By BigNazik @ Shutterstock.com

Dear Survivor,

Your Survival Guy wants to share a word or two about my money. For one, I eat my own cooking. I don’t hope for my money to do something for me. I don’t bet on markets. I don’t gamble. I don’t use leverage. I don’t look at prices. I basically look at my account here and there, see the income coming in, and that’s it.

Sometimes, my portfolio is higher than the last time I looked, and sometimes, it’s not. I have a consistent investment plan in place, one I’ve had my entire adult life. It’s simple. I save a third, spend a third, and pay taxes with a third. I don’t have any debt. I own my house.

Yes, I know I could have held my mortgage at super-low rates and let inflation help with the payments, but that’s not me. That’s a game I don’t want to be involved with because it’s not a guarantee it will play out that way. And I don’t like chance.

I want to be the owner. So, I paid off the bank. Now, being an owner provides me with a tremendous amount of peace of mind and comfort. It allows me to have a clear mind. And that’s something you can’t put a price tag on. Actually, you can.

You can put a price tag on your economic independence. You’ll feel great about the control you have. You’ll face tough markets as a shepherd of your money, not a sheep. And yes, focus on income rather than prices.

Prices are fickle. Income is math.

A lot of how I think about money is doing what needs to be done to make me, not anyone else, happy. To make me comfortable. And to be able to sleep well at night. Because doing productive things with money can bring happiness. Just like doing unproductive things can bring sorrow.

I believe in you. Keep it simple. Make things happen. Be happy.

Another Word about Your Survival Guy’s Money: Spending

Let’s talk about spending and the importance of living your life to keep you young. Because it makes all the difference in the world. Within reason, of course.

Your Survival Guy and Gal recently celebrated our 25th wedding anniversary in Anguilla. Located in the British West Indies, our last name of Smith made us feel like locals in no time. And with only 14,000 or so residents, it seems like everyone knew our name by the time we left. It’s not unusual to see your server at breakfast working at a nearby restaurant at dinner.

When it comes to spending and taking trips, it’s the anticipation, the thinking about it, and planning that’s half the fun. It gets you through a lot of rainy Saturdays in New England, thinking about frozen pina coladas on the beach and planning activities for your trip. Not that we’re beach people, but we adjust accordingly. I’m Your Survival Guy, after all.

Getting to Anguilla can be a bit of planes, boats, and automobiles. Landing in St. Maarten, we took a transfer boat to Anguilla, about a 20-minute ride in some rough water, and a 15-minute car ride put us at the front security gate of Cap Juluca, a Belmond Hotel. If you want to get away from it all, this is your place. Relaxation is the key word. But it doesn’t have to be. Because everyone’s having fun and meeting new friends to keep in touch with back home is a big part of it.

Don’t be in a rush, though. You’re on island time. Not that they observe daylight savings. They don’t. Imagine my surprise when my iPhone matched the time on my watch the next morning. “Now that’s service,” I thought to myself. And then realized the time doesn’t change there. I was happy to gain the extra hour when we got back home.

Enjoy exploring outside the resort with your Moke. Visit nearby Prickley Pear Island off the coast for some lunch. Snorkel. Listen to music. Read a book. Think about your next meal. You’re on vacation. Note: The sun is blazing hot. I didn’t think I’d last a week. But when it came time to leave, we felt like we were just settling in. But it was time. You can only spend so much. And home is sweet.

If you want to talk about Anguilla, let me know. I feel like I’m a local now. One love.

“So far…”

Your Survival Guy and Gal recently celebrated their 25th wedding anniversary. Before we were married in Key West, surrounded by family and friends in the southernmost state, we were anxiously watching the tail end of hurricane season.

Right before the big day, Tropical Storm Mitch hit, rerouting some flights to Miami, making the drive south on Route 1 far from beautiful as causeways were closing left and right just after crossing. Somehow, everyone made it in time for our rehearsal dinner. And the next day was one of those days after the storm, beautiful.

That made everyone even happier, especially when the spread at the Casa Marina included stone crab claws, Key West shrimp, warm Cuban mixes, and frozen boat drinks. Not that I remember much of that, or had any because I was too nervous to eat or drink much while thinking about giving my first toast as a married couple. But I’m told the sunset was incredible, and the foreign beer tab through the roof.

