By Alextype @ Shutterstock.com

With market volatility creeping upward, this is once again a question I’m getting, but I urge you to reread what I wrote back on February 28, 2018.

Well this was a fun month for the stock market with wild swings from high to low of around 2,000 points in the Dow Jones Industrial Average.

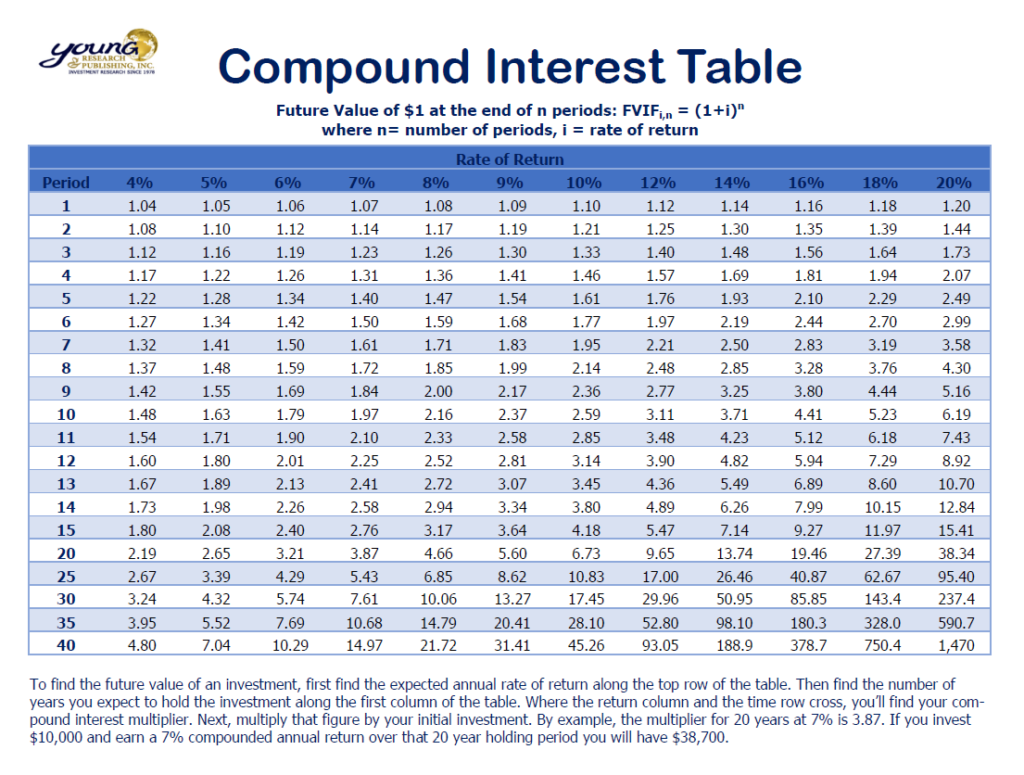

One question I’m asked on a consistent basis is “E.J., is your phone ringing off the hook?” and my answer is “no,” and I know why. Most of you have been educated by Dick Young that investment success is achieved over a lifetime, not a month or two. Investment success is about hitting singles and doubles, taking some walks here and there and sometimes getting hit by a pitch. Staying in the game is key. It’s a winning strategy because it puts compound interest into play. Spend a lifetime compounding money on a consistent basis and you’ll wake up one day and say “Wow, I have a pile of money.” It’s funny, when I ask investors how they achieved their success. They don’t talk about the stock market. They talk about working long hours, putting one foot in front of the other, showing up for work every day and s-a-v-i-n-g as much as they could save. Looking back 40-years, they know how tough it was to save $1,000. Compound that at 8% and it’s $21,725 today. Not a bad start.

