President Donald J. Trump joins Xi Jinping, President of the People’s Republic of China, at the start of their bilateral meeting Saturday, June 29, 2019, at the G20 Japan Summit in Osaka, Japan. ( Official White House Photo by Shealah Craighead)

Dear Survivor,

You’ve known for some time now that for many Americans today the “American Dream” is simply that, a dream. You’ve instinctively known this. It was in your gut.

If you haven’t, hopefully you’ll seek out the peace of mind and safety you deserve when the coast is clear. That may be a while.

You know I’ve been a big supporter of the message Tucker Carlson’s been making on his show each night, that we need an American Dream (my words) that is open to Americans.

When I was in college, globalism dominated discussions about the future. In hindsight I wonder, how has that helped America’s next-generation compete on the global landscape? American manufacturing is undercut every step of the way on price by politicians who regulate and mandate. During these tough times America’s main advantage has been its world-best university education system. Now the progressive left wants to devalue that education by attempting to make it free. Anything that’s free isn’t worth a dime.

President Trump saw the writing on the wall. He was the first president to voice skepticism about America’s host-parasite relationship with China. He fights for American manufacturers, especially their employees. It is easy to understand the sorts of “Made in America” ideas Trump has been promoting for decades now that America faces shortages in even the most basic healthcare supplies. The country is reliant on China for many medicines and the protective equipment nurses and doctors need to fight coronavirus.

Only Trump was sounding alarm bells over China’s manufacturing stranglehold before all this began. He’s got great instincts and listens to those who are on the same page. Carlson recently visited Trump at Mar-a-Lago and discussed his visit, and Trump’s instincts, with Freddy Gray at Spectator USA. He told Gray:

Yeah, and I will say: I don’t know this because you can’t know it, but my instinct is that everything I said comported with what he knew was true. And I think that’s very often the case with Trump, who clearly has a lot of things working against him — being hated by every power center in American life, for example. He has excesses and ticks that make it harder for him to govern, obviously. But I think the reason he became president, in spite of all of that, is because he has good instincts, in some cases very good instincts, and he generally listens to them. And to the extent he screws up, it’s because he’s talked out of obeying his own instincts.

My impression on this from day one has been that Trump knew because he could feel that it was a problem. I mean, if you’re Trump, you don’t survive all that he’s been through — multiple bankruptcies and marriages, media attacks and all the things that he’s been through in 73 years — you don’t get through that and become president anyway without a very finely honed sense of danger or impending danger. People have this or they don’t. Some people can feel it coming and others can’t. And so I’ve always thought that he sensed that this was coming. And people around him told him it’s not a big deal. And it’s very easy to believe the happier forecasts than it is the threatening forecasts. Again, it’s kind of an unprovable hypothesis, but that’s always been my opinion.

The stock market will see better days ahead we just don’t know when. In the meantime collect your dividends and Breathe In, Breathe Out, Move On.

P.S. It’s Times Like These

What Are You Doing to Survive and Thrive?

