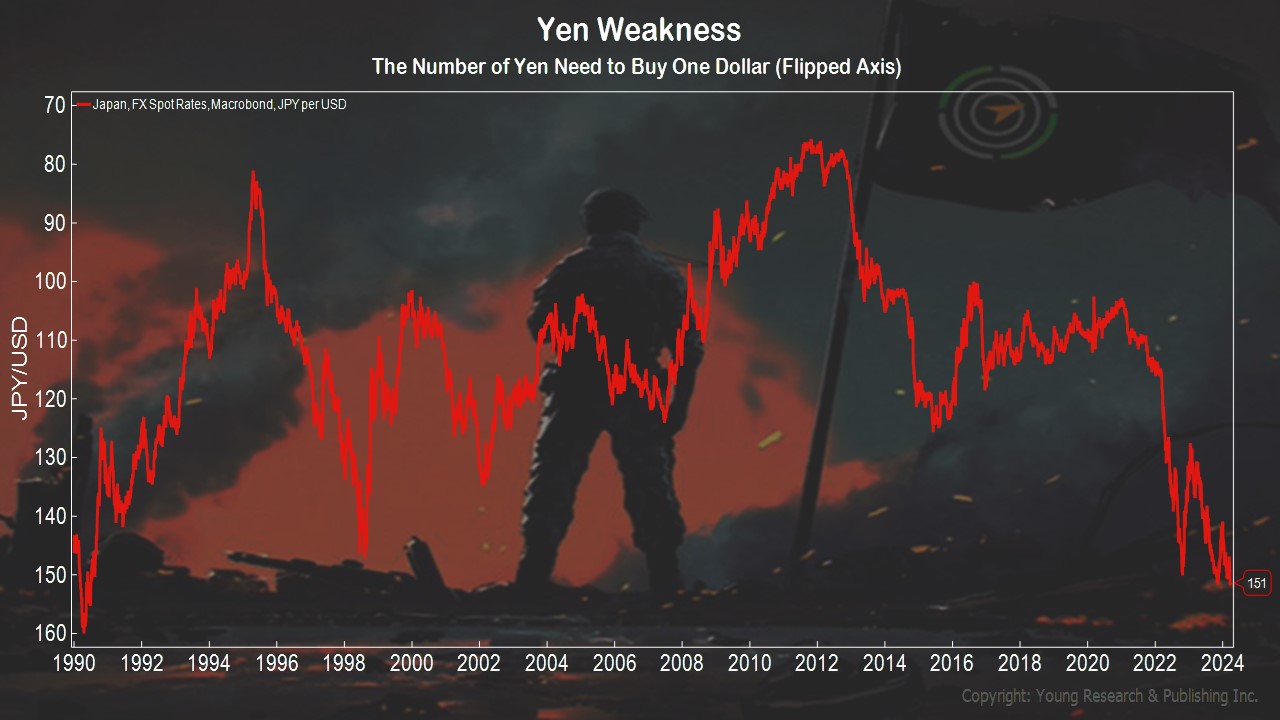

It takes more yen to buy a dollar today than at any time since 1990. Not even during the Asian Financial Crisis did the yen become this weak compared to the dollar. Foreign exchange is a matter of comparison, and right now, the US Dollar happens to be a nice house in a bad neighborhood.

The Wall Street Journal’s editorial board writes of the yen:

Excitable market analysts talk as if the main risks to the global economy are when and how much central banks will raise interest rates. A different danger came into view in Japan on Wednesday as the yen plunged to another multi-decade low against the dollar.

The yen briefly sank to ¥151.97 per dollar, its lowest value in 34 years. Finance Minister Shunichi Suzuki warned Tokyo will intervene if it deems further currency moves “excessive.” Investors think that red line is ¥152 per dollar, although we’re old enough to remember when ¥125 also was deemed a “psychologically important” floor for the yen.

This is the latest loop-de-loop in a wild rollercoaster ride for the yen and Japan’s economy. The central bank recently took a modest step toward policy normalization, setting a positive short-term interest rate for the first time since 2016. The yen had swung up and down in the months before that news as investors speculated on when the Bank of Japan might move.

The currency dragged Tokyo stocks with it. A bout of yen weakness in February propelled the market above the peak set in 1989 before the bubble economy deflated. Pre-BOJ-meeting yen strength then triggered stock declines this month. Now the foreign-exchange market appears to be acting on a belief that the BOJ won’t further tighten policy for a while and that the U.S. Federal Reserve may not cut interest rates for a few more months.

What this will mean to Japan or the global economy is anyone’s guess. Yen depreciation against the dollar in recent years has boosted the yen-denominated profits of Japan’s global companies while making yen-denominated assets such as stocks in Tokyo look cheaper to foreign investors.

Action Line: The yen’s weakness is a warning. Americans should be wary of economists who suggest following the Japanese model to deal with excessive debt or low growth. Click here to subscribe to my free monthly Survive & Thrive letter, and when you’re ready to talk, I’m here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024