For the first time in a decade last year, West Virginia had a net inflow of residents. People are moving to West Virginia, and it’s most likely a response to the state’s efforts to stop the woke agenda, to promote school choice, and to protect the Second Amendment. What could really drive more businesses to the state is the upcoming planned tax rate reduction. The Wall Street Journal reports:

West Virginia lawmakers want their state to become a destination for people and investment, and GOP Gov. Jim Justice has proposed a major tax cut to help. But he’s going to have to overcome misguided opposition from the Republican Legislature.

Mr. Justice’s plan would cut West Virginia’s top income-tax rate to 3.25% from 6.5%. The full reduction would phase in through 2025, beginning with a 30% cut this year. “It will take us three years to pull it off,” Mr. Justice said in his State of the State address. “But absolutely it is that aggressive pathway that will absolutely put unbelievable money right back into all of our pockets.”

The proposal is ambitious, but it isn’t radical by any measure. The rate cut would help the state compete for investment with its neighbors, many of which have also slashed rates. West Virginia’s current 6.5% top rate is higher than those in the five states that surround it. That includes Ohio (3.99%) and Kentucky (5%), which have passed cuts since 2021, as well as Virginia (5.75%), which is considering a cut.

That’s why the GOP-led state House passed the plan last month, 95-2. Yet the bill has faltered in the Senate, even though the GOP holds 31 of 34 seats.

The opposition is led by Senate finance committee chairman Eric Tarr and Senate president Craig Blair. “It’s unsafe for your family, because you’re going to now bank on an increase in revenue,” Mr. Tarr says. “Then a future legislature is going to have to go back and say, ‘Oops, we’re going to have to go back and raise taxes somewhere.’”

That’s the usual line from politicians who want to keep more revenue for themselves, but it doesn’t wash in West Virginia today. The Mountain State finished fiscal 2022 with a record $1.3 billion surplus, which equals about 28% of planned spending for 2023. The state’s economy is benefiting from high prices and demand for coal and natural gas, but the state needs to diversify its economy for the future.

Mr. Justice’s tax bill sets aside $700 million for a reserve fund to help with any revenue downturn. That’s on top of the state’s nearly $1 billion rainy day fund. “In years past we haven’t had billions of dollars of surplus,” Mr. Justice told the press recently, saying the time is right to return funds to taxpayers.

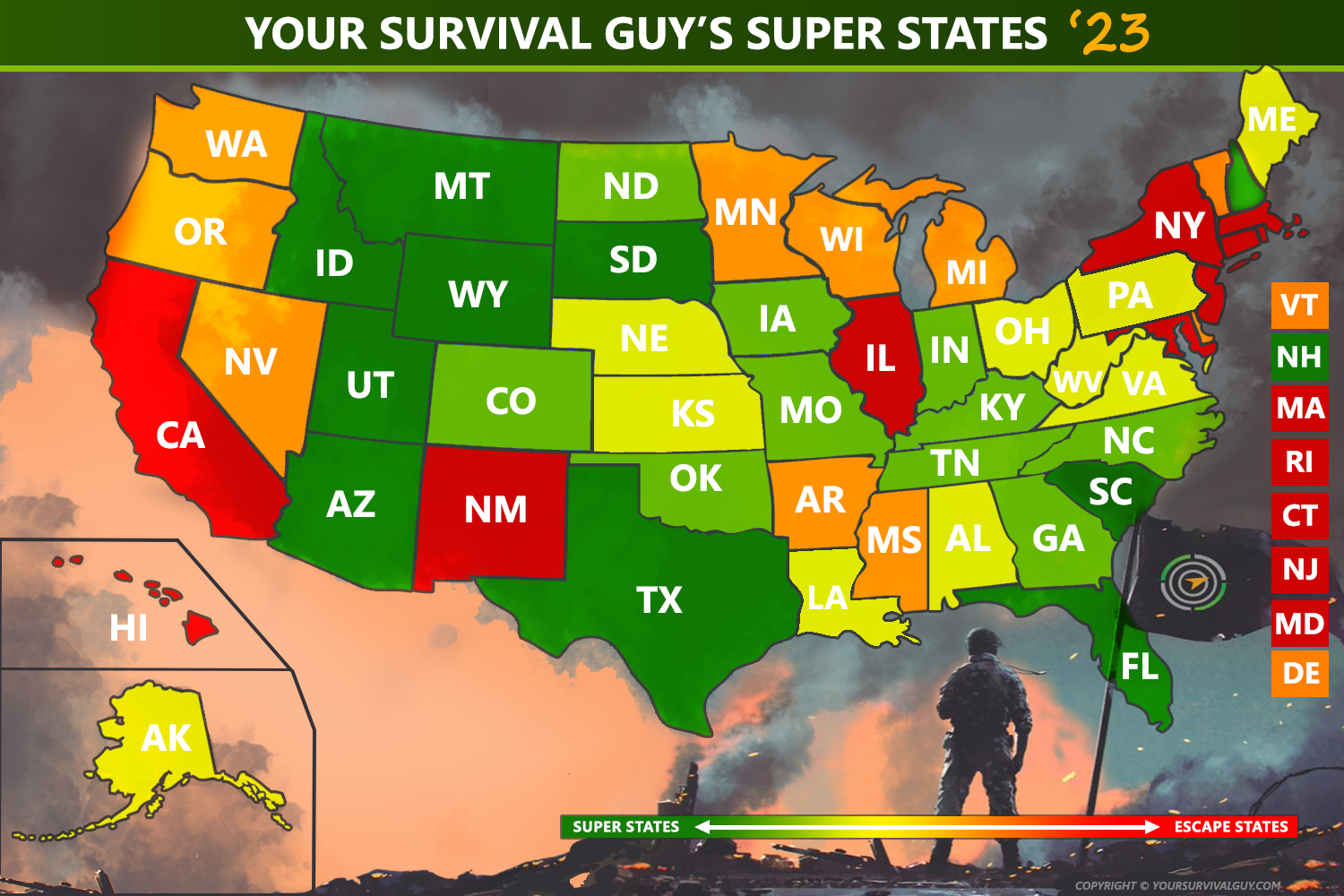

West Virginia moved from 31st on my 2022 list of Super States to 23rd on my 2023 list of Super States. The state’s leaders are doing what it takes to turn the Mountain State into a prime location for people looking for a better America.

Action Line: Keep an eye on West Virginia’s progress by clicking here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- A Word on Stocks - July 26, 2024

- Is Vanguard Too Big? What’s Next? - July 26, 2024

- Boomer Candy? - July 26, 2024

- My BEST Insider’s Guide to Key West - July 26, 2024

- Having Fun Yet? Nasdaq Worst Day in Years - July 25, 2024