Dear Survivor,

Much of your long-term investment success depends on your ability to shrug off markets. It sounds simple, but is hard to do. Sell in May and go away? Not me. Why risk missing dividend and interest payments, especially when Vanguard GNMA, by example, is a consistent income producer through thick and thin? In this record-breaking market, I want you to consider the future of long-term investing, the economy, and what you want to do with your hard-earned money. Take action, because at the end of the day your retirement life is all about my favorite three letters: Y.O.U.

A Record Breaking Stock-Market

While I was speaking with clients recently, we reviewed the current stock market and what may lie ahead. We talked about the record start to the year, with the S&P 500 on track for the best first four-months in more than three decades. We also talked about the bond side of their portfolio, and the role it plays.

To me, this feels like what the late-great Richard Russell would refer to as the third phase in the bull market. The first is the low-hanging fruit, then the moderate advance—both climbing a wall of worry—into the “we can’t afford to miss the boat” third phase, when everyone’s a stock picker.

We may not be there quite yet, but as I’ve written to you in the past about my concerns with passive indexing and ETFs, (read Do ETFs Belong in Your Portfolio?, my series Dead or Alive? The Future of Long-Term Investing, Can You Avoid Investing with the Herd?, Still Sure Indexing is Right for You? and Vanguard Founder Jack Bogle Sounds the Alarm on Index Funds for more) when everyone’s hopping around on Easter talking stocks, you might want to check out your bonds. Because records are made to be broken—on the way up—and, not to be forgotten, on the way back down.

Dead or Alive? The Future of Long-Term Investing

Ask anyone if they’re a long-term investor and nine out of ten will tell you they are most definitely long-term investors. That is, unless something crazy happens to the market. It’s like the profile pieces you read about someone’s workout and eating regimen. Every minute of the day is carefully planned, and it seems every person profiled sticks to salads topped with salmon and the occasional piece of dark chocolate.

In the real-world, life gets in the way, and it gets messy. OK, maybe it’s doable if you don’t have kids, or a job, or grandchildren, or any other fabric of life that makes it worth living.

Time and time again you see money flow into stocks when they’re up, and ebb into bonds when stocks are down. Take a look at the money flow late last year when stocks tanked—it flowed into bonds. It’s a self-fulfilling prophecy for sure, but the exact opposite took place at the beginning of this year—money flowed into bonds—as stocks rallied.

Avoid oscillating between asset classes by making both bonds and stocks part of your portfolio at all times. Don’t take it from me. At the end of his life the legendary Jack Bogle said about bonds and stocks that half the time he loved them and half the time he hated them. Sage advice all-round, as usual from Mr. Bogle. Setting up such a plan isn’t easy, but it can prevent you from making emotional decisions at the worst times.

That’s the difficulty of being a successful long-term investor. Life gets in the way. It’s easy to move into bonds when stocks are down. You start to wonder who will take care of your family when you’re dead. It pulls at your emotions and you cannot feel better until you know you’re in “safer” investments. That’s what makes investing successfully so tough.

Investing successfully can feel terrible. It can be grueling. And once you’ve retired and you’re no longer working, it’s worse by a factor of 100x to be kind.

We would all like to be successful investors much like healthy eaters that wink-wink stick to salads and salmon. But we all know life gets in the way and oftentimes it’s helpful to have an advisor to keep you on track when things get messy and salmon isn’t on the menu.

Read the entire Dead or Alive? The Future of Long-Term Investing series.

Your Survival Guy in Paris: Peking Duck

When you land in Charles de Gaulle airport, taxiing to the gate can feel longer than the flight. It’s big. And if it’s not a long taxi, it means you might be closer to home than the gate.

That was us on this trip. And unfortunately, before deplaning we had to wait until the wheelchairs were available. My daughter Izzy recently had ankle surgery from a cross country running injury, and much to her despair (“Dad it’s embarrassing”) we were on the wheelchair list. We were joined by all the other crips including an overweight gentleman crutching forward with a duty-free bag of smokes, chocolates, and whiskey.

Thankfully after we took a shuttle bus to the gate, we were met by our pre-booked Meet and Greet representative. He whisked us through customs, gathered our bags and introduced us to our driver.

In case you miss home, driving into Paris during rush hour is like Boston traffic with Star Wars speeder bikes from Return of the Jedi. Motorcyclists fly by as if you’re a tree on Endor. Horns beep, lights flash, and fenders, like ours, are boot-kicked to express displeasure. Bienvenue en France.

