By ADragan @ Shutterstock.com

Good morning from post-winter storm Gail. Your Survival Guy is safe and sound. Not much of a snowmaker here in Newport. But the snow is pretty, especially this time of year. Let me know how you’re faring in your neck of the woods.

In my conversations with you, you’re telling me about your own island life you’ve created, and I thank you for that. You’re telling me you’re getting lost in your reading, doing a lot of thinking, and looking forward to when your band gets back together this Spring. In the meantime, your island life is alive and well. You understand you don’t need to spend a lot of money to be rich.

When you look around Main Street, you’re seeing what I’m seeing. Instead of Santa’s Little Village displays softly lit inside store windows, you see “for lease” signs hastily taped to the glass. In the northeast, restaurants that depend on a somewhat lively “shoulder” season are struggling from government-imposed restrictions. The lights are on in the big blue cities, but nobody’s home.

Sound like a thriving economy to you? Hardly. This is a time to take inventory of your portfolio and to understand the masters of the finance universe are calling the shots. It’s a time to get ready for Winter. Because as my father-in-law Dick Young explains, “This is THE MOST dangerous investing environment in my lifetime.”

“You should consider a battle-hardened strategy that will protect you in the ‘worst of times,'” he writes in his piece My Battle-Hardened Stock Market Strategy for the Worst of Times.

He writes:

In September of 2014, I explained to readers my battle-hardened strategy for dealing with the worst of times in the stock market. My strategy was inspired by Ben Graham, and I have used it throughout my 55-year career in investing. Here’s how it goes:

Ben Graham’s The Intelligent Investor was first published in 1949. I came in a little late in the game with my 1973 edition, which I have in front of me as I write. It is important to me that you and all of our management clients are able to sleep well, even during the periodic stock market busts that we all have to ride through from time to time. I never get out of the market; thus, I require a battle-hardened strategy to stay the course during even the worst of times. Ben Graham wrote, “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” From day one, I have stuck to Ben’s foundation principle to the benefit of all our subs and clients.

Primary Concern: Conserve Principal

Ben built on his foundation principle by writing that truly professional investment advisors are quite modest in their promises and pretensions. As he noted, “The leading investment-counsel firms make no claim to being brilliant, but they do pride themselves on being careful, conservative, and competent. The primary aim is to conserve the principal value over the years and to produce a conservatively acceptable rate of return. Any accomplishment beyond that—and they do strive to better the goal— they regard in the nature of extra service rendered. Perhaps the chief value to clients lies in shielding them from costly mistakes.”

The Defensive Investor

I like to think that it is just this approach that allows our subscribers and clients to sleep well and remain comfortable that we are all on the same team. Part of the complete program is your portfolio balance. Ben Graham wrote, “We have already outlined in briefest form the portfolio policy of the defensive investor. He should divide his funds between high-grade bonds and high-grade common stocks. We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequent inverse range of between 75% and 25% in bonds.”

With market volatility increasing, it’s time you reviewed your own strategy. You should consider a battle-hardened strategy that will protect you in the “worst of times.”

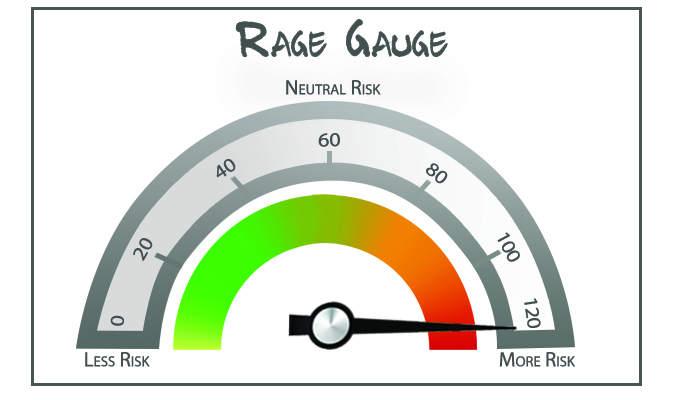

Action Line: With my RAGE Gauge at full tilt, you must consider the RISK of losing money before any thought of making MONEY. This is not going to be fun. I’ll be keeping you posted every single morning right here, so don’t be a stranger.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024