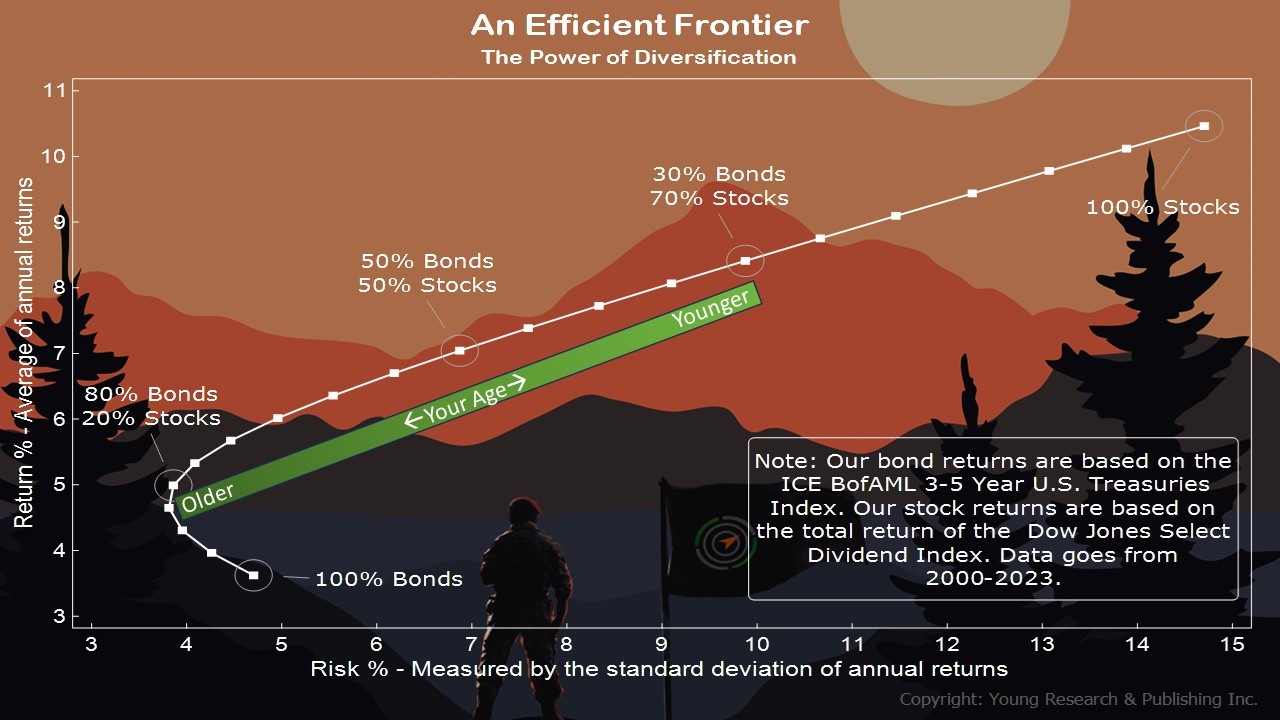

Don’t be left high and dry wishing you had a proper bond allocation for your retirement life. You know from my efficient frontier how important it is to focus on how you invest and not necessarily what you invest in.

Big pension funds are looking at today’s rates and deciding they’d like to lock them in. Heather Gillers and Charley Grant report in The Wall Street Journal:

Stock portfolios at large pension funds had a blockbuster run. Now, managers are cashing out.

Corporate pension funds are shifting money into bonds. State and local government funds are swapping stocks for alternative investments. The nation’s largest public pension, the California Public Employees’ Retirement System, is planning to move close to $25 billion out of equities and into private equity and private debt.

Like investors of all kinds, the funds are slowly adapting to a world of yield, where they can get sizable returns on risk-free assets. That is rippling throughout markets, as investors assess how much risk they want to take on. Moving out of stocks could mean surrendering some potential gains. Hold too much, for too long, and prices might fall.

For pension funds, which target specific investment returns to fund future obligations, this is a welcome change: It means they can take less risk and stay on track toward those goals. They can sell stocks, lock in price gains and move the money into bonds without sacrificing too much return. Or they can continue to push for higher returns without taking on much more risk.

Action Line: When you want to discuss your bond allocation, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Survive and Thrive April 2024: Our Dog Louis Passed Away on April 17th - May 1, 2024

- Dear Retired, or Soon to Be Retired, Investor - May 1, 2024

- What’s BlackRock Hiding in Your Target Date Fund? - May 1, 2024

- Red Lobster’s “Endless Shrimp” Was Too Much of a Good Thing - May 1, 2024

- The Hardest Part About Losing Our Dog Louis - April 30, 2024