My March Rage Gauge: Take Inventory of Your Investment Life

My March Rage Gauge: Take Inventory of Your Investment Life

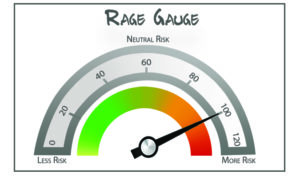

My March Rage Gauge is in, and it feels like the calm before the storm. Does that mean the market will have a huge downward correction this year? Like I’ve written to you in the past, I’m not in the prediction business. Because for you to be a great investor, you need to put together multiple seasons of investing and then maybe you’ll be able to look back and say: “Well, I wouldn’t want to do that again, but we made it.”

Let me explain. All of us have a pretty good feel for what’s going on today. Interest rates aren’t moving, the Trump economy is OK (It could be great again if the socialists don’t get their way), and the trade tension with China is easing. This is what I would refer to as a weatherman’s three-day forecast. We all know it. We all talk about it. It’s not worth much of anything.

What concerns me, and hopefully you, is that at some point there will be a price to pay for the mountain of U.S. debt, sustained rock bottom interest rates, an expensive stock market, low inflation, pension debt, and incompetent government, just to name a few. Because there are more than a handful of threats facing investors today.

And so, I ask? What is the downside of you being self-reliant as an investor and maintaining a survival guy investing mentality? The answer: there is none. There is no downside for you being on the safe side. It’s why now, this year, is a good time for you to take inventory of your investment life, including estate planning. It’s time to get your house in order while you can.

Tops on my list is thinking real hard about where you want to spend your retirement years. As we’ve seen in states like New York, New Jersey, Connecticut, and Rhode Island, money is mobile and will go where it’s well treated. For most of the year that is. Then, you can come back home. And trust me, your loved ones will visit you in Florida when the polar vortex descends upon them in January and February in New England or the upper Mid-West. There’s plenty of posts for you to read from me here, here, here, and here.

Just as important to your investment future is where you keep your investments. Consolidate your investments at Fidelity. It is #1A on my list of great ideas. Just recently, Fidelity posted record revenue and profit for last year as investors added $309 billion in new money in 2018. (I’m not a paid endorser of Fidelity, it’s just the best product I have found for investors like you and me).

But you don’t need me to tell you about my March Rage Gauge. Yes, it’s flashing warnings signs. But you see it every day in your car on your way to anywhere in America. The tension is right in front of your eyes. Actually, it’s in your rearview mirror. It’s the car jammed up to your bumper creating needless tension to push you out of your comfort zone. The fight is on. And to everyone else, you’re in the way. Not exactly pleasant.

Here’s what I want you to do.

If you felt upset at any point at the end of last year, now is the time to look yourself in the mirror and ask if you’re doing everything you can to make sure your family survives the next financial crisis. Because I don’t know if the big one is coming, but I do know you’ll be much more comfortable if you face the facts head-on and make the appropriate adjustments. Because the storm clouds will form again. And the calm before a storm is a terrible thing to waste. Get your financial house in order.

Will the Dow’s Mega-Companies Use Blockchain to Change the World?

You may still not have recovered consciousness after the 19% drop from October 3 through Christmas Eve. So, I wouldn’t blame you for not noticing the Dow’s rapid 16% rise over the past nine weeks. One question I receive quite often is, “what are your thoughts on technology?” My quick response—I love technology. But when it comes to investing, the company better pay a dividend. I want to be—and I want you to be—paid for investing in stocks.

One area in tech I’ve been writing to you about is blockchain. It’s the backbone behind cryptocurrencies such as Bitcoin and Ethereum. And as I’ve told you in the past, I wouldn’t invest in either one, but I love the premise behind blockchain—a distributed ledger—where you don’t have to trust just one entity or source for its accuracy. Imagine if TV networks were guided by blockchain and you could quickly strip away opinion and were left with just facts. Maybe that’s wishful thinking.

But when it comes to food, for example, the more information the better, right? Want to know if your chicken lived free and how it died? Now you can, writes Robyn Metcalfe in The Wall Street Journal:

We’re more eager than ever to understand our food’s journey from field to fork, and the market is responding. I recently held my smartphone up to a QR code on a box of blackberries to see the smiling faces of the family who produced them. And while poultry-video analysis may sound absurd, tracking and tracing is critical when it comes to food safety and handling. Our growing appetite for this information comes from a lack of trust in the global supply chain, fueled by revelations about contamination, fraud, animal welfare and safety-inspection lapses. But the industry is investing heavily in technology—from internet-connected sensors to geolocation data and blockchain—that will help producers, shippers, regulators and consumers know where our food is at every step (From the Future of Everything in the WSJ)

When it comes to investing in technology, especially blockchain, the opportunities are endless as we crave ever more information. But my favorite way to invest in this technology is via the deep pockets of boring old companies that know a thing or two about supply chain management. Don’t think for a second that you’re not investing in technology if you own industrials—tech is what separates them from the pack.