Months of planning went into this. My toast, that is. I would think about it and what I wanted to say on my runs. But when the moment of the toast finally came, the way I started it wasn’t planned at all. The energy of the big room, the band quietly watching, me standing there in what felt like a scene from the Roaring 20s. I looked around the room, looked at Becky, smiled, and said, “So far so good.”

There wasn’t a better place to be.

Which brings me to you and to our talks. Your milestones. Ones you’re crossing that make twenty-five years look like a walk in the park. The milestones we hear about less and less these days. I hear about them all the time from you.

Our first song seems like yesterday. Twenty-five years goes by fast. “So far so good.”

Your Survival Guy and Gal, 1998.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Retirement income. We all want it. We all need it. How do we get it? Well, dear reader, you’ve come to the right place. Let’s start with bonds. My feeling about them is once you get to age 50 or so, if you don’t already have them, then you need to get some. Your Survival Guy rounded that corner not too long ago, and I have had bonds for years. But I’m probably one of the more conservative investors you’ll come across.

I don’t “play” interest rates. I don’t try to predict where they’ll be. I look at what the markets are paying today, and I decide if I like the value proposition. A big part of my decision-making process is what are the chances for the return of my assets, not the return on them. I work too hard to see my money disappear. Treasurys, backed by the full faith and credit of the U.S. government fit the bill today.

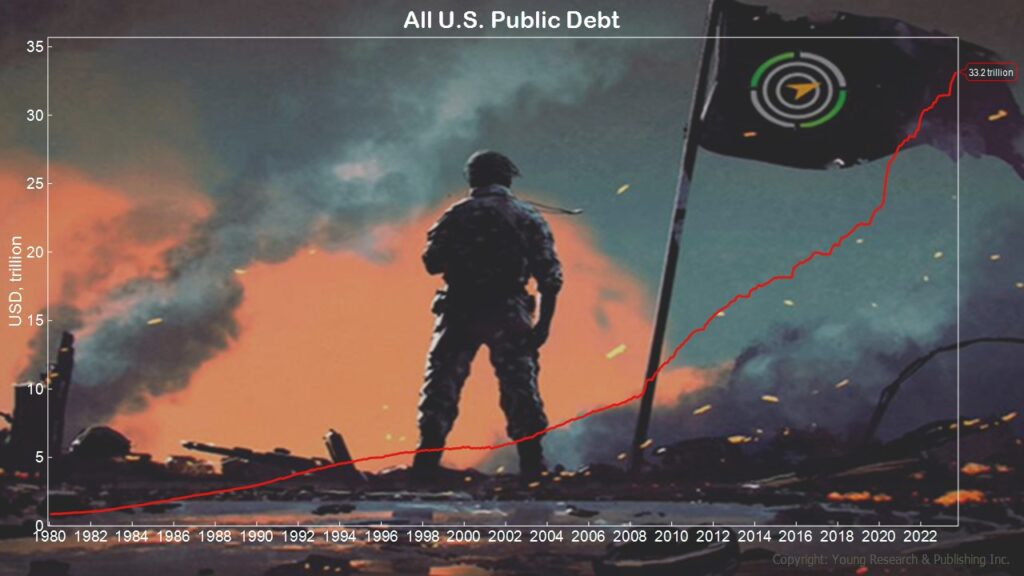

Yes, the U.S. dollar and government are still the nicest house in a bad neighborhood. But that’s no guarantee. It’s not an entitlement. Because that’s a huge IOU for the country, and based on the debt held by the public, the neighborhood’s not getting any safer.

But let’s not forget that you can draw around four percent on Treasurys today without touching principal. I like that math, and it’s why I like locking in these rates for longer periods of time. You can sink your teeth into these yields and keep them for years to come. I like that.

P.P.S. Our dog Louis is 12 years old going on two. I have a theory. You see, Your Survival Guy and Gal are empty nesters—both kids away at college—we’re home alone (not to be confused with economically free). And then there’s Louis. The house all to himself. No kids to take the attention away from him. He couldn’t be happier or more needy. He rules the roost and loves it.

When we walk him, we’re often asked what kind of dog he is. “Australian Labradoodle,” I say. “Oh, you’re one of those people,” they yell. Kidding. They don’t say that, but I know they’re thinking it.

“What makes him Australian?” they ask.

“His accent,” I say.

Then Your Survival Gal pushes me aside and explains how his breeder was Australian, where the breed originated in the early 80s, and how he’s a mix of lab, poodle, English cocker spaniel, American cocker spaniel, and Irish water spaniel.

