Coronavirus Infects Stock Market: Part XLIX

A new client of mine is consolidating his eight-figure fortune with Fidelity. What’s shocking is how easily he decided to leave Vanguard.

“Why?” I asked him.

“E.J., I haven’t heard from anyone at Vanguard in over a year,” he said.

“They’re letting a quarter of a hundred million dollars walk out the door,” I thought to myself. “The front door.”

That is shocking.

“I’ve read your father-in-law Dick Young for over 30-years,” he said. “I miss him.”

“Welcome home,” I said.

When the late Vanguard founder Jack Bogle released Bogle on Mutual Funds, Dick Young wrote the forward:

“Congratulations! You have made one of the wisest investment decisions of your life… Jack Bogle’s basic premise is the model of simplicity and integrity: Give investors clearly defined investment products at the right price.”

The rest is history.

Vanguard exploded.

Then things changed.

Vanguard became too big.

“There no longer can be any doubt that the creation of the first index mutual fund was the most successful innovation—especially for investors—in modern financial history,” Bogle said in 2018 only months before his passing. “The question we need to ask ourselves now is: What happens if it becomes too successful for its own good?”

“Who is talking with the customers?” he may have wondered.

Who is penalized when the only choice for a Vanguard advisory service is from a narrow offering of Vanguard only funds like the Vanguard 500 Index?

Does the phone rep, fresh out of college, even understand what market cap means? Do they know how to calculate it?

The Vanguard 500 Index is market-cap-weighted, meaning the largest companies by market cap (shares outstanding times price) have the most impact on its direction.

Only ten companies, or two percent, account for a quarter of the performance for the fund. Imagine a pie with four pieces: Ten companies account for one piece and 490 the other three. Talk about income inequality.

Makes you want to yell at someone.

Good luck getting through to a live voice.

Investing is emotional. I get it.

The basic calculation of the components comprising the core of the Index 500 Index is e-m-o-t-i-o-n. We know how many shares are outstanding when calculating market cap, but isn’t the price of anything a guess at best?

To understand the guesswork involved with market cap, take a look at Canada’s Shopify.

The e-commerce platform, founded in 2004, sells stuff like snowboarding gear, has 5,000 employees, posted a billion and a half in sales in its most recent fiscal year, and has zero profits. Compare Shopify to Royal Bank of Canada. Incorporated in 1869, RBC employs over eighty thousand and booked $12 billion in profits on $46-billion of revenue.

Earlier this month Shopify traded at a higher market cap than RBC.

Why expose your hard-earned money to emotions? Like you need more to worry about, right?

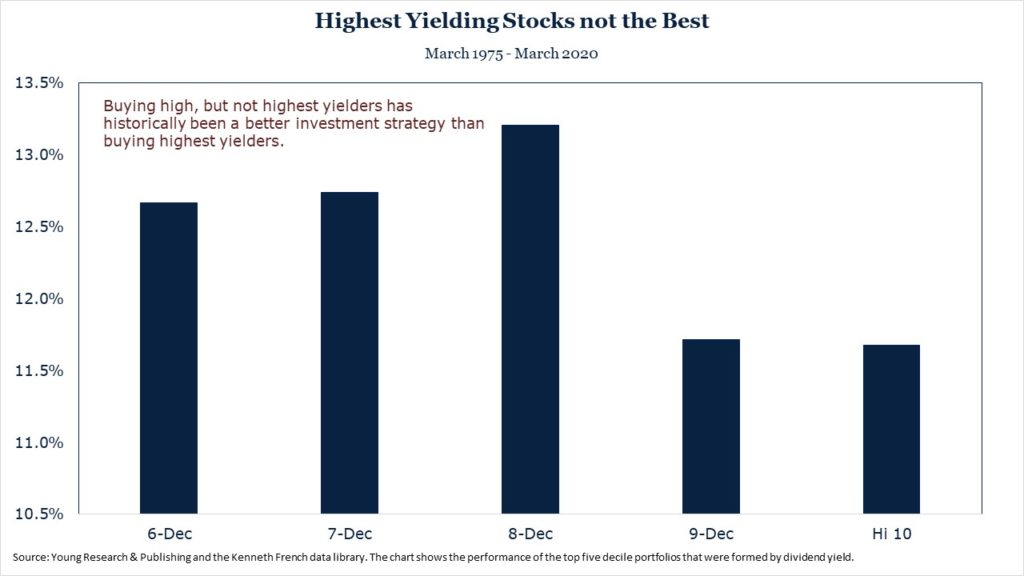

Why not seek out companies that pay you to invest in them? Take a look at how measuring a company by its dividends—the cash it actually pays out to you the shareholder—can help you.

Don’t speculate that higher stock prices or market cap will make you rich.

Let me remind you, the two-percenters are busy catering to the one-percenters, leaving a precious few crumbs to spread around.

| Company | Symbol | Weight | Yield |

| Microsoft Corporation | MSFT | 5.88% | 1.1% |

| Apple Inc. | AAPL | 5.41% | 1.1% |

| Amazon.com Inc. | AMZN | 4.22% | 0.0% |

| Facebook Inc. Class A | FB | 2.13% | 0.0% |

| Alphabet Inc. Class A | GOOG | 1.73% | 0.0% |

| Johnson & Johnson | JNJ | 1.67% | 2.7% |

| Berkshire Hathaway Inc. Class B | BRK.B | 1.39% | 0.0% |

| Visa Inc. Class A | V | 1.32% | 0.7% |

| Procter & Gamble Company | PG | 1.20% | 2.8% |

| UnitedHealth Group Incorporated | UNH | 1.16% | 1.5% |

Remember, my favorite investment in the world is in you. Your business, your skills.

It’s your work that can make you rich.

Investing well is how you keep it.

And it’s not inherent knowledge what I’m telling you.

It’s something you need to be continually reminded of.

To keep you on course.

Read my entire series, Coronavirus Infects Stock Market here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- A Word on Stocks - July 26, 2024

- Is Vanguard Too Big? What’s Next? - July 26, 2024

- Boomer Candy? - July 26, 2024

- My BEST Insider’s Guide to Key West - July 26, 2024

- Having Fun Yet? Nasdaq Worst Day in Years - July 25, 2024