Dear investor, wouldn’t it be nice to forget it all and live without a care in the world? Ah, the good life. Sounds pretty nice, doesn’t it? But is it really that good? Living the good life isn’t necessarily a healthy one.

Now let’s contrast “the” good life with “a” good one. Living “a” good life is hard. When you hear “John lived a good life,” you picture a different individual than when you hear “John, he lived the good life.”

As an investor, you want to live a good life. Nice and steady. No crazy ups and downs that push you out of positions, forcing a sale. Because that’s what can happen overnight with an investor who is living “the” good life as if investing is a party. It’s not.

The good life investor—maybe he’s a friend of yours—tells you all about his winnings and shows you his new foreign car to boot. Then when the lease is up, and the money’s gone, you don’t hear too much about how hard life got. You just know.

Now, an investor focused on living a good life is quiet. Laser-focused on slow and steady, just putting one foot in front of the other and compounding successes. Collecting dividends from stocks and interest from bonds. This investor understands it’s much easier to buy stocks than it is knowing when to sell.

Two lives. Easy to understand. One much harder than the other.

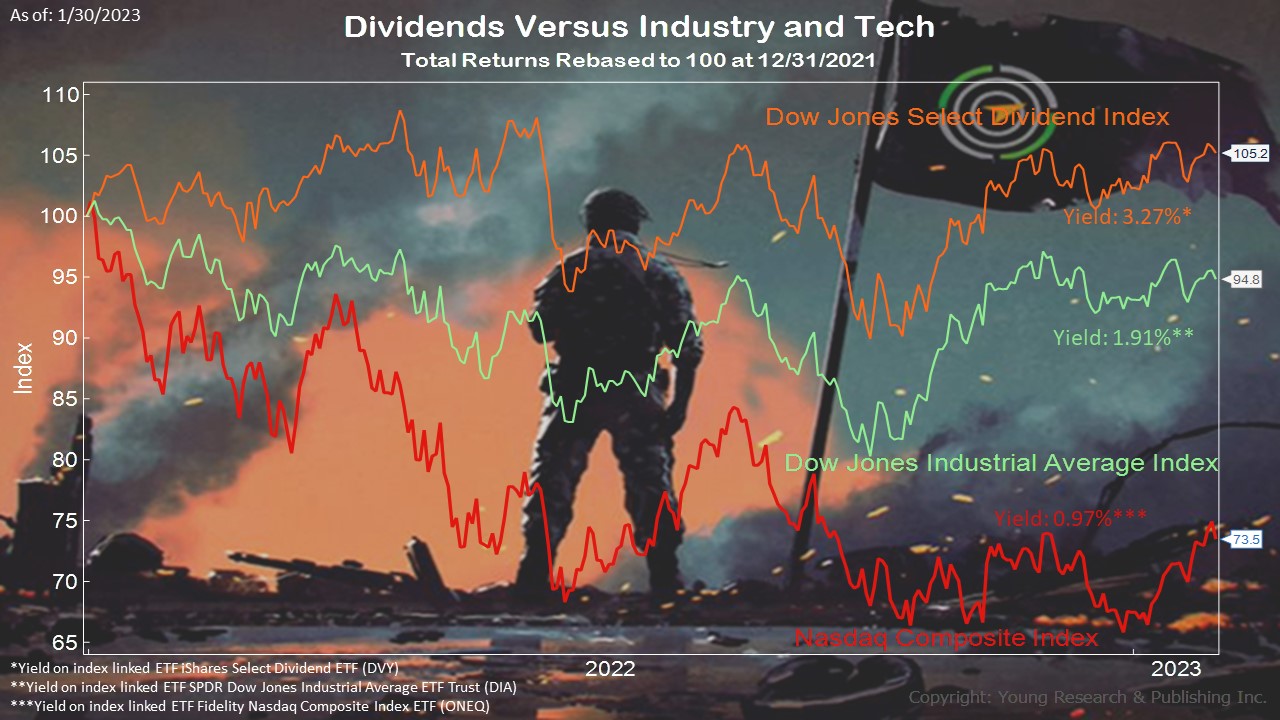

Action Line: Dear investor, look at these yields and understand stocks are selling for less than they were just months ago. Maybe it’s time we talk.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024