investment: YOU. Why not do the same with your precious retirement savings. Keep reinvesting or take the income. Don’t lose sleep over prices. I don’t lose sleep over how long this will last. Focus on what you can control: YOU. Easy, yet hard to do.

Do you have a 15-year plan? Let’s talk.

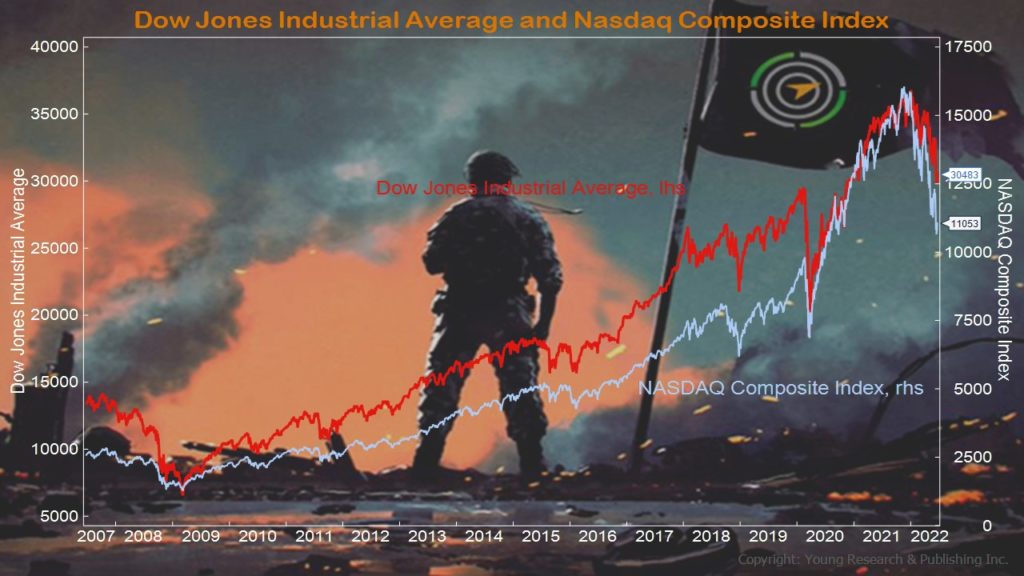

Here’s the last 15 years of performance for the Dow Jones Industrial Average and the NASDAQ Composite Index.

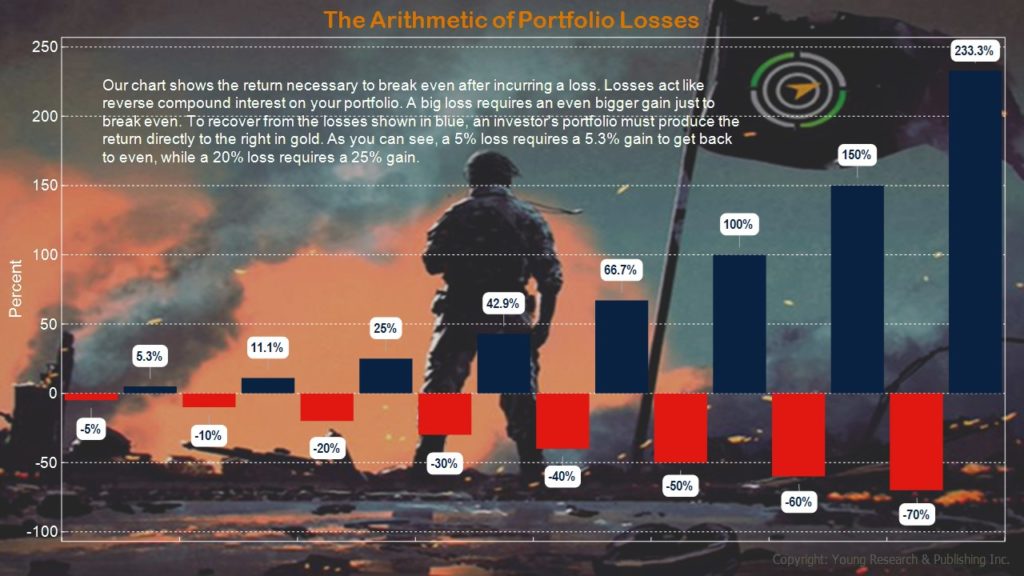

If you sold out at any one of the most recent dips in the market, and locked in those losses right before the market rallied, it is going to take a long time to recover. Take a look at my Arithmetic of Portfolio Losses chart for an idea of how difficult it is to come back from a big loss.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024