Dear Reader,

For the seventh consecutive year Barron’s has ranked Richard C. Young & Co., Ltd. as a top independent adviser. After seeing us in Barron’s, the head of the speaking committee for the second oldest stock club in America noticed our Newport, Rhode Island location and called to see if I would give a presentation to its members.

We met at the Providence Art Club, not far from the campus of Brown University. Picture a wooden conference table the size of a ship’s deck in a, bright, sun-lit room. Imagine a relaxed luncheon setting and you undoubtedly understand how lucky I felt to be part of the club. It was a most memorable September afternoon.

An abbreviated excerpt from my talk

Privilege, Status, Access. When’s Lunch?

Thank you, for inviting me to speak today. I have had some wonderful experiences being part of investment groups. Some nice memories, some not so nice. In the heat of picking stocks it can get downright nasty. And it’s not always fun.

Contrary to the implied meaning of club: Privilege, status, access, manners, being in an investment club can be a lot of work, especially when debate amongst friends turns into a part-time job of reading reports and offering commentary without hurting anyone’s feelings. Coming to a decision is a process.

Because once you finally come to a consensus on what to buy, the next question becomes when to sell, and what to replace it with. Fun, right? When’s lunch?

You Thought Your Club was Tough

My mom was a sixth-grade teacher and every year she ran a stock market game, a club if you will. You thought your debates were heated? Imagine picking the wrong stock, bankrupting your team’s chances and knowing you won’t be picked for kickball at recess. That’s upsetting.

Warren Buffet, Steve Jobs, and Bill Gates

My younger sister and I would always perk up at dinnertime for my mother’s stories about her sixth-grade stock market game. It was initially played by my heroes, the older kids, because as a kid, age matters—a lot. One month can mean the difference between being too old for coach pitch baseball as a fourth grader and suddenly playing Little League against giant sixth graders. Talk about intimidation.

When my mom was telling fourth-grade me about so- and-so doing great in the stock market game, it felt as if she was talking about Warren Buffett, Steve Jobs, and Bill Gates—sixth graders were living legends.

But, then, when I was in seventh-grade, and then eighth-grade, her sixth-grade class never aged. And her stories would be about younger kids that looked up to me, and suddenly Mrs. Smith’s stock market game wasn’t that intimidating.

Ink Stained Fingers

When I was at Babson my mom had me come back to her classroom and talk about stocks. When the kids separated into their groups they didn’t have to say a word for us to know exactly how their stocks were performing.

Kneeling on their seats, they’d hover over the Wall Street Journal, scan it with their index finger, land on their ticker and give an ink stained fist pump “YES” or press their finger harder into the paper smudging the ink, dropping their head and whispering a loud “NO.”

We Thought it was a Good Company Too

That was real. Your stock was either up, or it was down. No hiding. No escaping. Inside you knew what it felt like to be an investor. And perhaps, at night when you would tell your mom and dad about the loss—you maybe didn’t understand the despair in their response: “We know, we thought it was a good company too.”

Inertia is a Terrible Foe

To this day my mom and dad are stopped on their walks by former students who tell her how much “You, Mrs. Smith, helped me get interested in the stock market. Thank you, Mrs. Smith!” And as I think about what she taught them—she made investing more approachable. She helped them beat a nasty foe that can weigh heavy on any investor: Inertia or simply put, not investing.

Welcome to the Family

You may know my father-in-law, Dick Young, from his investment newsletter Richard C. Young’s Intelligence Report that, at its peak, had around 100,000 subscribers with I’m guessing twice that in readership as the newsletter was a fixture on coffee tables and shared between friends and family.

After Becky and I were married, she said her dad was looking for someone to help with a common stock program and wondered if I’d be interested. Twenty years ago, this November I drove from our little house in Newport for my first day at Young Investments in the newly renovated, Old Stone Bank building near the Tennis Hall of Fame. My brother-in-law Matt, President and CEO, welcomed me in, showed me around and then I sat at my desk in front of a two-foot-high stack of buck slips from readers interested in the new stock program—and a phone. Welcome to the family!