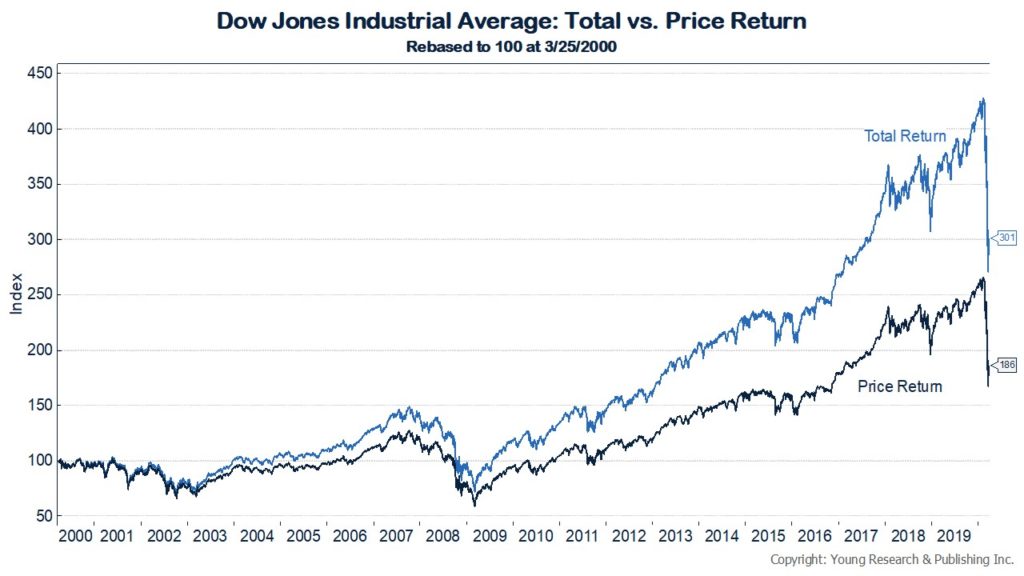

Before you hear about my conversations with successful Americans like yourself, let’s take a quick step back and look at where the market has been over the last 20-years and consider that if you’re receiving dividends they help you dollar cost average through thick and thin.

Every day during this crisis, I’m hearing about what you’re doing to survive and thrive, and thanks to you, I’ve gained some valuable on the ground intelligence.

Here’s an email I received after a relaxed morning call with a client who is certainly prepared to live off the grid:

One thing I didn’t mention…

It says a lot about where we are in this country when, for so many Americans, the immediate knee-jerk reaction to a crisis is to look to government (federal first, state second) for a “solution.” When exactly did self-sufficiency go out of fashion? The willingness of the masses (especially the left-leaning variety) to meekly forsake the liberties enshrined in our Constitution is very distressing to me. I truly don’t think what we need in the US is even more power vested in the federal government. It has way too much already and an insatiable appetite for more. Will our citizens ever awaken to the damage being done to our way of life by ever-increasing submission to and reliance on Big Brother?

Here’s some quick hits from yesterday’s conversations:

- A client explains that his gun shop in the South has never been busier with same month sales compared to last year set to be up 300%. He said Saturday it felt like a gun show in his shop as folks who were sellers had a buyer before the goods even hit the shelves.

- Another couple has been studying the bible, forming their own bible study group, and going to Sunday Mass on their iPad.

- A doctor couple has donated N95 masks to their local front line workers. They’ve also had a heck of a time trying to get their kids home from various locations around the world.

- A grocery store owner in NYC has never been busier. Our talks are short and to the point. Let’s get back to business.

- The client I told you about who is working the early shift at Target, is now working the night shift, which he likes better because he’s heading home as customers are heading in. It’s social distancing with a paycheck. He received a raise, has plenty of overtime, and said it feels like the Christmas rush. Toilet paper is still in high demand.

- Clients living at a resort in AZ tell me other residents are still golfing as if nothing is going on. They’re not, thankfully, and tell me they’ve been relieved by all the help they’ve received from the local community.

- Other clients at a different resort in the same state, said restaurants have been open for pick-up as they’re adjusting to their new schedule. They’ve been with me for twenty years, and we’ve seen some tough markets together. None of them are easy.

- Another business owner in the South said they’ve been open through this whole thing because we’re an essential business, which made us both wonder: “What business isn’t essential?”

Overall the tone is A++++.

You Must Protect Your Business: Looters Hit Walgreens in San Francisco

By Brian A Jackson @ Shutterstock.com

With first responders stretched thin, and some Americans getting desperate, it’s no surprise to see increased looting.

In San Francisco a few days ago, looters hit a Walgreens, stealing from a rack of products before fleeing by jumping on a bus. Here’s the story from Dave Urbanski at The Blaze:

A brazen couple was caught on cellphone video casually looting a Walgreens in San Francisco amid the city’s shelter-in-place order to stem the spread of the coronavirus.