Arriving at Le Bristol Hotel you can take a deep breath and be thankful you’re there.

My in-laws Dick and Debbie Young met us in the lobby as we proceeded to glorious Café Antonia while waiting for our room. A Café crème and tomato and cheese omelet later, our room was ready. We unpacked a few items and kept moving. Because it’s always a good idea to keep moving on the first morning. Typically, we walk to lunch at the Mini Palais but this time (reminder, one of us is on crutches) we took a taxi to Paul Bert.

“In another life, should I come back as a restaurant, I’d like to be the Bistrot Paul Bert, my idea of the quintessential Paris bistro,” explains Patricia Wells in her must-have Food Lover’s Guide to Paris app. “While meat and game reign here, fish lovers will also find a good selection—sole meuniere, scallops roasted whole in their shell…His classic version of steak frites is among the best in town.” You can see from my pics below why.

After lunch is always a good time to rest from a full night of travel in preparation for dinner. It’s also a nice time to stroll Saint Honore to work up your appetite. It would be a shame to show up to dinner stuffed like a goose.

To get the evening off on the right foot, the bar at Le Bristol is a perfect meeting place. If for no other reason, to sip their house made rum cocktail—an amuse-bouche in a glass—to motivate an on-time rendezvous.

Our first dinner on this trip was at one of our favorites, the Shang Palace within the Shangri-La Hotel—a beautiful palace hotel located in the ritzy 16th arrondissement. On the Right Bank of the Seine, it overlooks the Eiffel Tower where after dinner, if you time it right, you’ll see it glitter with diamond-sparkling lights displayed every hour, on the hour, for five minutes.

Ordering at the Shang can be a challenge. Thankfully Becky ordered a number of dishes for the table, including the must have Peking duck. The wine list can be daunting too, but don’t be intimidated. The sommelier is there to guide you, as is the waiter. Relax. Enjoy your champagne. You’re in Paris.

- If you want to experience one of the handful of Palace Hotels in Paris, then you want to go to our favorite home away from home: Le Bristol. If you’ve watched Woody Allen’s Midnight in Paris starring Owen Wilson, then you know the arrival scene at Le Bristol. Recently while the hotel showed the movie in the bar, Wilson happened to be in the lobby and popped in to check it out. Only in Paris.

- If you’re visiting Paris this spring, don’t arrive or leave on a Saturday. Easter weekend marked the 23rd consecutive Saturday of the gilets jaunes or ‘yellow vest’ protests.

- Paris is broken down into neighborhoods called arrondissements that unwind like an escargot shell, beginning on the Right Bank (to the north) of the river Seine in the First Arrondissement, where the Tuileries Gardens and the Louvre are located, to the Second, Third, and Fourth. Then, across to the Seine’s Left Bank into the Fifth, Sixth, and Seventh Arrondissements back once again to the Right Bank for the Eighth where Le Bristol is located at: 112 Rue du Faubourg Saint-Honore.

- Le Bristol is a block away from the Elysee Palace, France’s Presidential residence, at 55 Rue du Faubourg Saint-Honore, and was on lockdown on Saturday. Talk about a ghost town, and a loss of business. We felt safe on the day of the protests which are mostly peaceful except for the few small factions strictly there for the violence.

- The gilet jaunes movement, from the perspective of the French I spoke with, is met with sympathy and anger. Sympathy with the plight of the common man, but anger at how the movement is hurting business and France’s reputation as a safe place to visit, particularly in Paris.

- The police I spoke with were upset too. They were tired. But they were doing their job. They too seemed to relate more with the protesters or ‘Les Misérables’ than with President Macron.

- The anger this weekend was supercharged from the fire at Notre Dame. When over $1 billion is pledged in days, led by the super wealthy, there’s no wonder the gilet jaunes protesters are aghast. They wonder how so much money can be raised so quickly, when they have trouble putting food on their tables. They are the forgotten men and women of France, and will not go down without a fight.

- If you understand the Trump movement in America, the gilet jaunes movement is many degrees beyond, and is straight out of the pages of Victor Hugo. These stories do not end well.

