“History repeats.”

“It’s different this time.”

“Real estate always goes up.”

“I’m a long-term investor.”

“I’m a contrarian.”

I remember “It’s different this time,” back in the late 90s when investors were partying in tech stocks like Prince’s song “1999.” Then the tech bust happened, and serious money was lost, never to be seen again.

“Real estate always goes up” was true right up until the financial crises in 2008, and once again, money was lost, never to be seen again.

I could go on. And I will.

“I’m a long-term investor,” I hear more than I care to admit. Then markets get hit, and my phone rings as my caller ID reads “long-term investor,” who says he wants to move to cash. “OK,” I say.

The problem with so many long-term investors is they then get stuck in cash and miss the boat. It’s tough to understand one’s risk intolerance when times are good. It’s often discovered after it’s too late.

The same is true for the investor who says, “I’m a contrarian.” This investor loves sales at Costco, but when bond or stock prices are down—when yields rise to levels you can sink your teeth into for years into the future, contrarians are rare as hens’ teeth. That’s human nature.

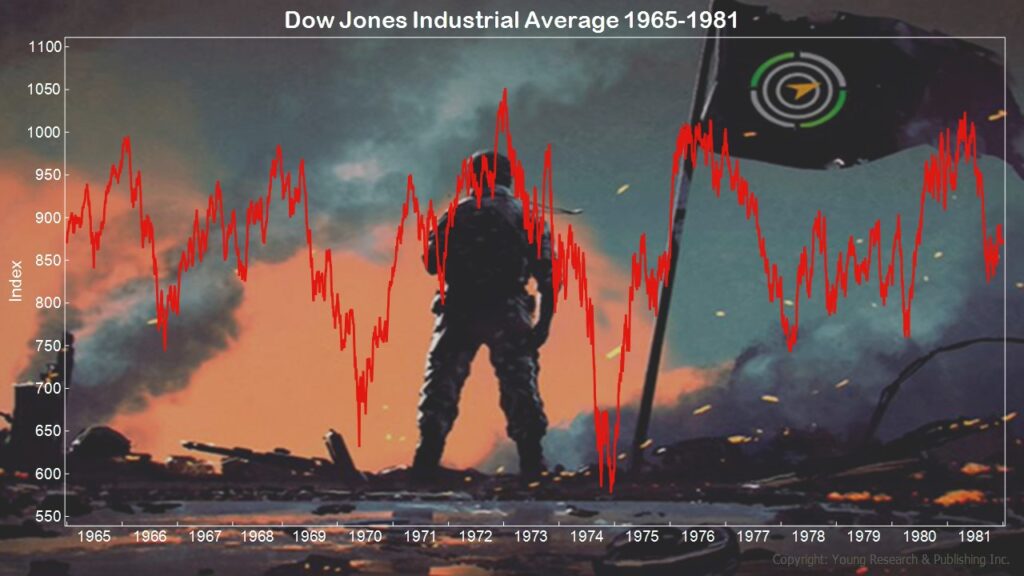

But perhaps the most relevant one for today is “History repeats.” But does it? Sure, this feels a lot like the late 60s through the early 80s. And it’s an ugly look for stocks that were as flat as a flounder skimming the bottom of the ocean.

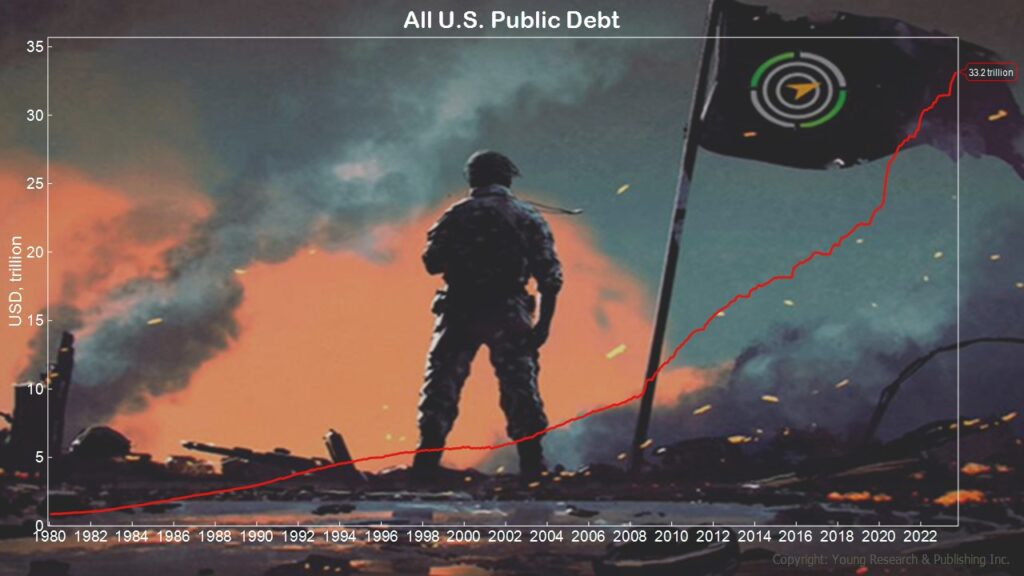

But “If you remember Woodstock,” as the saying goes, “You weren’t there.” The key difference today vs. then is the level of U.S. debt.

Life on Main Street has never been tougher. Which leads me to a phrase that withstands the test of time: “Margin of Safety.” You, my fairly wealthy investor, worked too hard for your money to live any other way.

Action Line: If you need a plan, let’s talk. Until then, try to avoid the big investing mistakes. To help, click here to download my free special report on the Top 10 Investing Mistakes to Avoid.

Read about all of the Top 10 Investing Habits of the Fairly Wealthy here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024