By LightField Studios @ Shutterstock.com

Coronavirus Infects Stock Market: Part XXIII

Barter is back. You may be one of the Americans who has been forced to trade eggs or soap for toilet paper. But you need to know the true value of what you own. That goes for your investments as well. Olga Kharif reports at Bloomberg:

Since the beginning of March, unattended folding tables have begun popping up at intersections and the end of people’s driveways, offering everyday goods like rice, a jar of jam or bread. Take what you need and leave what you can, the signs say.

Barter, the trade system prevalent in the Middle Ages, is back in the time of coronavirus pandemic, with a modern twist.

Social networks Facebook and Nextdoor are flooded with posts from neighbors and friends seeking to swap eggs for toilet paper. Small and midsized businesses, whose cash trade has dried up from the economic fallout of shelter-in-place orders, are turning to online barter exchanges.

“When cash is extra tight, it behooves us to buy as much as possible on trade,” said David Yusen, director of business development for Seattle-based Heavy Restaurant Group, which recently bought 56 cases of Malbec wine for $15,000 worth of barter credits. The company’s 10 restaurants have closed, but some locations will start offering pick-up and delivery this week. “It saves us money, it helps cash flow.”

In normal times, the roughly 200 barter exchanges in the U.S. let roofers fix leaks and get paid in restaurant takeouts or accounting services. With tens of millions of Americans under lockdowns, those cash-free trade systems are seeing an influx in participants.

You need to think in terms of values, not just eggs, and soap but also in terms of a string of dividends stretched out over a lifetime. Put a present value on that and you’re on your way to understanding compound interest.

Now, take it a step further and consider how you can help a loved one from the comforts of your home. Remember, in times like these it takes some imagination. Be creative, and remember your family is looking to you for inspiration.

Now may be the best time to teach a loved one by example.

How Can You Save Money for Your Grandchild?

The short answer is, early. The earlier you can start saving for your grandchild, the greater the impact you’ll have on their life.

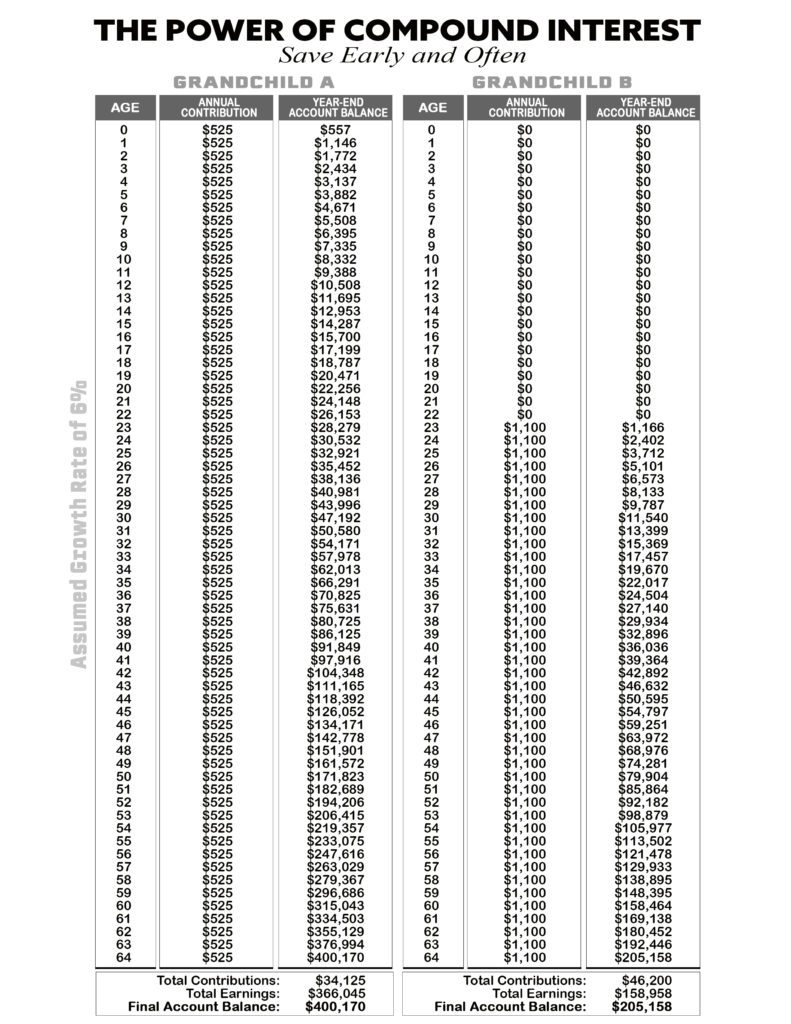

Take a trip with me. Let’s say you help a grandchild get into the savings game when they’re born by contributing $525 per year to an account you establish for them. (I favor UGMAs for this purpose). You diligently save each year for her first 21 years.

Then when she turns 22, she continues along the same path, saving $525 on her own each year until she’s 64.

Look at my table below to compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. Even though he’s saving twice as much each year, when he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side with your early generosity (I’ve used a long-term expectation for stocks of 6% growth per year).

So, how do you save money for your grandchild? Easy, put time on their side.

Read my entire series, Coronavirus Infects Stock Market here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024