Your Survival Guy has witnessed it all when it comes to investing. I’ve written to you about the top 10 investing mistakes to avoid and the top 10 investing habits of the fairly wealthy (see below).

I’ve told you how I see investors get overweight in stocks like it’s an all-you-can-eat buffet. Then they switch to a strict diet of cash, selling out at the bottom of a bear market, never to get back in. It’s why I don’t try to time the market, nor do I advise it for you because you need to be right twice: when to sell and when to rebuy.

Avoid the problem altogether. Don’t get greedy. Because the crowd with too much in stocks seems to always learn the hard way: they graduate from the school of hard knocks. And that’s a tough school. One I’d put up against Harvard.

As an inflation fighter, I want you to think about what you can handle. Yes, we’re in the business of investing over long periods of time. That’s our job, to help investors through thick and thin. But not everyone’s cut out for the ride.

We all know what can happen with risk tolerance when markets turn down. Like a food allergy, it quickly becomes an intolerance. Know what you can handle before lining up for the buffet.

Action Line: My conversations with you give you a chance to tell me exactly what’s on your mind. You can’t do that as easily with a spouse because it’s so emotional. If I can do one thing for you, it’s offer you a non-emotional opinion. Because you deserve nothing less. Let’s talk.

P.S. The #10 Investing Habit of the Fairly Wealthy is Powerball:

Your Survival Guy knows a lot about highly successful, fairly wealthy people because I talk to them.

On the flip side, I know plenty about those who’ve won and lost a fortune. I know about the guy who can’t hold onto his money. He just spends every penny, afraid it might be gone tomorrow. And sure enough, it is.

I also know all about the billionaires thanks to the real estate sections, the virtual tours of their homes, the shows on Netflix and HBO, and the books by Walter Isaacson. Plenty of drama to go around. Entertaining. Maybe not the best family life.

That’s why when I say I’m interested in the habits of highly successful, fairly wealthy people, I’m talking about a person or family I’m intimately familiar with because I actually know them. I know how they’ve worked, saved, and lived. I know what they appreciate in life and what drives them. Yes, money buys them happiness and the freedom to do what they want. But they aren’t flashy (maybe sometimes).

Which brings me to Your Survival Guy’s Habits of Highly Successful, Fairly Wealth People #10: They’ve made their money slowly and appreciate what they have.

They’re not the lottery winners as rich as Croesus overnight, emptying the bank account, and then we’re told how it’s all gone ten years from now.

No, the highly successful and fairly wealthy appreciate what they have because they never feel rich even though they’ve got plenty. They’re comfortable. But they’re also fearful, knowing how easily it can be taken away. And the work? They can’t do the work it took to get here again because there’s not enough time.

Read the rest of the Top 10 Investing Habits of the Fairly Wealthy here.

P.P.S. The #10 Investing Mistake to Avoid is “Picked Off First:”

Your Survival Guy has compiled a list of investing mistakes to avoid. It’s a list for highly successful, fairly wealthy investors. Today’s lesson is what I refer to as “Picked off first.” Do not get picked off first base.

When you have some money, or in my example, get a hit, you need to protect yourself. You can’t afford to be picked off and sent to the dugout. But it happens with far too much frequency because investors are caught sleeping.

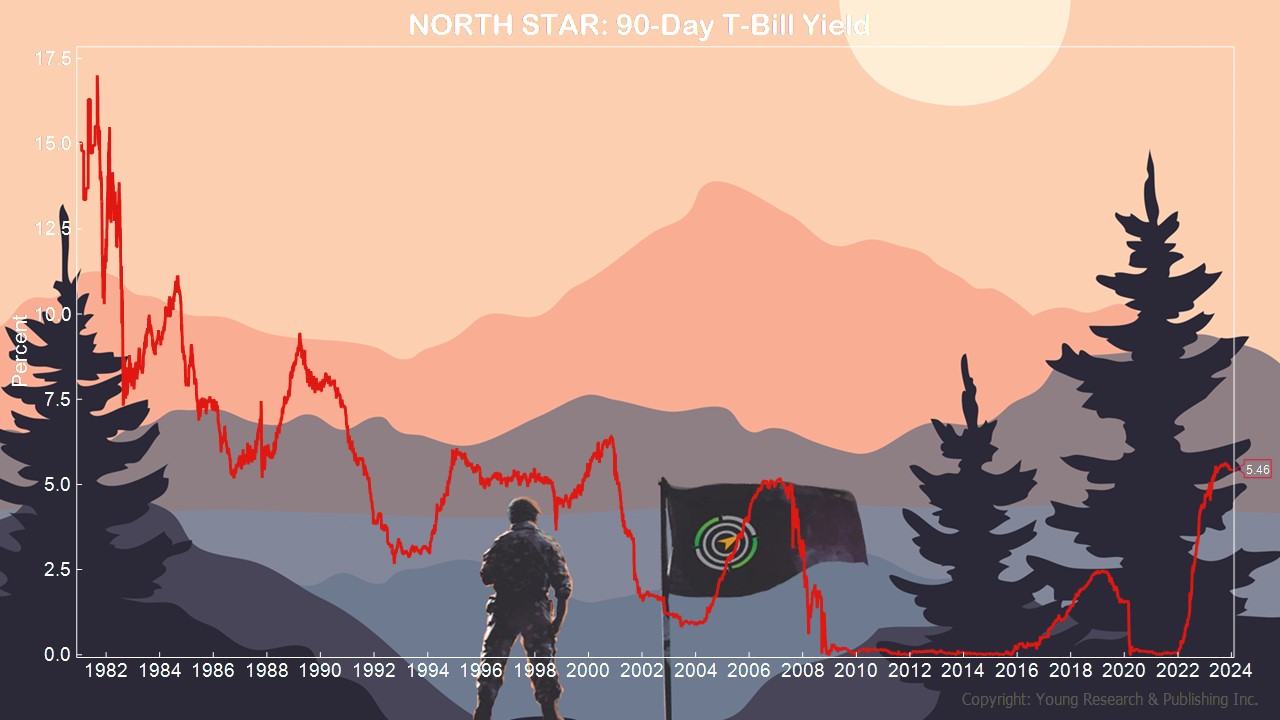

Here’s what I’m talking about. One of the first things you learn about investing in bonds is the risk-free rate of return. You can see it below. That’s gravity or Dick Young’s North Star. It’s your lay of the land.

Time and time again, investors risk their precious principal to get that extra percentage point. It makes no sense to Your Survival Guy, whose focus is to keep what you make. They’ll put $100,000 in something that pays a measly extra point to get $1,000 bucks and risk the principal.

This is the habit of the investor with a spending problem. He daydreams about his needs. Then disaster strikes. Do not be a needy investor. Start by saving ’til it hurts. Don’t get picked off first.

Read the rest of the Top 10 Investing Mistakes to Avoid here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Our Dog Louis Passed Away on April 17th - April 29, 2024

- The Burger and Fry Economy - April 29, 2024

- Less Is More at Work - April 29, 2024

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024