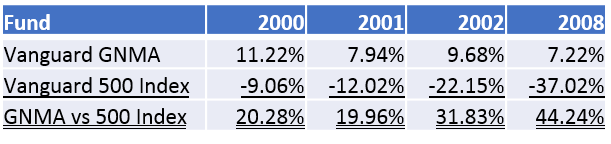

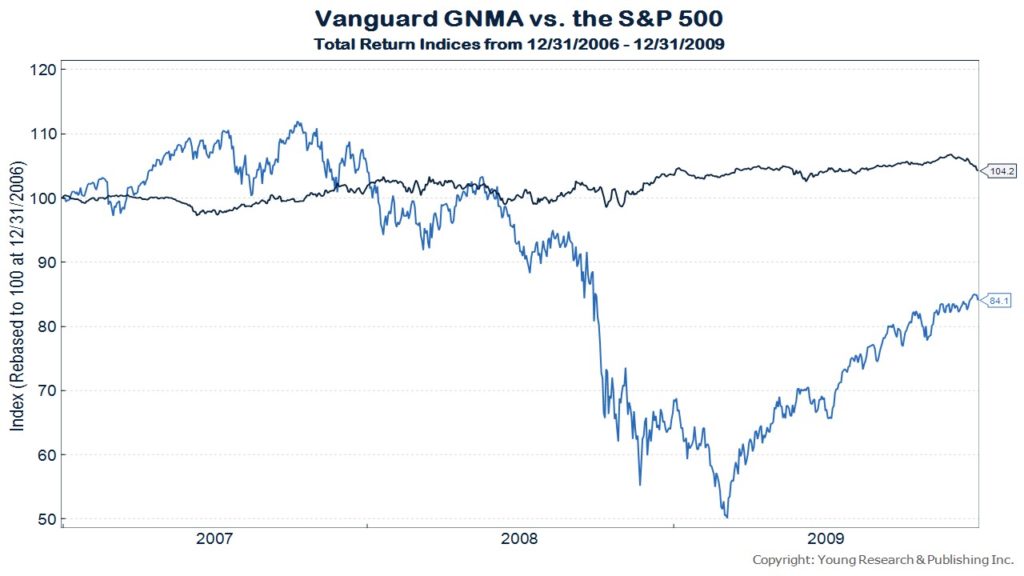

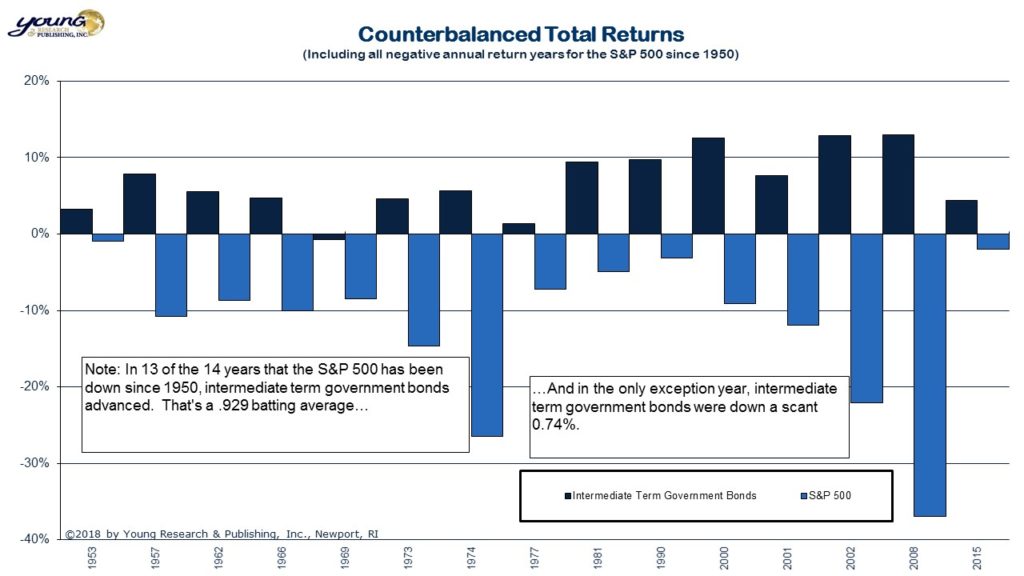

How can you compound money? Part of the answer is that you need to figure out a way to get in the game. The other part, and no easier mind you, is how to stay in the game. I believe February’s pullback is a good reminder that investing is a contact sport. How do you avoid the big hits? You come up with a way to soften the blows, and that’s where the magic of counterbalancing comes into play. Counterbalancing reinforces the defensive side of your portfolio which is where games are won. I know you’re wondering what’s going on with Vanguard GNMA. It’s worth reminding you of how the Vanguard Index 500 did in the tech bust and the real estate crash this century and the relative out-performance of GNMA vs. the Index 500.

No need to imagine how peaceful it felt to have some GNMA as a counterbalance in those brutal years for the stock market and to see how, once again, it worked this month.

And to remember why you counterbalance your portfolio in the first place.

How much money should you put into GNMA and a diversified fixed income strategy? It depends on your current employment status, your retirement goals, and anything else important to Y-O-U. The smart guys on CNBC or so called “experts” don’t know you as well as you do. They don’t know how you feel when the stock market crashes, and they don’t know how much comfort a diversified portfolio may bring to you and your family. It doesn’t cost them a dime to say bonds are in a “bubble,” especially when stocks are marching towards a tenth year of gains. Will they be there when you need help wading through the rubble of a disaster? When you need help surviving?