Free Stuff and Fake News

Last year, Dick retired from writing Intelligence Report to spend 100% of his time focusing on the money management firm. This is a man who is one of the hardest workers I’ve ever met, who lives on two islands between Key West and Newport and doesn’t sail or golf. Lucky me.

The reality is that the print investment newsletter industry collapsed under the weight of all the “free stuff” and “fake news” offered on the Internet. The individual investor is now virtually rudderless, with almost nowhere to turn for sound, prudent guidance.

The Way It Used to Be

When Dick started in the investment business, old-line brokerage firms dominated with salaried customers’ men, who met face to face with clients to talk investing and to place trades in a comfortable, low-key setting.

Brokerage house boardrooms were on nearly every corner in Boston’s financial district in the sixties. If you are anywhere near his age, you may remember the welcoming, comfortable hangouts for tape readers. Hundreds of customers’ men from Merrill, Estabrook, Moors & Cabot, Goodbody, Kidder Peabody and Clayton Securities ruled the day.

My Concerns as Money Piles up at Vanguard

As money piles up at Vanguard, Index Funds across the board have been purged from portfolios at Richard C. Young & Co., Ltd., never to return. Included in the purge were Vanguard managed equity mutual funds, all of which are gone. The amount of money in these areas is truly frightening, setting up for one of the biggest disasters we may ever see. The FAANGs plus Microsoft, for example, are responsible for 99% of the gain in the S&P 500 this year. And I’ll remind you there have already been two crashes so far this century.

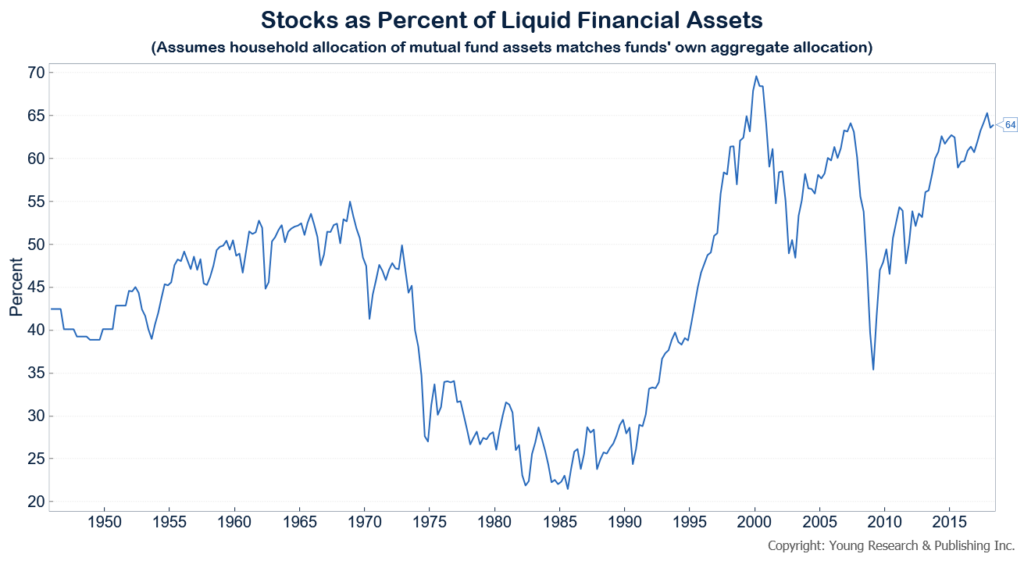

Percentage of Household Wealth in Stocks: Sand Bags Surrounding Waterfront Homes

The percentage of Household wealth invested in stocks has only been as high as it is today on two other times in history: Once prior to the bust in 2000, and again pre-2008. Defensive stocks—ones we favor that pay dividends and can help cushion losses—as a percentage of the market’s total capitalization were 40% in the early 90s, drifted lower in the late-90s, and more sharply over the last couple of years to comprise only 16% of today’s market. There’s not much of a safety net in today’s market. Imagine beautiful waterfront homes surrounded by sand bags in a hurricane and you get the picture.

