I didn’t want to open this one for a second because I knew NH would be up near the top of the list. But look at Illinois or New Jersey. Not only do they have high property taxes but residents are also paying income and sales taxes at some of the highest rates in the country. I don’t mind paying property taxes in NH (though it’s not fun) with the money going into the town level first. I feel like I see the benefits of paying all that money at a more local level. How much of their income and sales taxes are Illinois and New Jersey residents ever seeing again? Janelle Fritts reports for the Tax Foundation on where people are paying the most in property taxes. She writes:

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well. In fiscal year 2020, property taxes comprised 32.2 percent of total state and local tax collections in the United States, more than any other source of tax revenue. Local governments rely heavily on property taxes to fund schools, roads, police departments, fire and emergency medical services, as well as other services associated with residency or property ownership. Property taxes accounted for 72.2 percent of local tax collections in fiscal year 2020.

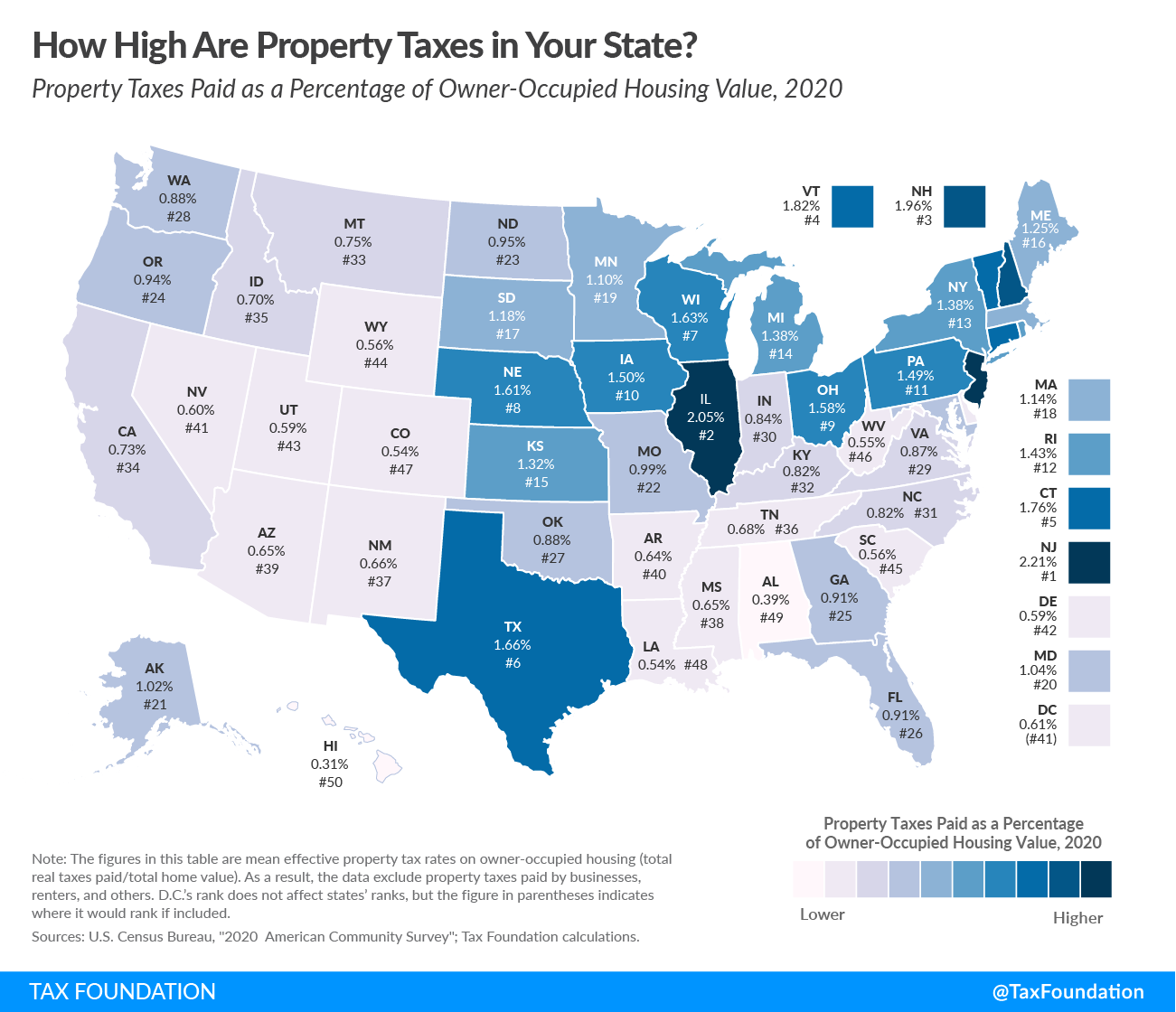

Because property taxes are locally levied, providing a useful state-level comparison can be difficult. So, in an effort to present a multifaceted view, today’s blog features two maps focused on the property tax. The first looks at median property tax bills in each county in the United States, and the second compares effective property tax rates across states.

Median property taxes paid vary widely across (and within) the 50 states. The lowest bills in the country are in six counties or county equivalents with median property taxes of less than $200 a year:

- Northwest Arctic Borough and the Kusivlak Census Area (Alaska)*

- Avoyelles, East Carroll, and Madison (Louisiana)

- Choctaw (Alabama)

(*Significant parts of Alaska have no property taxes, though most of these areas have such small populations that they are excluded from federal surveys.)

The next-lowest median property tax of $201 is found in Allen Parish, near the middle of Louisiana, followed by $218 in McDowell County, West Virginia, in the southernmost part of the state.

The eight counties with the highest median property tax payments all have bills exceeding $10,000:

- Bergen, Essex, and Union (New Jersey)

- Nassau, New York, Rockland, and Westchester (New York)

- Falls Church (Virginia)

All but Falls Church are near New York City, as is the next highest, Passaic County, New Jersey ($9,999).

Where Do People Pay the Most in Property Taxes?

