Federal debt is rising fast compared to GDP, and growth at these rates seems unsustainable. In recent testimony before the Senate Budget Committee, Cato Institute scholar Chris Edwards explained some spending reforms America should make to prevent a debt crisis and restore fiscal responsibility. He said: CBO projects that federal debt will rise continuously as a percentage of GDP in coming years, which could trigger a major economic crisis. Rising interest rates and new spending proposals are adding to federal budget pressures. Congress should offset any new spending and pursue reforms to … [Read more...]

Search Results for: Investing mistakes

Can the Federal Reserve Control Inflation?

According to new research by the Cato Institute's Center for Monetary and Financial Alternatives, the answer to the question "Can the Federal Reserve control inflation?" is no. Jai Kedia writes at Cato: Research by Cato’s Center for Monetary and Financial Alternatives (CMFA) shows that there is not much empirical support for the notion that the Fed can precisely control inflation. Earlier this year, Cato published a paper that suggested monetary policy was the least important contributor to inflation, far behind both demand and supply factors in the economy. However, that paper used … [Read more...]

ESG Bankers Worried about Legal Blowback for Greenwashing

Only recently, you read about BlackRock's ironic backpedaling on ESG because of its effect on supply chains for electric vehicles. Now, some more ESG chickens are coming home to roost as ESG bankers are becoming worried that the borrowers they've been lending to aren't quite up to the ESG standards they had claimed. Now the bankers are adding clauses to loans allowing them to strip the loans of their ESG designations. Greg Ritchie and Alastair Marsh report for Bloomberg: Bankers servicing one of the world’s biggest ESG debt markets are now actively seeking legal protections to guard against … [Read more...]

Some ESG Chickens Come Home to Roost

After years of hammering the mining industry with negative press and exclusion from ESG funds (meaning more difficulty in raising capital for the miners), BlackRock is backpedaling because it has finally realized how many minerals go into electric vehicles and other green technologies. The ESG chickens are coming home to roost as the scarce minerals become more expensive. ESG was always really just a way for the big dog mutual fund companies to charge higher fees and to put CEOs' politics in your portfolio. Now, firms like BlackRock must reconcile with the world they've created. Harry Dempsey … [Read more...]

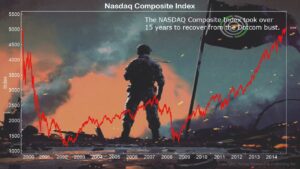

Don’t Forget How Long Markets Can Take to Recover

Don’t forget that markets can stay down for a long time after they’ve crashed. Remember how long it took the Nasdaq to recover from the tech crash? Jonathan Weil writes in The Wall Street Journal: “Five percent is more or less the average of investment-grade rates since the time of Alexander Hamilton,” said James Grant, founder and editor of Grant’s Interest Rate Observer. “The problem is the structures that 10 years of ultra-easy money brought about. People blame it on the normalization of rates. The previous bout of abnormal rates is the problem.” And the Nasdaq isn’t known for … [Read more...]

The End of Easy Money for Borrowers, Not Savers

You can see on the chart below of ten-year and three-month treasury rates that the era of easy money for borrowers is over. But savers finally have some rates they can sink their teeth into. Read more about the end of easy money in Storming the Magic Kingdom: Wall Street and the Raiders…. Action Line: When you want to talk about saving your money, I'm here. In the meantime, try to avoid making mistakes with your money. Click here to download my latest free special report on the Top 10 Investing Mistakes to Avoid. … [Read more...]

Time to Revisit Your Bond Portfolio?

In The Wall Street Journal, John Greenwood and Steve H. Hanke, both economists at Johns Hopkins, discuss the similarities of today's markets to that of 1987, and October 19 of that year, which is known as "Black Monday." They write: This brings us to the stock-market crash of 1987. In that year the key 10-year bond yield rose steeply from January onward (from 7% in January to 10% by Black Monday in October) and the money supply slowed sharply. In 1987 growth of M2 declined by almost half, from 9.7% year-on-year in January to 4.9% in September, while M3—no longer published by the Fed—slowed … [Read more...]

It’s More Important than Ever to Save Til It Hurts

According to the most recent reading of the Mercer CFA Institute Global Pension Index, the United States has come in at 22nd place among 47 countries in terms of retirement security. The big problem? The long-term solvency of Social Security. Oyin Adedoyin reports for The Wall Street Journal, writing: In a new ranking of the world’s retirement systems, the U.S. scored a C+, falling further behind the Netherlands, Australia and Sweden. The U.S. came in 22nd out of 47 countries, according to the latest Mercer CFA Institute Global Pension Index, released Tuesday, with a slightly lower score … [Read more...]

Friends Are You Living Like The Intelligent Investor?

In the mind of Ben Graham, author of The Intelligent Investor, and teacher of star pupil Warren Buffett, his thinking was to build a margin of safety into a portfolio. In addition, Buffett recalls that Graham taught that it was OK to go against the grain and avoid the crowds. And that being well-rounded in life was good for your body and soul. As my father-in-law Dick Young says, investing is more art than science. And finally, live a life of generosity—that does not necessarily mean with money, but with your time. In The Intelligent Investor, Graham wrote, “In the old legend the wise men … [Read more...]

Keep Other People’s Politics Away from Your Money

Keep other people’s politics away from your money. Your Survival Guy favors the selection and ownership of individual stocks to avoid the ESG crowd. In The Wall Street Journal, Matt Cole and Jeff Sherman discuss what they call "the charities hiding in your 401(k), writing: Environmental, social and governance investing is like the wrinkle in the rug; stomp it down and you shift the problem somewhere else. As investors and lawmakers push against ESG’s presence in portfolios, it is infiltrating index funds wearing a new disguise: the public-benefit corporation, or PBC. Unlike a standard … [Read more...]