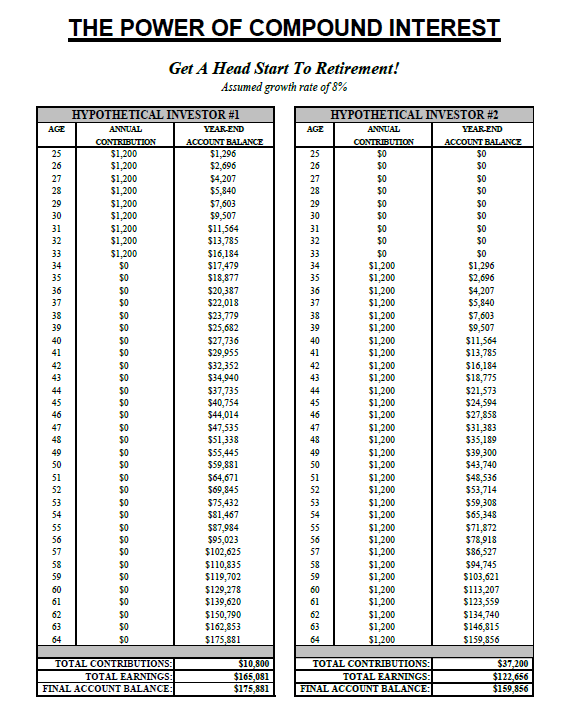

The Eighth Wonder of the World

Dividend paying stocks allow you to compound your money or take the income. Albert Einstein referred to compound interest as the “Eighth Wonder of the World.” Charlie Munger believes understanding the difficulty of getting it is the heart and soul of understanding a lot of things. The late great Richard Russell said there are two catches in the compounding process. The first is obvious – compounding may involve sacrifice (you can’t spend it and still save it). Second, compounding is boring – b-o-r-i-n-g. Or I should say it’s boring until (after seven or eight years) the money starts to pour in. Then, believe me, compounding becomes very interesting. In fact, it becomes downright fascinating! Tell your grandchildren about compound interest.

Here’s What We’re Buying

AT&T

A wonderful way to begin the compounding process is to buy AT&T with its 6.2% dividend. The company is one of the two dominant U.S. wireless companies in the U.S. with tons of potential upside in the Time Warner acquisition. And it has 33-years of dividend increases.

Walgreens

It’s the largest retail pharmacy in the U.S. that reaches 75% of U.S. consumers and Amazon fears may be overblown. The retail pharmacy business is much different than selling books and consumer electronics made in China. And there’s a compelling demographic tailwind. The 65-and-over population will increase by more than 30% over the next 12-years and as the CDC reports 91% have at least one prescription. It has a shareholder friendly management team offering a dividend yield of 2.5% and a $10 billion share buyback program which is generous relative to a $68 billion market cap.

Enterprise Products Partners

It’s the largest pipeline Master Limited Partnership with approximately 50 thousand miles of pipelines and significant oil and gas storage assets and yields 6%. The pipeline business has attractive economics and barriers to entry and its dividend has 19-years of consecutive increases, and growth potential of 5% plus making it attractive to us. Compound 6% for twelve years and you double your money while riding the energy revolution in safety.

Texas Instruments

It’s the world’s largest analog chip maker. Analog chips convert real-world signals into digital signals and are more proprietary in products they are used in, and often lower cost as a portion of product cost. Increased use of electronics in the automotive sector is a nice tailwind for TI. It has increased its dividend for 14 consecutive years and over the last five years, dividends have compounded at more than 20% rate.

