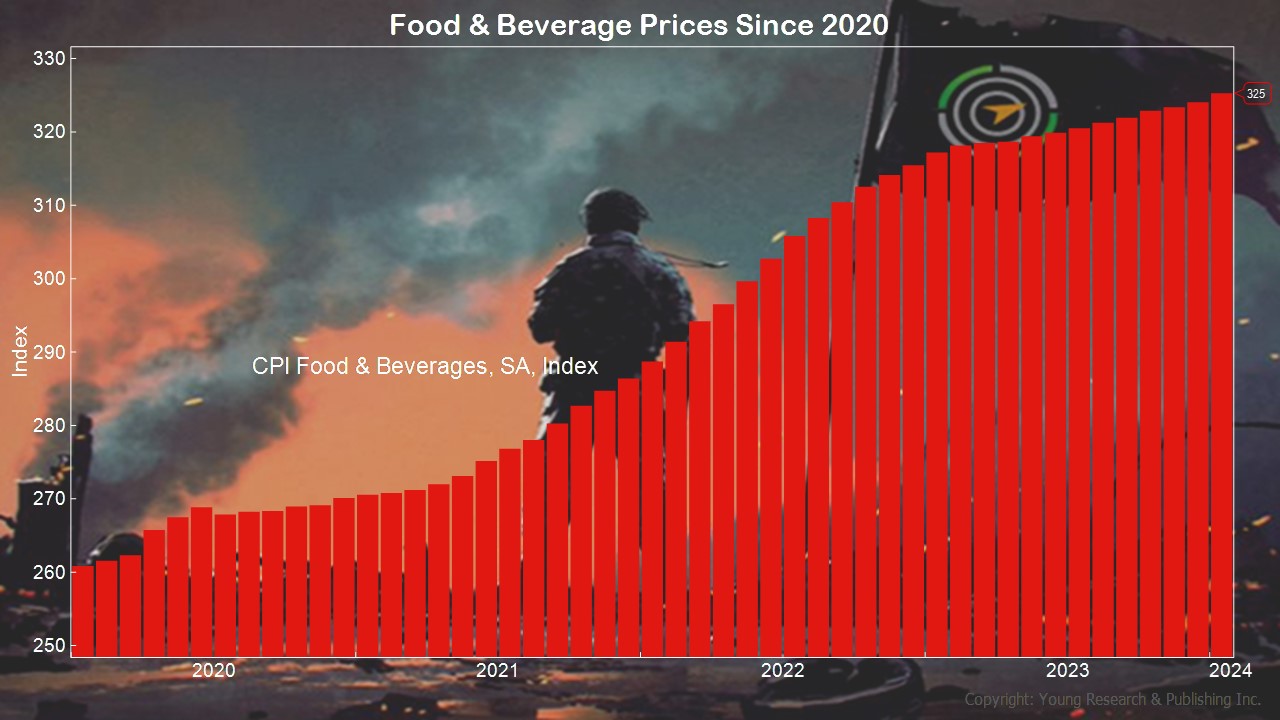

If you want to see what inflation looks like, take a picture of your grocery store receipt and check back in a few months. In The Wall Street Journal, Bob Henderson explains how risks in commodity markets around the world could put pressure on prices here in the U.S. Inflation is too much money chasing too few goods. The Federal Reserve has printed the money, and if the amount of goods gets cut, it’ll get even worse. He writes:

A surge in prices for the raw materials that power manufacturing and transportation shows investors betting on a prolonged expansion—and a potential rebound in inflation.

An index of global commodities prices, the S&P GSCI, has advanced 12% this year, outpacing the S&P 500’s 9.1% climb. Copper and oil have gained more than 10% and 17%, respectively. Even gold is posting fresh records, rising 13% to $2,332 a troy ounce.

The rally is rooted in expectations that economic growth will increase demand from the U.S. and China, analysts said. A pair of reports last week showing recoveries in both countries’ manufacturing sectors helped spark a fresh wave of buying. That extended an upswing that has boosted shares of energy and materials companies while threatening to lift the price of gasoline just ahead of summer driving season.

And many expect the climb could continue for some time. Real income growth has sparked a reacceleration in global goods demand that is likely to propel commodity prices even higher, the Commodities Strategy team at Macquarie Group said in a report.

That could complicate the Federal Reserve’s inflation fight when investors are already beginning to doubt if the central bank can trim interest rates later in the year. The prospect that borrowing costs would soon come down helped spur a stock-market rally that has carried major indexes to records.

“Commodities are going to be potentially one factor that can interfere with Fed cuts,” said Francisco Blanch, head of global commodities and derivatives research at Bank of America.

The rally reverses an 18-month-long slide from the highs reached after Russia’s invasion of Ukraine sent prices of oil, natural gas, grains and industrial metals skyrocketing. A gloomy U.S. economic outlook including an expected recession, higher interest rates and a Chinese economy struggling to recover from Covid-era lockdowns all dragged on futures in the subsequent months.

Action Line: You don’t have time to wait for the world to calm down. You’re saving for retirement now, or you’re already in it. You need to be an inflation dodger. When you want help with inflation, let’s talk. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Our Dog Louis Passed Away on April 17th - April 29, 2024

- The Burger and Fry Economy - April 29, 2024

- Less Is More at Work - April 29, 2024

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024