Read more on the blockchain here:

- The Big Implications of Blockchain

- Can Blockchain Survive Crypto-Mania?

- Cryptocosm and Life After Google

Do You Have What it Takes to be a Great One?

My son’s high school hockey team won their game the other night 7-1. In what can often be a tense ride home (dad’s you know what I mean) I was more relaxed talking about his play. One of his comments was “If we beat them 7-1 what are the other teams winning by that beat us 7-1?”

I’ve been thinking about that comment.

Becky responded that both teams looked evenly matched at the beginning and then at one point it shifted one way.

It’s hard to see that shift live and in person.

It’s easier to see it after the game.

Take baseball, for example. If you go to a Red Sox game and see American League MVP Mookie Betts play, you would have a hard time deciphering his MVP skills compared to the rest of the lineup. In one game that is. Because the difference between most professional players is only visible after dozens and dozens of at bats and even then there’s not much separation between the winner of the MVP and the runner-ups.

Growing up in the 80s, I had the opportunity to see Wayne Gretzky and his Oilers play the Boston Bruins at the old Boston Garden. The Great One scored 92 goals in the 1981-82 season, had 200 points in a season four times, which has never been repeated since (the reasons why are here). But when my dad and I watched him play, he wasn’t particularly big, or fast, or impressive. But for all the reasons we already know, he was the Great One for a reason, which was crystal clear at the end of each season.

Last weekend Bruins great Patrice Bergeron played in his 1000th game. If you watch him live you see he’s a great player but he’s not the biggest or the most skilled player necessarily. He just puts his head down and works. And after 1000 games, there’s something to see. But don’t think for a minute it was easier for him. Because it wasn’t. He remembers what it felt like to be cut from his midget team.

As an investor, it’s difficult to see success after one day, month, quarter, year or even a few years. I consider three-years to be perhaps equivalent to one season in sports. The key is to put several investing seasons together, and stick to your game plan. And if you do that you just might become a great investor. Because believe me, when you’re in the investing game, it’s nearly impossible to see who’s great and who isn’t. That takes time.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

P.S. Congratulations to Mark Calabria on his advance by the Senate Banking Committee to become the next director of the Federal Housing Finance Agency, which regulates Fannie Mae and Freddie Mac.

I know Mr. Calabria from his work with the Cato Institute, and I like his free market principles.

If confirmed this Spring, Mark will move to the FHFA directorship from his current role as chief economist and senior aide to Vice President Mike Pence.

P.P.S. From weapons specialist Steve Schneider:

The U.S. economy has become too dependent on GPS (Global Positions System), warns Dr. Bradford Parkinson, the “father of GPS.” Dr. Parkinson and many other experts are calling for a backup system to augment GPS, not in space, but here on earth where it’s harder to hack. The concept is known as PTA, which stands for protect, toughen, and augment.

Read more from Schneider on the subject here.

P.P.P.S. Every year the United Van Lines moving study sheds some light on which states are watching citizens leave, and which are receiving them. Last year, like many years, saw Americans fleeing the high tax states of New York, Illinois, New Jersey and Connecticut, the top four states for outbound traffic.

After leaving those high tax states, Americans are heading for places they can retire with low taxes, or get a job. The top five states for inbound traffic were Vermont, Oregon, Idaho, Nevada, and Arizona.

P.P.P.P.S. When I think of great business leaders, Steve Jobs comes to mind. If you read Steve Jobs by Walter Isaacson, you come away thinking there’s Apple with Jobs and there’s Apple without Jobs. There’s no replacing an Apple with Jobs.

But what’s incredible is that Steve Jobs was never a big business guy. He wasn’t a Wall Street guy, or a corporate titan from the 80s. Strikingly, he was more of an artist than CEO. He was good at both because you have to be a great CEO to lead a business. But he was more of an innovator. It was his ability to put a stake in the ground and rally the troops in a way where their life depended on it. Because in a way it did. If you didn’t perform, you were out. And there were certainly lots of hurt feelings under Jobs. But the guy knew what he wanted and how to get things done and the rest is, unfortunately, history. Read more here.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024