You know that Bidenflation has taken a toll on America. Now, inflation is down, but it’s not out. A new report on CPI released this morning recorded slower inflation than the previous month but was higher than had been predicted.

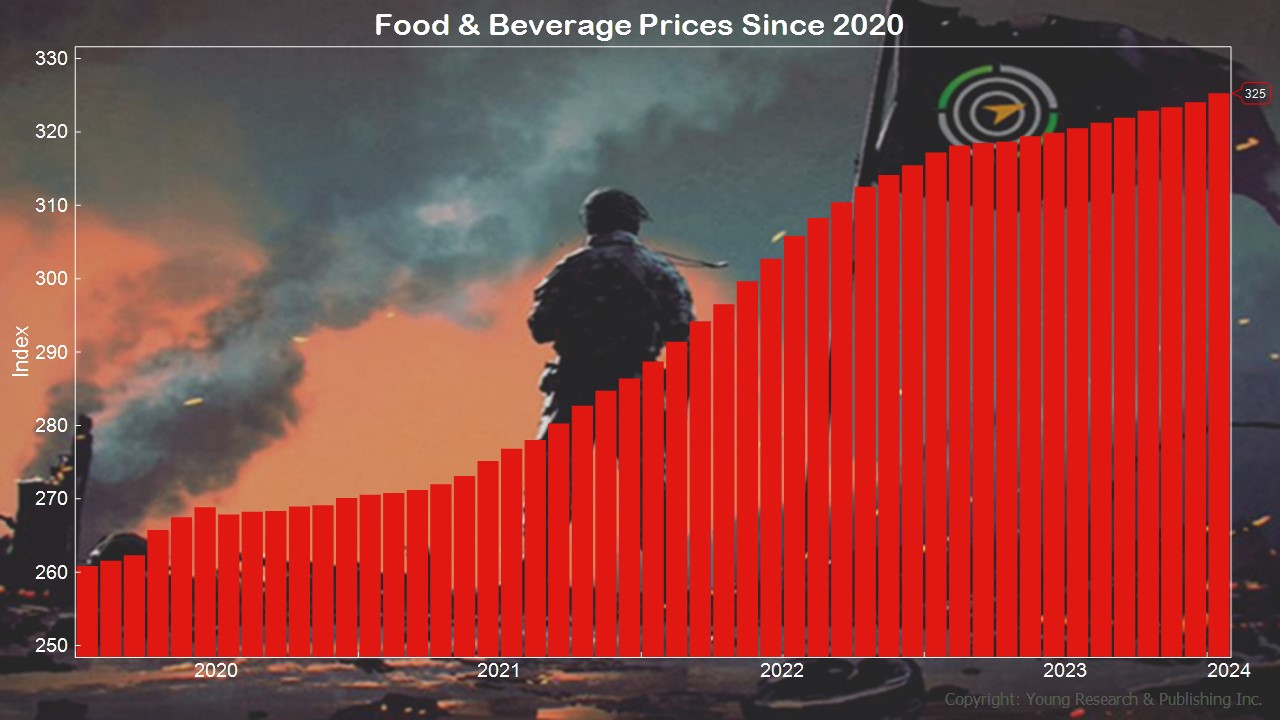

But the damage is already done for many on a fixed income. For instance, food prices have already settled in at a whole new level.

Justin Lahart discusses the report in The Wall Street Journal, writing:

Inflation cooled again in January, but the declines may have paused.

The Labor Department reported Tuesday that consumer prices rose 3.1% in January from a year earlier, versus a December gain of 3.4%. That marked the lowest reading since June. Economists had predicted that price increases would fall to 2.9%.

Core prices, which exclude food and energy items in an effort to better track inflation’s underlying trend, were up 3.9%. That was equal to December’s gain, which was the lowest since mid-2021.

From a month earlier, overall prices were up 0.3%, and core prices were up 0.4%—larger gains than economists expected.

Stock futures fell and bond yields rose after the release, which fueled worries that firmer-than-expected inflation would reduce the probability of the Federal Reserve lowering interest rates in the coming months. Interest-rate futures, which before Tuesday’s report implied the central bank would probably begin cutting rates by its May meeting, now suggest a June start date is more likely.

Action Line: Become an inflation dodger, and save til it hurts. When you want to talk about inflation and your portfolio, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- A Word on Stocks - July 26, 2024

- Is Vanguard Too Big? What’s Next? - July 26, 2024

- Boomer Candy? - July 26, 2024

- My BEST Insider’s Guide to Key West - July 26, 2024

- Having Fun Yet? Nasdaq Worst Day in Years - July 25, 2024