Dear Survivor,

This is one of my favorite investment pieces by the late Richard Russell:

Rich Man, Poor Man

By Richard Russell

The most popular piece I’ve published in 40 years of writing these Letters was entitled, “Rich Man, Poor Man.” I have had dozens of requests to run this piece again or for permission to reprint it for various business organizations.

Making money entails a lot more than predicting which way the stock or bond markets are heading or trying to figure which stock or fund will double over the next few years. For the great majority of investors, making money requires a plan, self-discipline and desire. I say, “for the great majority of people” because if you’re a Steven Spielberg or a Bill Gates you don’t have to know about the Dow or the markets or about yields or price/earnings ratios. You’re a phenomenon in your own field, and you’re going to make big money as a by-product of your talent and ability. But this kind of genius is rare.

For the average investor, you and me, we’re not geniuses so we have to have a financial plan. In view of this, I offer below a few items that we must be aware of if we are serious about making money.

Rule 1: Compounding: One of the most important lessons for living in the modern world is that to survive you’ve got to have money. But to live (survive) happily, you must have love, health (mental and physical), freedom, intellectual stimulation — and money. When I taught my kids about money, the first thing I taught them was the use of the “money bible.”

What’s the money bible? Simple, it’s a volume of the compounding interest tables.

Compounding is the royal road to riches. Compounding is the safe road, the sure road, and fortunately, anybody can do it. To compound successfully you need the following: perseverance in order to keep you firmly on the savings path. You need intelligence in order to understand what you are doing and why. And you need a knowledge of the mathematics tables in order to comprehend the amazing rewards that will come to you if you faithfully follow the compounding road. And, of course, you need time, time to allow the power of compounding to work for you. Remember, compounding only works through time.

But there are two catches in the compounding process. The first is obvious – compounding may involve sacrifice (you can’t spend it and still save it). Second, compounding is boring — b-o-r-i-n-g. Or I should say it’s boring until (after seven or eight years) the money starts to pour in. Then, believe me, compounding becomes very interesting. In fact, it becomes downright fascinating!

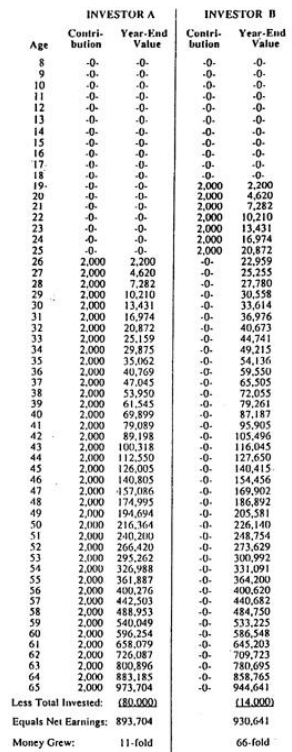

In order to emphasize the power of compounding, I am including this extraordinary study, courtesy of Market Logic, of Ft. Lauderdale, FL 33306. In this study we assume that investor (B) opens an IRA at age 19. For seven consecutive periods he puts $2,000 in his IRA at an average growth rate of 10% (7% interest plus growth). After seven years this fellow makes NO MORE contributions — he’s finished.

A second investor (A) makes no contributions until age 26 (this is the age when investor B was finished with his contributions). Then A continues faithfully to contribute $2,000 every year until he’s 65 (at the same theoretical 10% rate).

Now study the incredible results. B, who made his contributions earlier and who made only seven contributions, ends up with MORE money than A, who made 40 contributions but at a LATER TIME. The difference in the two is that B had seven more early years of compounding than A. Those seven early years were worth more than all of A’s 33 additional contributions.

This is a study that I suggest you show to your kids. It’s a study I’ve lived by, and I can tell you, “It works.” You can work your compounding with muni-bonds, with a good money market fund, with T-bills or say with five-year T-notes.

