What we have is a crisis in confidence. It’s not such a small world anymore. When countries retreat, look inward instead of outward, tension builds, and fingers are pointed. Look at what’s going on at home in the U.S., for example. The big blue blob cities continue operating as usual as unsustainable deficits and pension obligations build. Look at the stark differences on the state level between California and my favored red states, like Florida, by example. They’re night and day. The same is happening in the Eurozone.

Over the last eight years, what I’ve witnessed personally is a major shift in the outlook of France. In my conversations there, I’ve always felt a certain respect for the U.S., but that’s missing today. There has been such a shift post-Covid that it’s an “everyone-for-themselves” survival-type mode. The working class is trying to hold it all together. They’re exasperated that their non-working friends aren’t doing anything. Living off the state, if you will. Sound familiar?

The world is not joined together in an all-for-one-and-one-for-all type melody. It’s fractured. It will take a unique approach for the investing class to navigate these waters.

Action Line: Stick with me.

P.S. Confidence is waning in governments because they can’t seem to control their spending, putting their budgets at risk. David Malpass writes in The Wall Street Journal:

Solutions exist. First, markets are forward-looking, so credible government spending restraint would provide immediate encouragement to growth-oriented investment. Restraint that forces debt-to-GDP ratios to stabilize and then decline (without threatening default) would allow market-based capital flows to resume. Second, central banks should put more focus on policies that encourage currency stability and supply creation, not only demand destruction. They should give up their bond holdings and reduce their massive short-term debt. Combined with distortive credit regulation, current policies concentrate capital in narrow segments of the advanced economies and slow growth elsewhere. These policies need to be replaced to restart growth. This is discussed in international meetings but rejected in favor of the status quo.

The world needs a range of strong policies that spur production to combat inflation. With no change, the likelihood is a long period of slow global growth and downward asset repricing. Capital will continue moving in the wrong direction, toward a narrow group of “sinks”—governments, big corporate borrowers, excess consumption—rather than to small businesses, working capital and forward-moving developing countries that could add to long-term global growth.

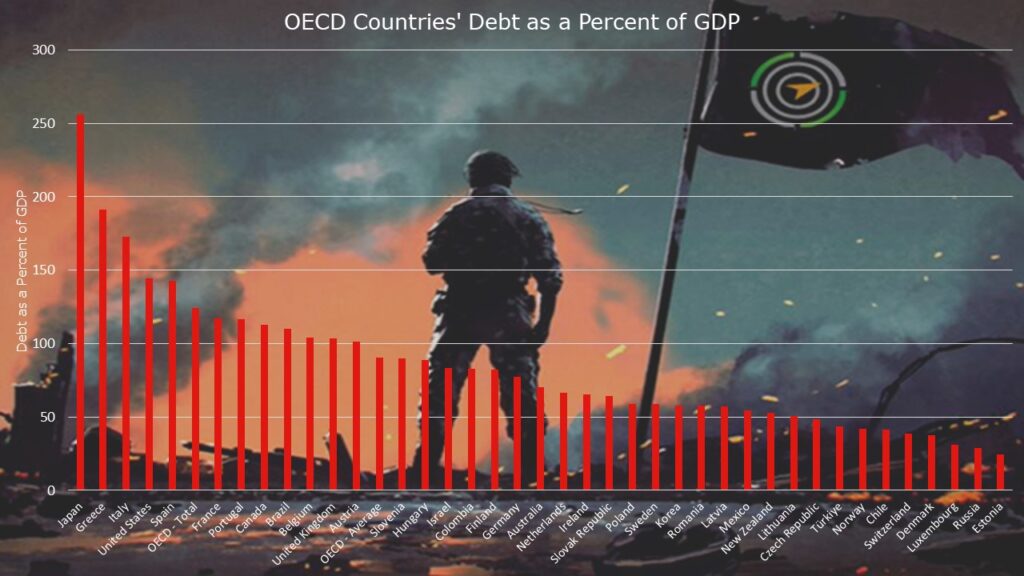

P.P.S. Take a look at just how bad debt as a percentage of GDP has become in many OECD countries. This is the so-called “developed world” you’re looking at. Frightening.

P.P.P.S. Read more about my recent research trip to Rome and Paris here:

- A Three-Week International Research Trip to Paris via Rome

- Survive and Thrive June 2023: Your Survival Guy in Rome 30-Years A.B. (After Babson)

- Birth Rates in France Worst Since Post-WWII Era

- Your Survival Guy Felt Like a U.N. Worker in Rome

- Social Security: Declining Italy Needs a Bambino Boom

- Your Survival Guy in Rome 30-Years A.B. (After Babson)

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Survive and Thrive April 2024: Our Dog Louis Passed Away on April 17th - May 1, 2024

- Dear Retired, or Soon to Be Retired, Investor - May 1, 2024

- What’s BlackRock Hiding in Your Target Date Fund? - May 1, 2024

- Red Lobster’s “Endless Shrimp” Was Too Much of a Good Thing - May 1, 2024

- The Hardest Part About Losing Our Dog Louis - April 30, 2024