You know that Your Survival Guy wants you to live a Liberty Retirement. That means paying the fewest of your hard-earned retirement dollars possible to a government that wants to spend them on politicians’ pet projects. In 2022, ten states have worked to lower the burden on retirees. Jackson Brainerd of the NCSL lists their actions:

- Alabama (H 162): Up to $6,000 of taxable retirement income is exempt from state income tax.

- Connecticut (H 5506): Exempt pension and annuity earnings from the state income tax.

- Georgia (H 1437): Increased retirement income exclusion.

- Iowa (H 2317): Exempts retirement income from tax for taxpayers aged 55 and older.

- Maryland (H 1468): Retirement income subtraction modification for public safety employees and created a new retiree tax credit.

- Nebraska (LB 873): Accelerated phaseout of income tax on social security benefits.

- New Mexico (H 163): Exempt social security income from income tax for certain individuals.

- Utah (S 59): Expanded eligibility for the social security benefits tax credit by increasing the threshold for the income-based phaseout.

- Vermont (H 510): Expanded income threshold for social security exemption.

- Virginia (H 30): Increased exemption on military retirement income.

Seniors, just like wealthy Americans, are fleeing high-tax states. At the Cato Institute, Chris Edwards explains why states focus on seniors, writing:

Why the focus on tax cuts for seniors? One reason is that seniors vote at substantially higher rates than other Americans. Another reason may be that policymakers think seniors impose lower costs because they don’t use state‐local services such as K‑12 schools. A further reason may be that policymakers view migrating seniors as particularly responsive to taxes.

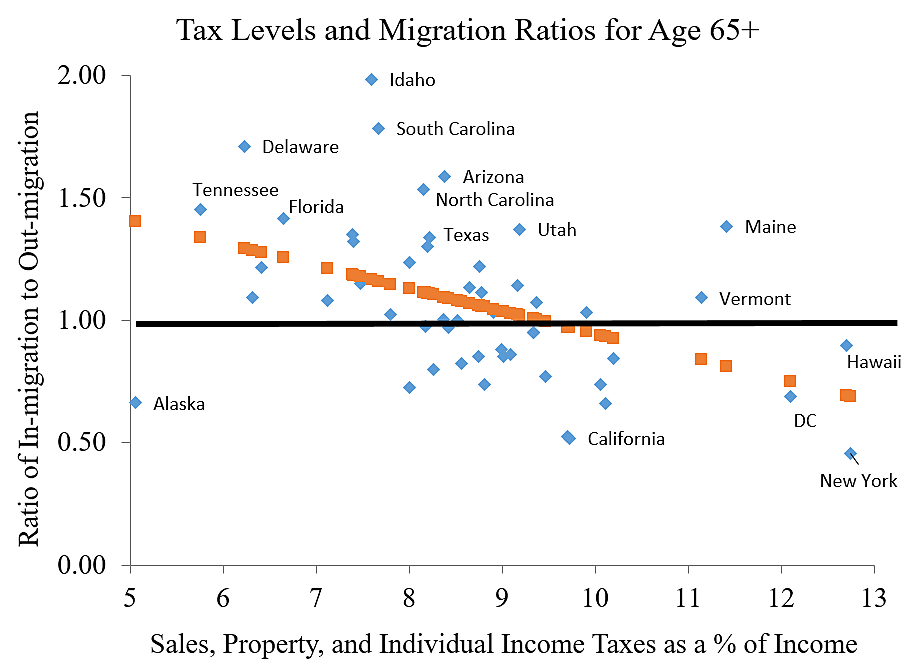

Seniors are moving from high‐tax to low‐tax states, as shown in the chart. On the horizontal axis is the sum of state and local sales, property, and individual income taxes as a percentage of income in 2019. On the vertical axis is the ratio of in‐migration to out‐migration for households age 65 and older, based on IRS data for 2020. The ratio is above one for states enjoying net in‐migration and below one for states suffering net out‐migration. Each state is a dot.

Seniors are moving from the high‐tax/out‐migration states on the bottom right to the low‐tax/in‐migration states on the top left. The orange line is Excel’s fitted regression line, which is highly statistically significant (F‑stat=12.3, t‑stat=-3.5). There are a few exceptions to the general pattern including Alaska, Maine, and Vermont.

Another angle on seniors and state taxes comes from Kiplinger, which provides a State‐by‐State Guide to Taxes on Retirees. Kiplinger examines income taxes, sales taxes, property taxes, and taxes on retirement income, and categorizes the states and D.C. as either “most tax‐friendly,” “tax‐friendly,” “mixed,” “not tax‐friendly,” and “least tax‐friendly.” It turns out that the degree of tax friendliness is correlated with the senior migration ratios discussed above. The average migration ratio for the “most tax‐friendly” states is 1.28, whereas the average ratio for the “least tax‐friendly” states is 0.86.

I would rather that states cut overall tax rates than just cutting taxes for favored groups. But for seniors, policymakers across the political spectrum see the need for their states to stay competitive. In Maryland, Governor Larry Hogan said, “Our state’s sky‐high retirement taxes remain the one area where we are still not effectively competing with other states.” In Connecticut, Governor Ned Lamont said, “We’re also going to eliminate the income tax on pension and 401(k) income for most households. Stay in Connecticut and watch your grandkids grow up in your living room rather than waving to them from a Zoom room in Delray, Florida.” Both governors followed through this year and cut taxes on retirees.

Action Line: A Liberty Retirement doesn’t come to just everyone. You have to work hard for it. Save ’til it hurts, and have a plan. You are the most important part of that plan, but you may need help. If you need help building a plan for a Liberty Retirement, click here to get in touch with me. I’d love to talk to you.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Our Dog Louis Passed Away on April 17th - April 29, 2024

- The Burger and Fry Economy - April 29, 2024

- Less Is More at Work - April 29, 2024

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024