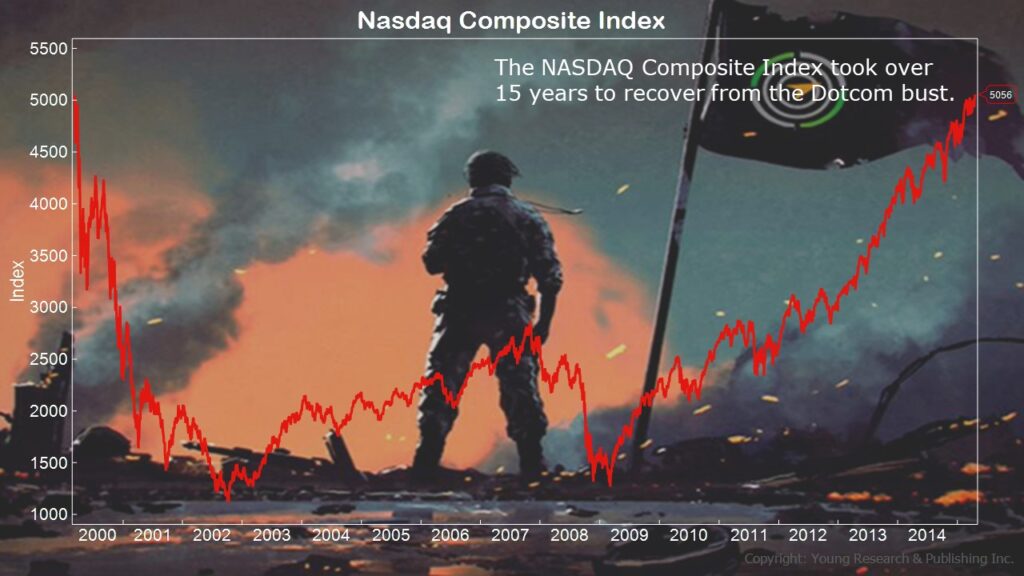

Don’t forget that markets can stay down for a long time after they’ve crashed. Remember how long it took the Nasdaq to recover from the tech crash?

Jonathan Weil writes in The Wall Street Journal:

“Five percent is more or less the average of investment-grade rates since the time of Alexander Hamilton,” said James Grant, founder and editor of Grant’s Interest Rate Observer. “The problem is the structures that 10 years of ultra-easy money brought about. People blame it on the normalization of rates. The previous bout of abnormal rates is the problem.”

And the Nasdaq isn’t known for paying much of a dividend.

Action Line: Speculating on tech shares in 2000 was a big mistake. Try to avoid the big mistakes by clicking here to download my free special report on the Top 10 Investing Mistakes to Avoid.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Forgot His Razor - May 10, 2024

- Get Everything You Want with Concierge Service, from Sig Sauer - May 10, 2024

- BRACE FOR IMPACT: Solar Storm Headed Toward Earth - May 10, 2024

- Celebration: Your Survival Guy and Gal in Boston - May 9, 2024

- Which Jimmy Buffett Album Is Your Favorite? - May 9, 2024