The clip shows the couple — both of whom wore dark sunglasses — in an aisle while the male grabs handful after handful of items from a shelf and stuffs them in a large bag. The female also was seen carrying a large bag full of items.

It isn’t clear what specifically the couple were after, although the individual who recorded the video was heard saying, “I hope you overdose!” as the pair left the store without paying.

A Walgreens employee, who was wearing a mask and gloves, watched the crime helplessly. He appeared to try grabbing the bag the male was carrying on their way out to no avail.

As employees of a massive corporation, the Walgreens workers are probably told not to intervene in these types of thefts, but what if it was your business? Is everything insured?

Today, many Americans are arming themselves to protect their families and property. Sometimes you are the only person who can protect that which you value from those seeking to harm you or take your livelihood. That said, if you are buying a firearm, please get some training along with it.

I have spent many days training at Sig Sauer Academy in Epping, New Hampshire. The lessons I learned from the instructors there were invaluable. Here’s a sample of my experiences with the Sig Sauer Academy:

- Sig Sauer Academy: Rely on Your Training

- Key to the Draw: Economy of Motion

- Survival Tactics: One Hand Tourniquet Application

- Be Ready to Defend Yourself and Family

- Sheep Get Killed: How to Be a Wolf

A firearm is a powerful and essential tool, but in untrained hands, just like a car or a speedboat, it can be very dangerous. Get your gun and your training now.

Watch the video here, warning, contains some strong language:

@SFPD @chesaboudin @Walgreens SF GOV – PROTECT OUR LAW ABIDING CITIZENS AND BUSINESSES. THE LOOTING HAS BEGUN. Walgreens on Drumm. Suspects jumped on bus and didn’t pay right after on Market and Drumm @sfmta_muni pic.twitter.com/n5T5CEeYub

— Jared William (@Jared_William) March 19, 2020

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Twitter, Instagram, and Facebook.

P.S. My father-in-law, Dick Young, is working seven days a week in Sunny Key West, Florida. He writes:

Value, dividends, interest, and compounding have formed the foundation I have given to my investment subscribers and consulting clients since 1964.

For the first time since I began following the guidance of Ben Graham back in the early 1960s, I am able today to invest in some dividend payers that would have put a smile on Ben’s face. For me and I hope for each of my longtime clients, there is much to be thankful for. There is a bright light at the end of the current long, dark tunnel.

I don’t expect in my lifetime to see such values again. And I do not plan to miss one minute on the hunt for dividends.

In Key West, only a scant 90 miles from Cuba, Debbie and I are beavering away seven days a week. With temps in the mid-80s, we awaken to roosters (you should here ‘em) crowing way before dawn.

So 7 days a week, 3X a day we choke down Liposomal vitamin C and active trans Resveratrol, and usually walk two blocks (mostly alone) to Eaton Street Seafood. Usually mavericks, Key Westers seem to be taking social distancing seriously.

Make it as good a day as you can.

Thanks to Donald Trump’s foresight on the scourge that is China, the folly of open borders, the mathematical naiveté of free trade, and the “America Last” fraud of globalization, America will snap back like a catapulted Navy Super Hornet off a carrier deck.

You can count it.

P.P.S. Have you seen Lockheed’s High Energy Laser weapon in action? Steve Schneider writes of the program, dubbed HELIOS:

Lockheed Martin’s High Energy Laser with Integrated Optical-dazzler and Surveillance (HELIOS) has met the U.S. Navy’s requirement’s to be integrated onto an Arleigh Burke destroyer. HELIOS will undergo systems integration and testing this year and will look to deploy in FY 2021. The 60kW+ laser will counter emerging threats from fast inshore attack craft and drones. Lockheed Martin’s press release from March 11, 2020 reads:

Lockheed Martin (NYSE: LMT) and the U.S. Navy moved one step closer to integrating a laser weapon system onto an Arleigh Burke destroyer after successfully conducting a Critical Design Review (CDR) for the High Energy Laser with Integrated Optical-dazzler and Surveillance (HELIOS) system.