The Suffering of Leveraged Muni Funds

Your Survival Guy does not like municipal bonds and despises leverage. Both forces are at work here as closed-end munis that use borrowed money get hit hard. Heather Gillers reports in The Wall Street Journal: Some municipal-bond funds are suffering their worst stretch since the 2008-09 financial crisis, an acute example of how two years of rising interest rates have slammed investors’ portfolios. Closed-end municipal-bond funds have been particularly hard-hit because they often use borrowed money to invest in fixed-rate, long-term bonds sold by state and local governments. The … [Read more...]

“No Pain, No Gain,” They Chant

What we’re seeing in markets is a repricing of risk—an often misunderstood four-letter word until it hits one’s portfolio. Risk is not a word Your Survival Guy even likes using because it implies dangerous stuff could happen. Risk control is more my speed. Your Survival Guy’s risk tolerance is most likely lower than that of most investors (and they might outperform), but I’m okay with that. The rah, rah, rah of the crypto bros, the look-at-me crowd, and the cocktail party big shots chant “No pain, no gain” in an upward-moving market. Then they wake up one morning and see the real … [Read more...]

BACKYARD TINY HOME: A New Must-Have for Homeowners

Your Survival Guy has been talking about the benefits of living small and saving big for years. Now, the "tiny home" has caught on as an accessory. It's no surprise when so many young people are still living with their parents, and so many adults are taking in their elderly parents to care for them. Having a second mini-home on the property gives everyone the privacy they want with a bill they can afford. The Wall Street Journal's Nicole Friedman reports: The latest amenity for homeowners is another, smaller home. These add-ons are known as accessory dwelling units. They can be … [Read more...]

The Flight from Downtown

A mix of crime, high costs, and poorly run governments have ignited a flight from downtowns in America, and one of the worst-hit cities is Chicago. Commercial real estate is facing a crisis downtown as office vacancy rates hit an all-time high of 23.7% over the last three months. Danny Ecker reports in Crain's Chicago Business: The office vacancy rate in the heart of the city during the past three months rose to an all-time high of 23.7% from 22.6% midway through the year, according to data from brokerage CBRE. The share of available space is up from 21.3% a year ago and 13.8% when the public … [Read more...]

Can a Shutdown Shrink Government?

With the prospect of a government shutdown only weeks away, emotions are mixed. Some people are terrified that pieces of the government may not operate, while others are jubilant over the prospect. At Cato Institute, Jeffrey Miron explains that Americans should instead focus on a different view of government shutdowns. Shutdowns, Miron explains, won't be a catastrophe, nor will they shrink government by starving the beast. "The only way to shrink government, significantly and sustainably," Miron concludes, "is to convince more people that smaller government is better." He writes: What should … [Read more...]

Another Under-the-Radar Crypto Fraud?

The trial of Sam Bankman-Fried of FTX is getting a lot of attention right now, but there may be yet another cryptocurrency fraud coming to light, albeit a smaller one. Xerberus, which calls itself a "risk rating protocol," has uncovered what it claims is shady activity by the executives of Ardana Labs. Tom Blackstone reports in Cointelegraph: In 2021, Ardana Labs claimed it would provide an innovative stablecoin platform for the Cardano network. The new project, called “Ardana,” would allow investors to lock up crypto collateral and mint fiat-pegged stablecoins, including a U.S. dollar-based … [Read more...]

Just a Few Problems I See with AI Portfolios: Part II

As I wrote to you yesterday, “How much Artificial Intelligence do you want in your portfolio? Your Survival Guy doesn’t want it anywhere near mine. But AI is already in the sports pages with a recent Ohio high school football recap written with the heart of a Tin Man. How much longer until we have ivory tower dwellers and woke politicians writing the rules for investments? What could possibly go wrong?” Here’s some more I’ve come up with. AI, I’m on a fixed income. Can you help? AI, I want a conservative mix of stocks. AI, I want a portfolio that is oriented to Main Street … [Read more...]

A Simple Plan to Feel Better Tomorrow

The one way for you to beat inertia is to take action. We all have dreams about who we want to be and how we want to live, but actually doing something about it can be hard. Taking action is doing something. If you have money collecting dust in a low-interest-bearing bank account, consider opening an account with Fidelity. There’s a cornucopia of money funds to choose from. Fidelity’s Treasury Money Market, for example, yields about five percent. You can simply go to Fidelity.com, but don’t leave Your Survival Guy in such haste. Read my Top 10 Investing Mistakes to Avoid (and one bonus … [Read more...]

Don’t Be Average, Be Better: Avoid This Mistake

You bet it’s an exciting time to be a fixed-income investor. But I’ve been telling you that for years. You don’t have to compound big numbers to be a successful fixed-income investor. You need to harness time and let the magic of compound interest do the heavy lifting. What never fails to amaze Your Survival Guy is how the average investor always wants more, more, more. When rates are at levels you can sink your teeth into with some peace of mind and comfort—look at treasuries—they reach for yields that are double that with terrible credit ratings. Good luck. Because it’s in times like … [Read more...]

“An Insurance Company with an Army”

Scary headlines aren’t necessarily wrong, but one mistake to avoid is not being prepared at all times. Spencer Jakab explains in The Wall Street Journal how the federal government has become a heavily indebted "insurance company with an army." He writes: Now, though, the government’s pile of debt has swelled following the War on Terror, the global financial crisis and the Covid-19 pandemic. Low interest rates and Fed bond buying masked the strain: Interest costs recently were no higher than in the early 1990s as a share of federal spending. But the Treasury barely seized the … [Read more...]