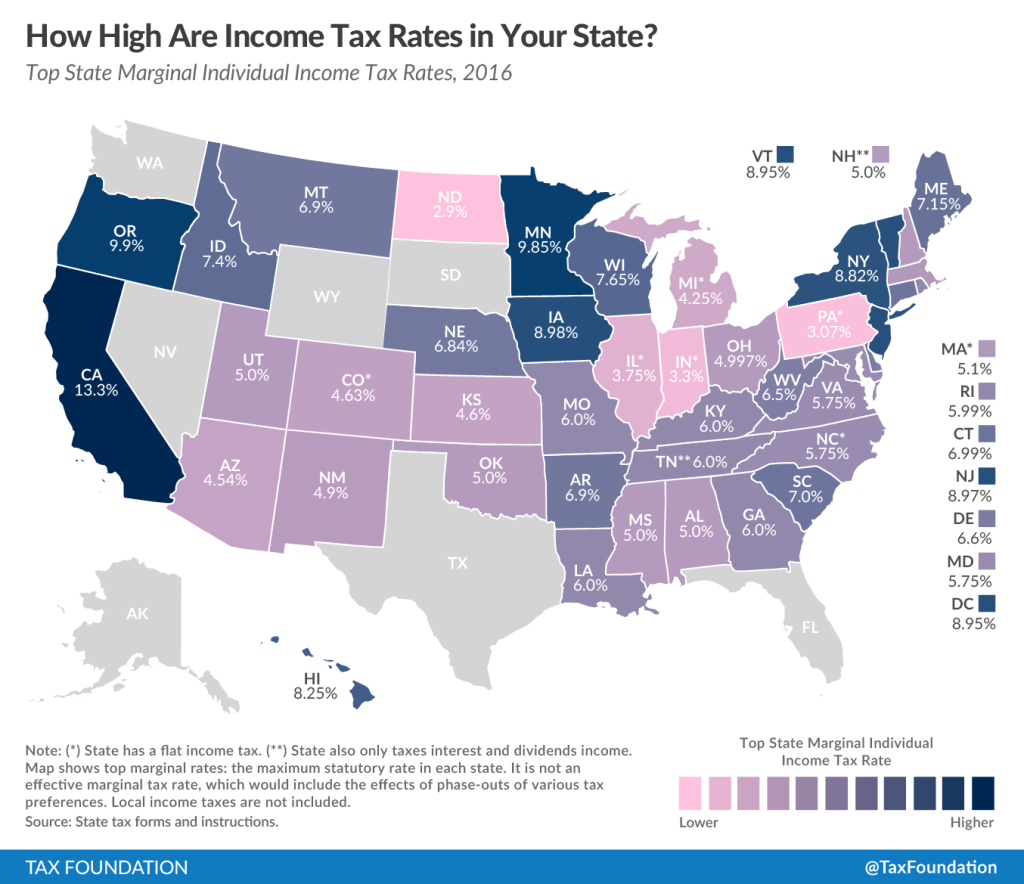

The Tax Foundation has released its annual review of income tax rates among the states. There were some big changes in a few states, and overall they were business friendly tax reductions. The Tax Foundation’s Nicole Kaeding writes:

Several states changed key features of their individual income tax codes between 2015 and 2016. These changes include:

- Arkansas lowered its top marginal rate from 7 percent to 6.9 percent on income over $35,100. Also, it adopted a new tax schedule for individuals earning between $21,000 and $75,000 in income. The state now has three tax schedules, with differing rates, depending on income.[2]

- Temporary tax increases expired in Hawaii. The three top rate brackets were eliminated, and the top marginal rate fell from 11 percent to 8.25 percent.[3]

- Maine lowered tax rates and added a third tax bracket. Rates were cut from 6.5 and 7.95 percent to 5.8, 6.75, and 7.15 percent.[4]

- Massachusetts’s rate fell from 5.15 percent to 5.1 percent.[5]

- Ohio’s tax rates decreased with the top marginal rate falling from 5.333 to 4.997 percent.[6]

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024