Median Property Taxes Paid by County, 2020 (5-year estimate)

Property tax payments also vary within states. In Georgia, for example, where the median property tax bill is relatively low, median taxes range from $413 in Quitman County (near the Alabama border in the southern part of the state) to $3,185 in Fulton County (a suburb of Atlanta). This is typical among states; higher median payments tend to be concentrated in urban areas. This is partially explained by the prevalence of above-average home prices in urban cities. Because property taxes are assessed as a percentage of home values, it follows that higher property taxes are paid in places with higher housing prices. However, because millages—the amount of tax per thousand dollars of value—can be adjusted to generate the necessary revenue from a given property tax base, the higher payments also reflect an overall higher cost of government—and commensurately higher taxes—in these areas.

While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, it’s worth noting that property taxes are largely rooted in the “benefit principle” of government finance: the people paying the property tax bills are most often the ones benefiting from the services.

Because the dollar value of property tax bills often tracks with housing prices, it can be difficult to use this measure to compare between states. Further complicating matters, rates don’t mean the same thing from state to state, or even county to county, because the millage is often imposed only on a percentage of actual property value, as is discussed below. However, one way to compare is to look at effective tax rates on owner-occupied housing—the average amount of residential property taxes actually paid, expressed as a percentage of home value.

In calendar year 2020 (the most recent data available), New Jersey had the highest effective rate on owner-occupied property at 2.21 percent, followed by Illinois (2.05 percent) and New Hampshire (1.96 percent). Hawaii was at the other end of the spectrum with the lowest effective rate of 0.31 percent, followed closely by Alabama (0.39 percent) and Louisiana (0.54 percent).

Action Line: Despite having the third highest property taxes in the nation, New Hampshire still has a far better than average effective tax rate (including all forms of taxation). If you live in a state that taxes your property, your income, your purchases, and even your soda, it’s time to look for a better America. Find a better place in one of my Super States. Subscribe to my free monthly Survive & Thrive letter, and I’ll push you to make the right choices for your family and to find your best America.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024