Rule 2: DON’T LOSE MONEY: This may sound naive, but believe me it isn’t. If you want to be wealthy, you must not lose money, or I should say must not lose BIG money. Absurd rule, silly rule? Maybe, but MOST PEOPLE LOSE MONEY in disastrous investments, gambling, rotten business deals, greed, poor timing. Yes, after almost five decades of investing and talking to investors, I can tell you that most people definitely DO lose money, lose big time — in the stock market, in options and futures, in real estate, in bad loans, in mindless gambling, and in their own business.

RULE 3: RICH MAN, POOR MAN: In the investment world the wealthy investor has one major advantage over the little guy, the stock market amateur and the neophyte trader. The advantage that the wealthy investor enjoys is that HE DOESN’T NEED THE MARKETS. I can’t begin to tell you what a difference that makes, both in one’s mental attitude and in the way one actually handles one’s money.

The wealthy investor doesn’t need the markets, because he already has all the income he needs. He has money coming in via bonds, T-bills, money market funds, stocks and real estate. In other words, the wealthy investor never feels pressured to “make money” in the market.

The wealthy investor tends to be an expert on values. When bonds are cheap and bond yields are irresistibly high, he buys bonds. When stocks are on the bargain table and stock yields are attractive, he buys stocks. When real estate is a great value, he buys real estate. When great art or fine jewelry or gold is on the “give away” table, he buys art or diamonds or gold. In other words, the wealthy investor puts his money where the great values are.

And if no outstanding values are available, the wealthy investors waits. He can afford to wait. He has money coming in daily, weekly, monthly. The wealthy investor knows what he is looking for, and he doesn’t mind waiting months or even years for his next investment (they call that patience).

But what about the little guy? This fellow always feels pressured to “make money.” And in return he’s always pressuring the market to “do something” for him. But sadly, the market isn’t interested. When the little guy isn’t buying stocks offering 1% or 2% yields, he’s off to Las Vegas or Atlantic City trying to beat the house at roulette. Or he’s spending 20 bucks a week on lottery tickets, or he’s “investing” in some crackpot scheme that his neighbor told him about (in strictest confidence, of course).

And because the little guy is trying to force the market to do something for him, he’s a guaranteed loser. The little guy doesn’t understand values so he constantly overpays. He doesn’t comprehend the power of compounding, and he doesn’t understand money. He’s never heard the adage, “He who understands interest — earns it. He who doesn’t understand interest — pays it.” The little guy is the typical American, and he’s deeply in debt.

The little guy is in hock up to his ears. As a result, he’s always sweating — sweating to make payments on his house, his refrigerator, his car or his lawn mower. He’s impatient, and he feels perpetually put upon. He tells himself that he has to make money — fast. And he dreams of those “big, juicy mega-bucks.” In the end, the little guy wastes his money in the market, or he loses his money gambling, or he dribbles it away on senseless schemes. In short, this “money-nerd” spends his life dashing up the financial down-escalator.

But here’s the ironic part of it. If, from the beginning, the little guy had adopted a strict policy of never spending more than he made, if he had taken his extra savings and compounded it in intelligent, income-producing securities, then in due time he’d have money coming in daily, weekly, monthly, just like the rich man. The little guy would have become a financial winner, instead of a pathetic loser.

RULE 4: VALUES: The only time the average investor should stray outside the basic compounding system is when a given market offers outstanding value. I judge an investment to be a great value when it offers (a) safety; (b) an attractive return; and (c) a good chance of appreciating in price. At all other times, the compounding route is safer and probably a lot more profitable, at least in the long run.

Here’s how you can put Rich Man Poor Man to work for your grandchildren:

The short answer is, early. The earlier you can start saving for your grandchild, the greater the impact you’ll have on their life.