“Our adversaries are rapidly developing sophisticated weapons and the threats to the U.S. Navy’s fleet are getting more challenging,” said Hamid Salim, vice president, Advanced Product Solutions at Lockheed Martin Rotary and Mission Systems. “Our warfighters need this capability and capacity now to effectively counter threats such as unmanned aerial systems and fast attack vessels.”

P.P.P.S. You may want some insurance against hyperinflation now that the Fed has cranked up the printing presses in response to the economic damage being caused by the coronavirus. Tim Jones explains how hyperinflation devastated the economy of Weimar Germany in the 1920s. He writes (abridged):

The world’s most extraordinary episode of hyperinflation happened between 1919 and 1922 in post-World War I Germany.

To finance the new war, the Germans took on debt. The war turned out to be long, bloody, and expensive, chewing up 50% of German production capacity.

After the war, Germany was loaded with debt. Additionally, the countries of the Triple Entente, especially France, demanded reparations to pay for the costs incurred. They demanded 132 billion gold marks (marks backed by gold). A huge sum.

Germany Ran Huge Deficits

To keep the country operating post-war, the government began running huge deficits around 50%, and sometimes even more. Germany’s leaders chose to fund the deficits by selling debt to the national bank, the Reichsbank. The plan lowered foreign confidence in the Weimar government’s ability to pay its debts. As a result, foreign investment crashed, and the value of the mark, Germany’s currency, sank. Thus began the first round of inflation.

German Foreign Minister Walther Rathenau, a Jew, was assassinated in 1922 by anti-Semitic radicals. Rathenau had been a much-respected figure in German economics, and his death shook confidence in Germany’s ability to manage its economy. The murder caused capital flight, and soon hyperinflation began, driving the value of the mark even lower.

At this point, Germany began printing money with gusto. The government decided to sacrifice the value of the mark to provide businesses with the liquidity they needed. Thomas Piketty explained this period of rapid money printing in his book, The Economics of Inflation, writing (my emphasis in bold):

But in the summer of 1922 the Reichsbank began to supply directly to commerce and industry the financial means, the need of which, in that period of credit crisis, was urgently felt. To mitigate this crisis the Reichsbank insistently counselled the business classes to have recourse to the creation of commercial bills,* which it declared itself ready to discount at a much lower rate than the rate of the depreciation of the mark, and even than the rates charged by private banks.

Indeed the official discount rate was 6 per cent at the end of July 1922; it was raised to 7 per cent at the end of August; to 8 per cent on September 21st; 10 per cent on November 13th; 12 per cent on January 18th, 1923; and 18 per cent in the last week of April 1923. It is enough to compare these rates with the increase in the dollar rate (a gold mark was worth 160 paper marks at the end of July 1922; 411 paper marks at the end of August, 1,822 at the end of November; and 7,100 at the end of April 1923) to be convinced that the policy of the Reichsbank could not but give a strong stimulus to the demand for credit and to the inflation.

By November 1923, the mark was trading at 4,200 billion to one dollar. That’s when the government finally decided to peg its value to the dollar, ending the hyperinflation. Before the war, the mark-dollar exchange rate had been 4.2 to 1. And as recentty as 1922 it had been 1,500 to 1. It then took less than a year for the mark’s strength to fall from 1,500 to 1, to 4,200 billion to 1.

In the end, Germany’s decision to take on debt to start a war, and subsequently to run deep deficits to pay for it, destroyed the country’s economy. The price of gold soared in Germany during its hyperinflation. Those few Germans who still owned any gold (the government had strongly encouraged them to turn it in to bolster the Reichsbank) owned an asset that had held its value despite the inflation.

Gold, along with silver, tends to maintain its value in the face of inflation. That ability can act as an insurance policy in investment portfolios that own gold. With governments around the world today using higher deficits and the devaluation of currencies to fund spending, prudent investors should own precious metals in their portfolio today.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024