You have probably heard politicians and central bankers who dismiss inflation in gasoline and food, saying they’re “non-core.” They want you to forget that these are the most important items you buy each week. They say those prices are too volatile to count. You’ve noticed just how volatile they are when you balance your accounts.

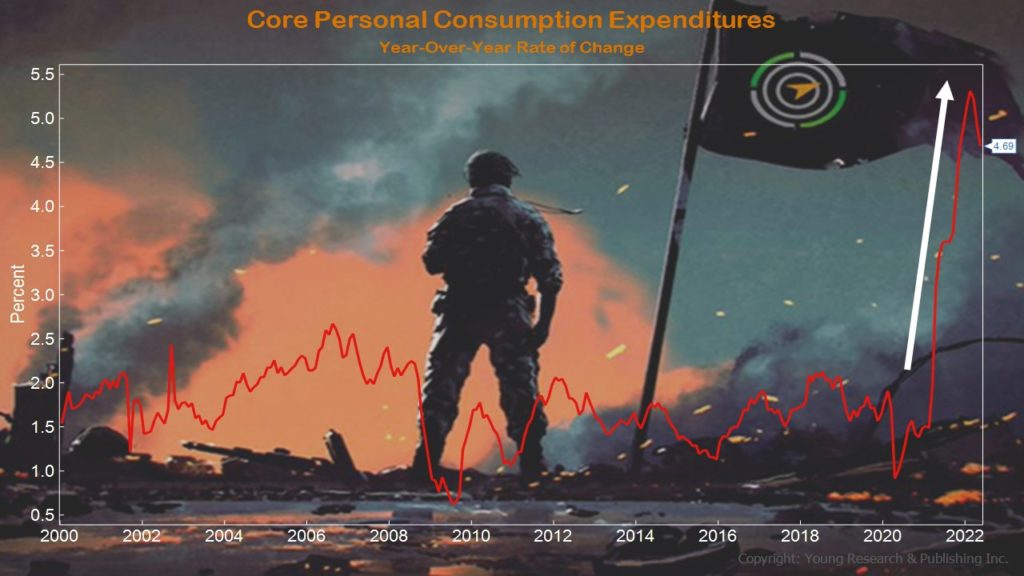

Instead, they want you to focus on “core” inflation. The Federal Reserve prefers you to follow an inflation measuring index known as Core Personal Consumption Expenditures (PCE), which excludes prices of food and energy. The problem for them, and for you, is that even this core inflation measure is flashing a great big warning signal.

Look at my chart below and you’ll see that Core PCE is still rising at levels unseen this century.

Jeff Cox reports on the most recent PCE inflation report at CNBC, writing:

Inflation held at stubbornly high levels in May, though the monthly increased was slightly less than expected, according to a Commerce Department gauge closely watched by the Federal Reserve.

Core personal consumption expenditures prices rose 4.7% from a year ago, 0.2 percentage point less than the previous month but still around levels last seen in the 1980s. Wall Street had been looking for a reading around 4.8%.

On monthly basis, the measure, which excludes volatile food and energy prices, increased 0.3%, slightly less than the 0.4% Dow Jones estimate.

Headline inflation, however, shot higher, rising 0.6% for the month, much faster than the 0.2% gain in April. That kept year-over-year inflation at 6.3%, the same as in April and down slightly from March’s 6.6%, which was the highest reading since January 1982.

In addition, the report reflected pressures on consumer spending, which accounts for nearly 70% of all economic activity in the U.S.

While personal income rose 0.5% in May, ahead of the 0.4% estimate, income after taxes and other charges, or disposable personal income, declined 0.1% on the month and 3.3% from a year ago. Spending adjusted for inflation fell 0.4%, a sharp drop from the 0.3% gain in April, though it was up 2.1% on a year-over-year basis.

“The rising cost of living absorbed all of the increased spending power from added jobs and higher wages in May,” said Bill Adams, chief economist for Comerica Bank. “Americans are running faster just to stay even. No wonder consumer confidence is in the pits.”

Action Line: It’s no use investing in the same old thing if inflation just eats up your gains. You need a portfolio that takes inflationary pressures into account. If you need help building a portfolio with inflation in mind, get in touch with me, and let’s talk. If you want to get to know me better before giving me a call, click here to sign up for my free monthly Survive & Thrive letter, and each month you’ll learn more about my constant efforts to improve your family’s personal and financial security.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024