“He’s a lot,” I say.

Which brings me to you. Not the dog part. But the relationship you and I have. The camaraderie we enjoy. The connection we have from our conversations, emails, or from you just hanging around www.yoursurvivalguy.com and reading my “Friday Missives,” as some of you refer to the emails. We have a lot in common. We do.

Because you’re living the retirement life you dreamed about, taking big trips, playing the best golf in a long time, or pickleball. You’ve done some big things since you stopped working. I also know you like your life just the way it is. Your family time. Time with your grandkids. The fact you can leave (it’s exhausting). And your happy place with your flock of snowbirds. (Don’t worry, the kids visit).

These are the good years. Make sure you’re getting the love and attention you deserve, and that you’re giving it to those around you, too. And don’t feel like you’re above begging. It’s working miracles over here.

We all need to be heard. When you’re ready to talk, I’m listening.

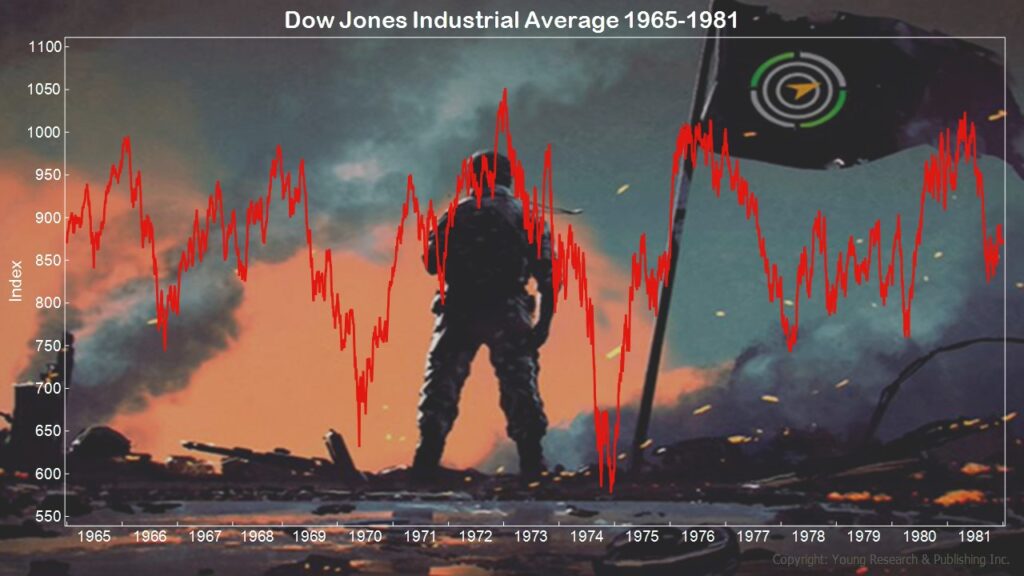

P.P.P.S. Ahhh, Mr. Market. He goes up, he goes down, but in the long run, so they say, he always goes up. Maybe. But not necessarily on your schedule. The long run might not be in time for your short-term needs. Mr. Market might not show up on your schedule. Stocks can stay down for a long time.

Which brings me to your retirement life. When it comes to you, I don’t want you hoping you’ll get your portfolio to a certain level. Hoping something will happen to you is no way to live.

Instead, I want you to control everything you can control. Your savings, your earnings, your money. In other words, work for as long as you can and save’ til it hurts. That’s Your Survival Guy’s formula for success. Live within your means, and don’t expect retirement to be cheap. I’m working with hundreds of investors through thick and thin, and I’ve been at it for over a quarter century. I can tell you retirement life is certainly not cheap. And it’s hard.

But don’t just take my word for it. In my conversations with my father-in-law Dick Young, who’s been doing this twice as long as me, he reminds me that even he wasn’t expecting how hard it would be to live off his investments. “Survival Guy,” he said recently, “It ain’t easy. Prepare yourself and your clients accordingly. Good luck. How was your day?” It was fine until now.

And so, when I think about living standards for you and your loved ones, I want you to think about taking care of business before you retire. What I mean is this: own your home, get out of debt, do not lose money. Simple, yet hard to do. I want you to retire in a position of strength, not biting your nails, wondering how to make it all work. You can do this. I believe in you.

I want you to have the retirement you deserve. Take care of business beforehand. Get your ducks in a row. You’ll be glad you did. Let’s talk.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024