Because I’ll never forget those who are no longer with me today. Those who have passed away. You never forget the ones you’ve helped. And I’ll tell you, not once, during our time working together did they say “E.J., I wish I were more aggressive or E.J. I wish I spent less time with my family.” No one ever wishes they spent more time watching TV or trading stocks. It just doesn’t happen. Keep that in mind as you preserve your legacy.

What is your legacy? I’ll tell you, there is joy in educating a child or grandchild about the essence of investing—keeping and preserving what you’ve made. It’s just one way that money brings happiness. And yes, it does bring happiness, especially when it makes life easier, or when it provides choices and opportunities you never imagined you’d have. Money is nothing without you. You give money its soul—its meaning—and you give yourself happiness.

Driving through the White Mountain National Forest recently, I thought about the meaning of money and how it has allowed my family to go skiing from Bartlett, New Hampshire where we have a log cabin. I know it’s easy to let a 2,000-point swing in the market ruin a month. But imagine how meaningless it all is if you don’t know why you’re investing in the first place. Your success is important to me. You have the tools to chart your course. And if my phone doesn’t ring, I’ll know it’s you.

Survive and thrive this month.

Warm regards,

E.J. Smith

“Your Survival Guy”

P.S.: Take a Drive with Us to Cannon Mtn. in the Live Free or Die State

Over the President’s Day weekend we hit the slopes of New Hampshire skiing Attitash, Wildcat, Sunday River, and Cannon. In this video, drive with us from Bartlett, where we have a log cabin, through the White Mountain National Forest to ski Cannon Mountain.

It was a typical New England weekend with rain, sleet, snow, and wind, and yet you’d never know it in this video. Check it out.

The first mountain you see is Mount Willard (I called it Wilber, sorry!) which is in Crawford Notch. It’s a great hike in the summer especially when the train passes through the Notch along the side of the mountain.

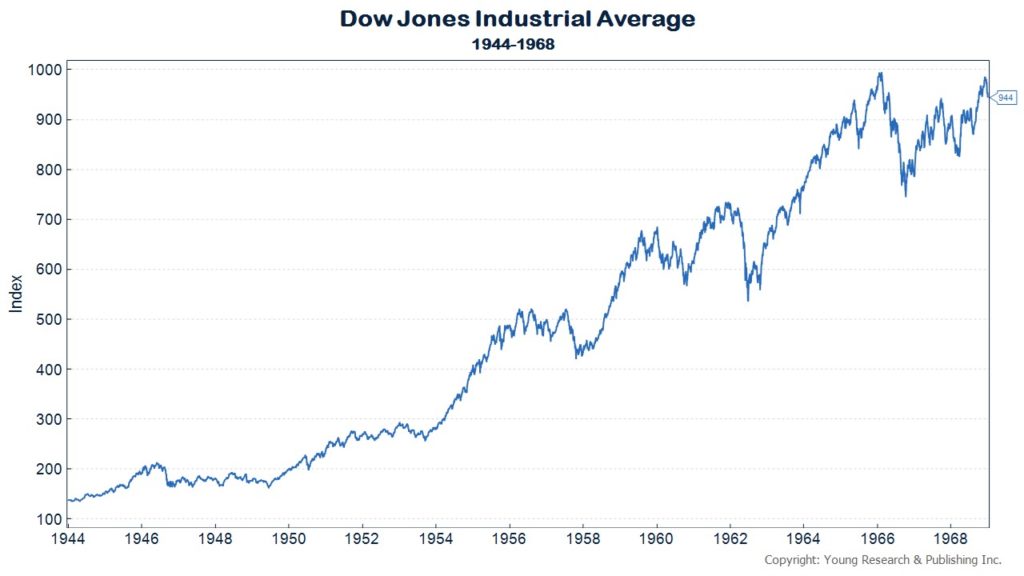

Next, you’ll see us driving through the Notch and passing the visitors center on the left followed by the Mount Washington Hotel on the right. This is where the Bretton Woods agreement was signed in July 1944 where currencies were pegged to gold and the U.S. dollar was seen as a reserve currency linked to the price of gold. You’ll note how well the stock market did when there was some stability on the monetary front until the agreement’s dissolution between 1968-1973.

Cannon Mountain is home to the first passenger tramway in North America. A little history: “From its construction in 1938 to its 1980 retirement, 6,581,338 passengers made the thrilling 2.1 mile journey up Cannon Mountain. The dedication of Cannon Mountain Aerial Tramway II on May 24, 1980 marked the end of a 42 year era, and the exciting beginning of a bright new future for Cannon Mountain.” The tram fits 70+1 skiers. That +1 is the operator who makes sure you make it to the top.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024