- And yet I would recommend that you visit Paris. You just have to know the lay of the land, and where to be, and when to be there.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

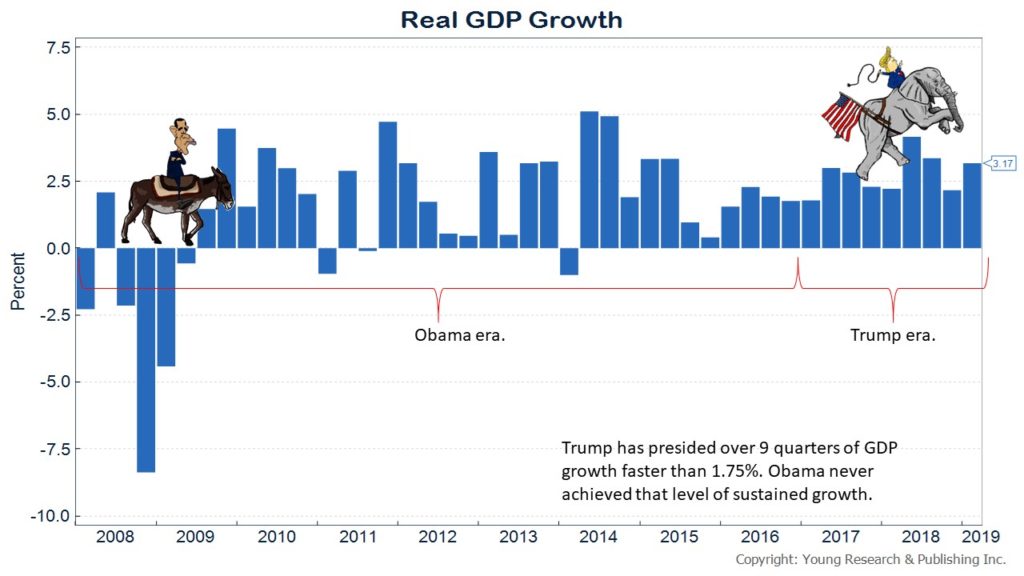

P.S. You can see in my chart below that President Trump’s business friendly policies have led to sustained GDP growth unlike anything seen during the Obama-era.

P.P.S. Vanguard GNMA: If you didn’t lose your patience and held your bonds over the last year, then you know it was a perfect example for why you own them. Case in point, Vanguard GNMA ended the last 52-weeks up 4.46% and its recent 30-day SEC yield was 3.06%. The catalyst for much of the recent gains? The midterms and the Fed—socialists storming the castle, and pathetically lower rates. Whether you own treasuries, agencies and/or corporates, avoid the temptations of predictions or your gut. Because you just might end up being wrong.

P.P.P.S. This picture of Becky and me was taken from the chairlift at Deer Valley. We were there in early March and I think we were smiling because it was the first time we saw the sun. It was a snowy trip to say the least, where it felt like you were skiing inside a snow globe.

P.P.P.S. This picture of Becky and me was taken from the chairlift at Deer Valley. We were there in early March and I think we were smiling because it was the first time we saw the sun. It was a snowy trip to say the least, where it felt like you were skiing inside a snow globe.

Most of our trip was spent skiing Park City and the Canyons. We stayed in the Silver Star area, with a chairlift and café by the same name that made it feel like your own resort within a gigantic resort.

Getting to Park City is a piece of cake. We took a late afternoon flight out of Boston, landed in Salt Lake City around nine at night, and were at Park City around 10:15. A common practice is to take an early flight and be on the slopes that same afternoon.

The skiing is what you’d expect—awesome—with a ton of terrain. As East Coast skiers, our muscle memory prepared us for icy spots that simply did not exist.

If you want a retirement location with lots to do in the winter and summer and a booming economy, consider Salt Lake City. If you want to work, there’s a job for you. And if you want to ski and be near a cool ski town, it’s hard to beat Park City, Utah.

P.P.P.P.S. Does it make sense to take your children to Paris? In their teenage years, communication is a barrier—never mind the language—and keeping everyone happy can be a challenge.

On day two of our recent trip for example, after his breakfast of waffles and chocolate croissants, my son Owen asked about our plan for the day.

Our plan?

You can read the full story here.

P.P.P.P.P.S. If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

P.P.P.P.P.P.S. If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

P.P.P.P.P.P.P.S. Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.P.P.P.P.P.P.P.S. You can also follow me on Twitter, Instagram, and Facebook.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024