Your Survival Guy has watched as Bidenflation has eaten up paychecks and retirement savings for Americans. Recent inflation numbers have abated, but they’re still high compared to historical averages. In The Wall Street Journal, Greg Ip explains why Americans’ acceptance of inflation as normal is so bad. He writes:

Last fall, Americans were obsessed with inflation. The issue dominated the midterm elections. One in five respondents called it the nation’s most important problem, according to Gallup.

These days, their attention is elsewhere. Just 9% of Gallup respondents now call inflation the most important problem, behind government leadership and the “economy in general” and just ahead of immigration and guns. It has barely come up in Washington’s fight over raising the debt ceiling.

Good news? Maybe not. It may mean people are getting used to higher inflation, which would be very bad news. The more people behave as if high inflation is here to stay, the likelier it is to stay. That would force the Federal Reserve to choose between inducing a potentially deep recession to force inflation lower, or giving up on its 2% inflation target.

The Labor Department reported Wednesday that consumer prices rose 4.9% in the year through April, the lowest in two years and down substantially from 9.1% last June, mostly because gasoline prices have fallen. That drop helps explain why people aren’t obsessing as much over inflation, though they are still obsessing more than before the pandemic.

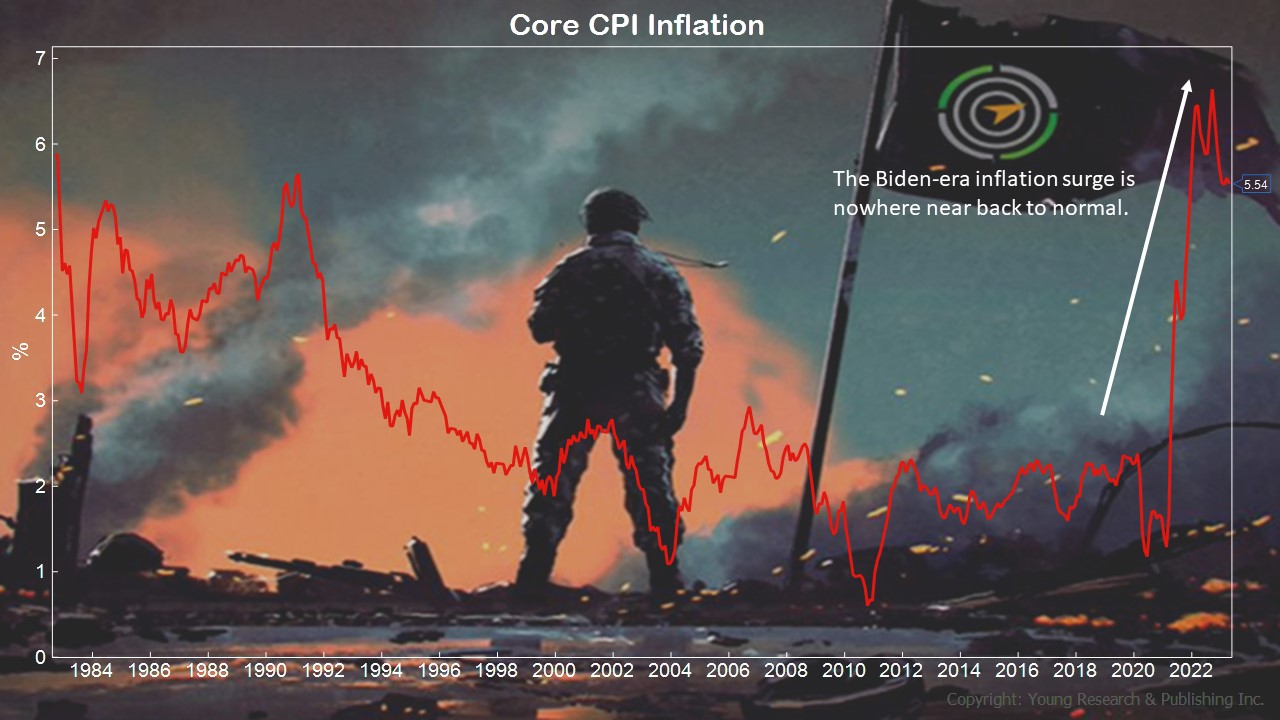

And yet inflation is very much still a problem. Core inflation, which excludes food and energy, is a better predictor than overall inflation of underlying price trends. Core inflation was 5.5% in April, down from 5.6% in March. On a monthly basis, core prices rose 0.4%, equivalent to 5% at an annual rate, in line with the past four months. Excluding shelter, core services prices, which the Fed watches closely, rose a much more tame 0.1% for the month, according to independent analyst Omair Sharif. Wages, which strongly influence service prices, grew 4% to 5% through the first four months of the year, too high to be consistent with 2% inflation.

You can see on my chart of Core CPI inflation that the Biden-era inflation surge is nowhere near a return to normal.

Action Line: Inflation is still very much a problem, especially for Americans saving for retirement. When you want to talk to someone about inflation and its impact on your retirement, I’m here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024