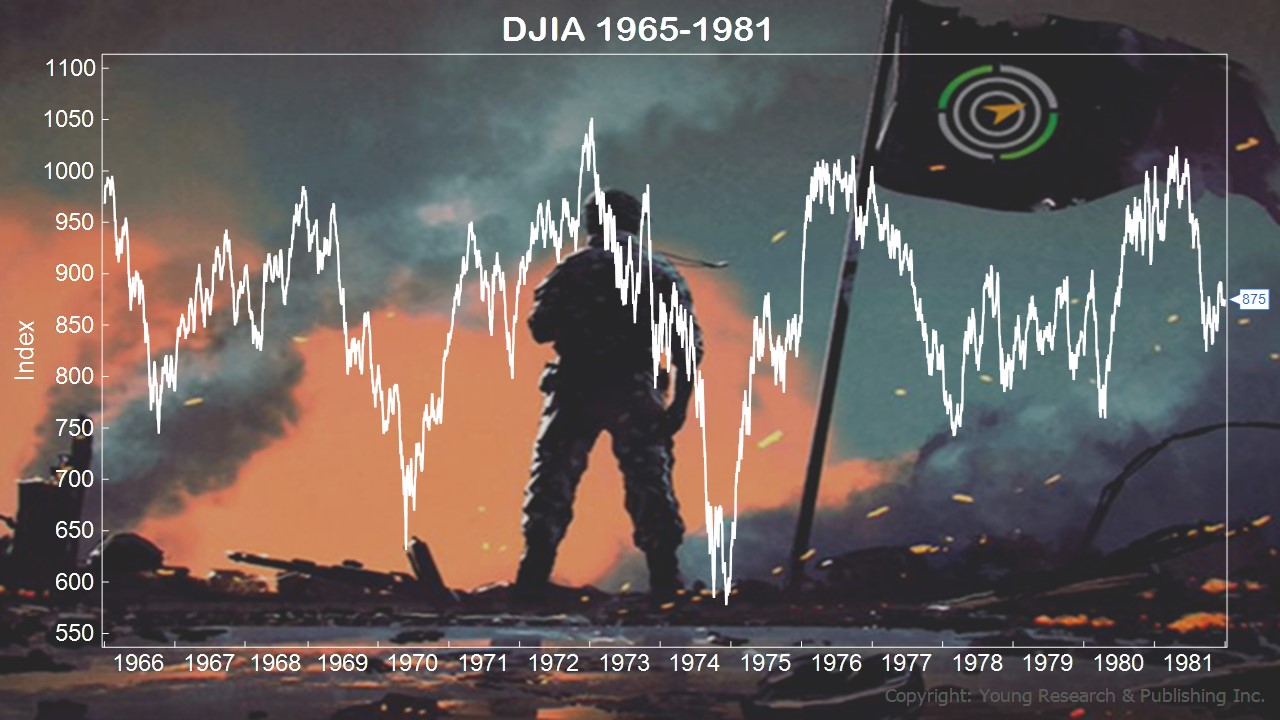

As you prepare for the quarter’s end, let’s reflect on where we’ve been. As the Dow Jones Industrial Average temporarily crossed 40,000 were you reminded of how far we’ve come? Because in my conversations with you, you tell me you remember when it was Dow 10,000, 6,000, or lower. The older we get, the higher the Dow goes, the more astonishing its new highs become.

I know this isn’t your father’s or your grandfather’s stock market. But it can feel like it. What has been true at different stages for them might be true for you: Stocks tend to go up, but not on your schedule.

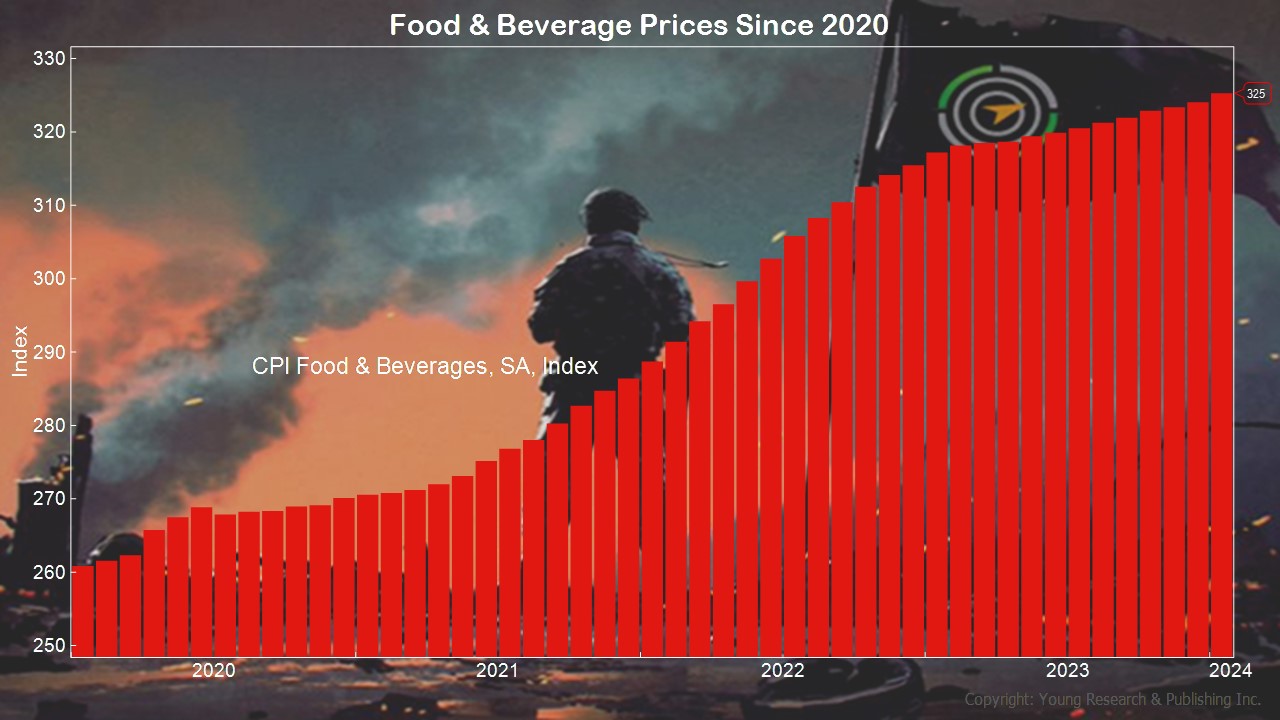

Who doesn’t like new highs? If we get to Dow 80,000, how much will it cost for a bag of chocolate easter eggs? Because even if we’re told inflation is under control, you and I know it’s not.

When everything is many multiples more expensive, does a higher Dow simply mean jogging in place? In other words, are you richer?

Yes, I want you to be an inflation fighter. But don’t lose your money caught up in some scheme that’s “guaranteed” to fight it. When you retire, lost money is lost money. Gone forever. There is no paycheck to fill in the heartache.

Action Line: Focus on return of assets, not return on them. Your kids will appreciate it, like when they found an easter egg, happy to have whatever you left for them. Remember the real joy is in the hunt. Happy Easter to you and your family.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024