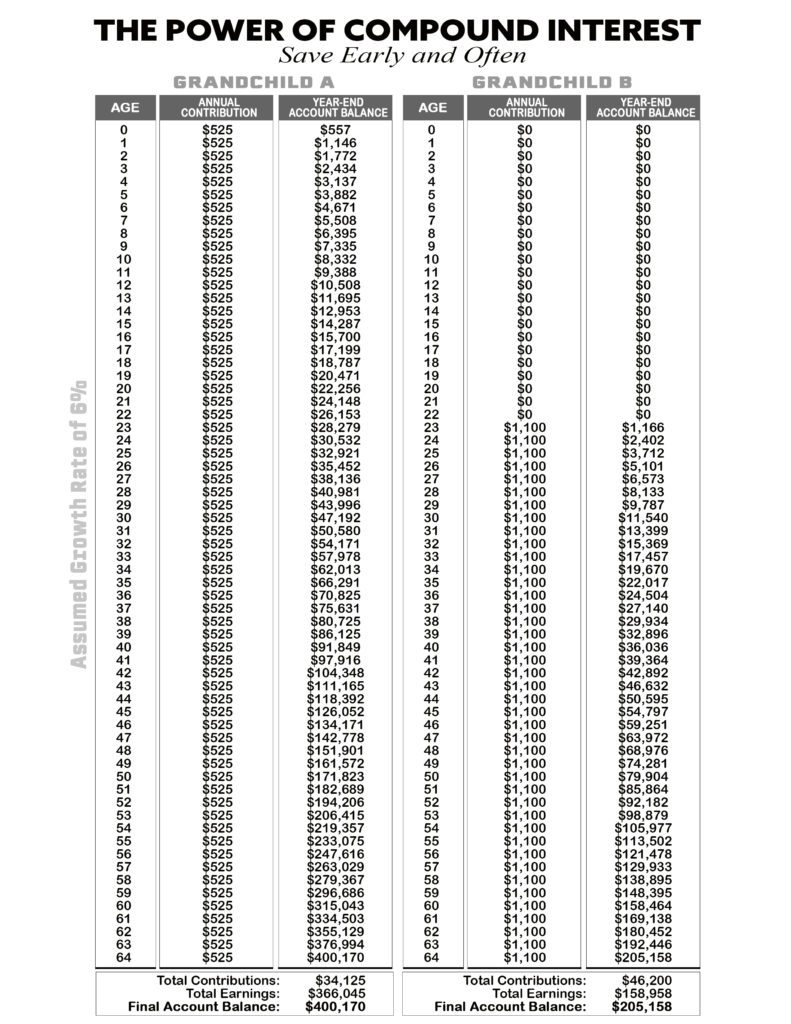

Take a trip with me. Let’s say you help a grandchild get into the savings game when they’re born by contributing $525 per year to an account you establish for them. (I favor UGMAs for this purpose). You diligently save each year for her first 21 years.

Then when she turns 22, she continues along the same path, saving $525 on her own each year until she’s 64.

Look at my table below to compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. Even though he’s saving twice as much each year, when he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side with your early generosity (I’ve used a long-term expectation for stocks of 6% growth per year).

So, how do you save money for your grandchild? Easy, put time on their side.

Save Yourself! 92% of Wealthy Danes Want to Pull Their Money from Banks

In Denmark, the central bank began setting negative rates in 2012, and for wealthy Danes, it’s been a chore to avoid giving money to the banks ever since. There are 178,000 Danes with more than 750,000 crowns in the bank, and they have been moving money to separate accounts, or simply taking it out of the bank altogether ever since negative rates were instituted.

Who wants to pay the bank to hold their money? No one, of course.

Last week I detailed for you the growing trend of wealthy individuals using safety deposit boxes. A safety deposit box has many benefits besides moving your money out of an insecure home and into a highly secure bank vault. Putting your money in a safety deposit box can also help wealthy savers in countries with negative rates avoid paying those rates to have their money kept in the bank. Storage fees apply, but depending on the amount of money you have, it could be much cheaper to leave it in a safety deposit box. It also could be less complicated than opening multiple small accounts.

In Reuters, Jacob Gronholt-Pedersen and Nikolaj Skydsgaard explain the lengths wealthy Danes are going to in their efforts to avoid negative rates:

Last month, a survey of wealthy individuals indicated that only 8% of respondents would accept paying interest rates on their private deposits. The remaining 92% want to pull their money out of deposits and put it elsewhere.