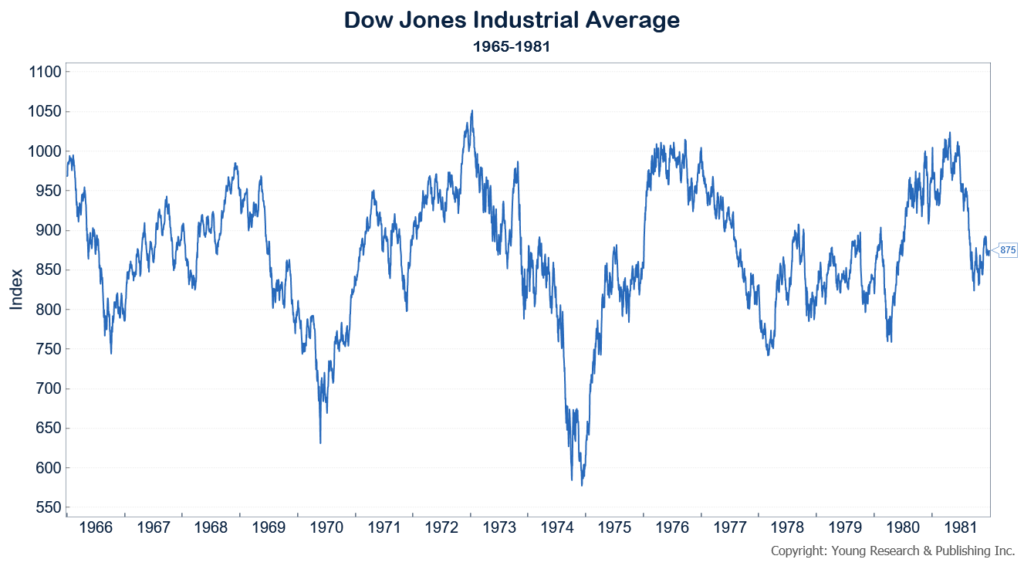

Welcome to the 60s, 70s and 80s: Interest Rates, Inflation, and the Economy Stupid

Few investors realize that you can keep your portfolio in shape simply by asking three questions. One, are short-term interest rates moving up or down on a trend basis? Two, is inflation advancing or declining on a trend basis? And three, is the economy expanding or contracting? You don’t need to go beyond these questions for help in balancing your investments portfolio in any cycle.

Rates are moving up on a trend basis, trend inflation has been accelerating since early 2015, and the economy is expanding, and faster than it has for some time.

In the 1960s, the Dow gained an average 1.8% per year. In the 1970s, the average annual advance was only 0.5%. In the 1980s, however, the Dow averaged a whopping 12.2% per year (these average annual figures are exclusive of dividends).

In the 20-year span beginning in 1960, the stock market made little headway. In the 1980s, it was gangbusters.

Why the shocking divergence? Interest rates and inflation. A rise in both is bad for the stock market. Both the 1960s and 1970s opened with low interest rates and low inflation that moved higher during the decade. The 1980s, however, opened with high interest rates and inflation that would, over the decade, fall sharply, triggering a boom in stock prices.

With rates rising today, and inflation advancing, it would benefit investors to pay close attention when making portfolio allocation decisions.

Self-Reliance

Much of my thinking today centers around self-reliance. I’m interested in helping my circle of influence find positions of strength whether it’s through self-defense training, storing water, or having cash on hand for when banks and ATMs lose power in the next disaster. Being smart about diet and exercise are also crucial ingredients. The key is not relying solely on others. Because sometimes help isn’t coming.

My Favorite Investment in the World

As we get older we tend to want to spend more time with our family and do things we want to do. Many of you, like my parents, didn’t send your children through college using profits from stocks. Maybe some, but probably not all the tuition. You probably made a good portion of your money from your work. Because you were the one that was up early every morning doing your job—building your business. You were the one that didn’t buy that fancy car and instead put the money away for a rainy day or a college fund.

Is Today all that Different?

And you might say times are different today. There’s more to worry about today. It’s not the same. But I’m not completely sold on that. Because what isn’t different is the value of believing in yourself—the value of investing in yourself. That never goes out of style. And the earlier you understand it, and believe in it and commit to it, the sooner you begin to understand the most precious investment symbol of all: Y.O.U.

Thank you for having me as your guest today. Good luck investing and make it a good day.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

Download this post as a PDF by clicking here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024