In parts, I, II, and III you learned about those who have embraced the FIRE lifestyle—Financial Independence, Retire Early—and the ways it can help you in your own life.

One of the things I think you and I will learn from this movement is if it’s truly feasible to live off a portfolio for 60-plus years—a necessity when retiring in one’s early 30s. But this is not your typical set-it-and-forget-it retirement demographic.

Self-reliance is a way of life for the FIRE movement.

Yes, they are casting off the lines and heading out to the sea of financial independence with a portfolio that will need to keep them afloat for a long, long time. But they are also ready and willing to work out of choice and perhaps necessity at some point, all the while doing it on their terms. Think Uber driver, part-time construction work, and consulting as just a few examples of some side-hustles they will leverage.

This is a group who will do what it takes to survive. And what sets them apart from others is their massive savings rate, and a young enough age where they have harnessed the power of compound interest. Because the key to compounding money is t-i-m-e and they’ve carefully and methodically put time on their side.

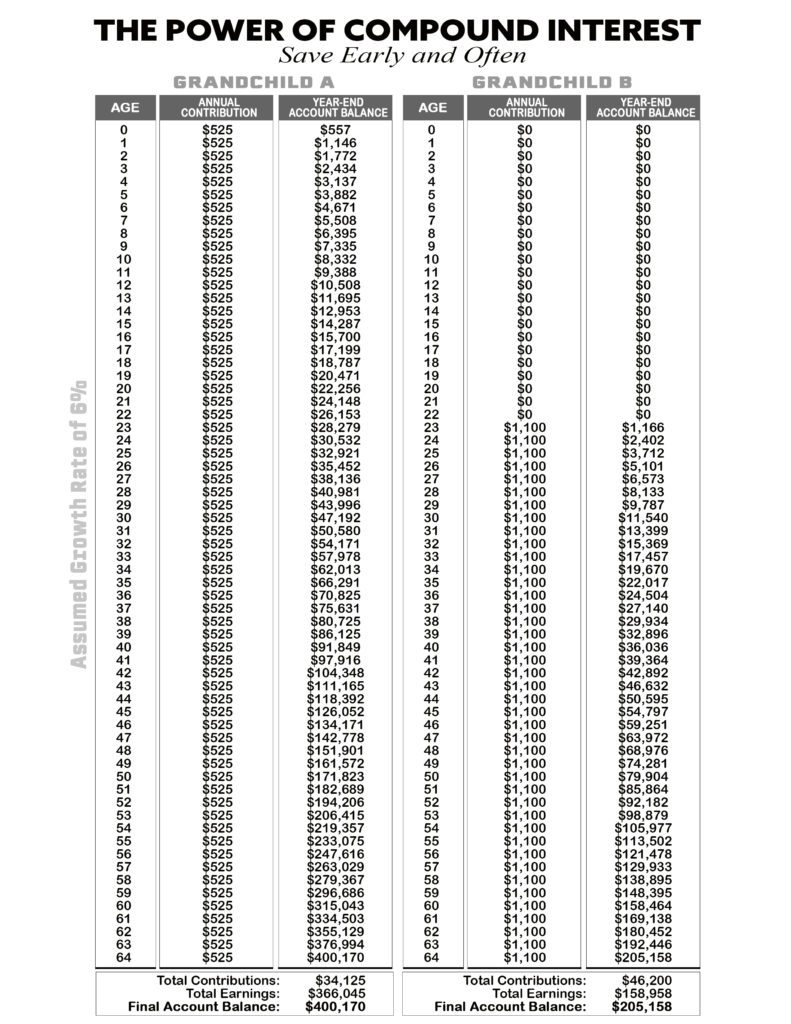

Take a trip with me. Let’s say you help a grandchild get into the savings game when they’re born by contributing $525 per year to an account you establish for them such as my favored UGMA. And then when the child is 22, she continues along the same path saving on her own, saving each year $525 until she’s 64. Compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. When he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side which did a lot of the heavy lifting. Not that your generosity didn’t help! Of course it did. And what’s not to be missed here is my conservative long-term expectation for stocks of 6% year. Which I also believe is being kind—much to the dismay of the needy crowd.

But when the intention is retiring forever, and to depend solely on your portfolio for 60-plus years, a lot of things need to go right. That’s why you and I need to pay attention. Will the FIRE movement be able to survive and thrive on their savings alone?

It’s a tough question, because no one knows the future. No matter how many scenarios are run, no one knows what tomorrow’s markets will bring.

At the core of living a lifetime on your money is having a safe withdrawal rate. This is really where the rubber meets the road for the next 60 years—having a safe withdrawal rate.

So where to go from here? A safe withdrawal rate is whatever keeps you in the game for the rest of your life. You do what you must, whether that’s go back to work, spend less, sell assets in a depressing fashion, or my advice—work as long as you can and say the heck with the markets (see Rich Man, Poor Man).

For me, I don’t see the margin of safety of living off a portfolio at such a young age. But I most definitely like how the FIRE group is approaching life. I want you to be able to retire and live comfortably off your portfolio for the rest of your life without the side hustle. How do you do that?

I’ll discuss that next.

Follow along with my entire series on FIRE here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024