Of those, 7% percent said they would take out cash and keep it at home or in a deposit box at the bank.

“Danes seem to like the security of having large amounts of money in the bank,” said Nykredit analyst Mira Lie Nielsen. “The growing focus on the consequences of excess consumption for the climate and the environment may have begun to make Danes more reluctant to spend.”

Jyske Bank, Denmark’s second-largest bank, was the first Danish bank to announce negative rates on wealthy client deposits, in August, with roughly 11,000 clients due to be affected as of Dec 1.

It was also the first to offer a negative rate on a home loan, in effect paying customers 0.5% to borrow money for 10 years.

The move was followed by a wave of announcements from other banks, including Nordea (NDAFI.HE) last week, to begin charging wealthy individuals for their deposits of more than 750,000 crowns.

Read more here.

U.S. Navy Wants Mini F-35 Carriers

An artist rendering of the amphibious assault ship USS Tripoli (LHA 7). (U.S. Navy photo illustration/Released)

The Navy’s demand for aircraft carriers is growing almost as fast as the cost to build them, but there’s one thing that’s not keeping pace, and that’s the budget. To bridge the gap in supply and demand, admirals are looking to a WWII strategy to fill their needs. The U.S. Navy is exploring the idea of converting an amphibious assault ship (LHA) to serve as a mini-carrier. Mike Glenn of the Washington Times writes (abridged):

The U.S. Navy is looking to the past for a possible solution to its current aircraft carrier problems.

Borrowing an idea employed in World War II, the service is seriously looking at retrofitting smaller ships normally used to transport Marines into battle. Instead of troops, the new “Mini Carriers” would have a squadron of F-35B Lightning II jet fighters.

“I have a demand for carriers right now that I can’t fulfill,” Secretary of the Navy Richard Spencer said Wednesday in a briefing for reporters at the Heritage Foundation.

While aircraft carriers are the centerpiece of the Navy’s forward-deployed military strategy, they are expensive. The U.S.S. Gerald Ford — the first in the Ford class of supercarriers — cost about $12 billion.

Mr. Spencer said the U.S. military’s combatant commanders want the overwhelming combat power aircraft carriers give them.

“Part of the mission of the carrier is presence and forward deployability,” he said.

In World War II, the Navy augmented their fleet with a class of ships called escort carriers, sometimes known as “Jeep Carriers” or “Baby Flattops.” They were smaller and carried fewer aircraft but cheaper and quicker to build. While they couldn’t keep up with fast-moving invasion fleets, escort carriers accomplished a variety of missions including protecting convoys from U-boats in the North Atlantic campaign.

It’s a concept the U.S. Marine Corps has been studying to see if there are modern applications. They are looking to see if an amphibious assault ship called an LHA could be adapted to serve as a new “Jeep Carrier.”

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Twitter, Instagram, and Facebook.

P.S. Season’s greetings from our cabin in Bartlett, NH.

I thought you’d like to see this picture taken by a client at the Wanenmacher’s Tulsa Arms Show.

P.P.S. One of the best parts of helping people in retirement is getting to be a part of their retirement life. A client recently sent me this picture, and said: “Above is a snap of Rainbow Bridge taken from a nearby alcove that held some old signatures.” It was great to be able to share that moment he had worked for his whole life.

P.P.P.S. In high school in the late 80s, my friends and I were part of the snowboarding revolution that Jake Burton was pioneering. I remember in my ski club taking a van full of skis, snowboards, and classmates to Canada. A 10-to-12-hour slog from Marion, MA to Quebec, a brutal drive.

But it was all worth it once we were snowboarding from morning to late afternoon for the long weekend. It was such a great feeling because while most were skiing—we were snowboarding. It just wasn’t that common to see a lot of snowboarders at the time.

Those were special memories from high school. Snowboarding on those trips we felt like we were part of something new that was sweeping through the sport. That will always be an incredible memory for me.

Last week, Jake Burton Carpenter, the snowboarding pioneer, passed away. Read more about him here.

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024