President Barack Obama meets with Warren Buffett in the Oval Office, July 14, 2010. (Official White House Photo by Pete Souza)

At the recent Berkshire Hathaway shareholder meeting, Warren Buffett shared some of his knowledge on investments. Taylor Locke of CNBC reports:

Buffett warned against investing in individual stocks, as “I do not think the average person can pick stocks,” he said.

“I would like particularly new entrants to the stock market to ponder just a bit before they try and do 30 or 40 trades a day in order to profit from what looks like a very easy game,” Buffett said.

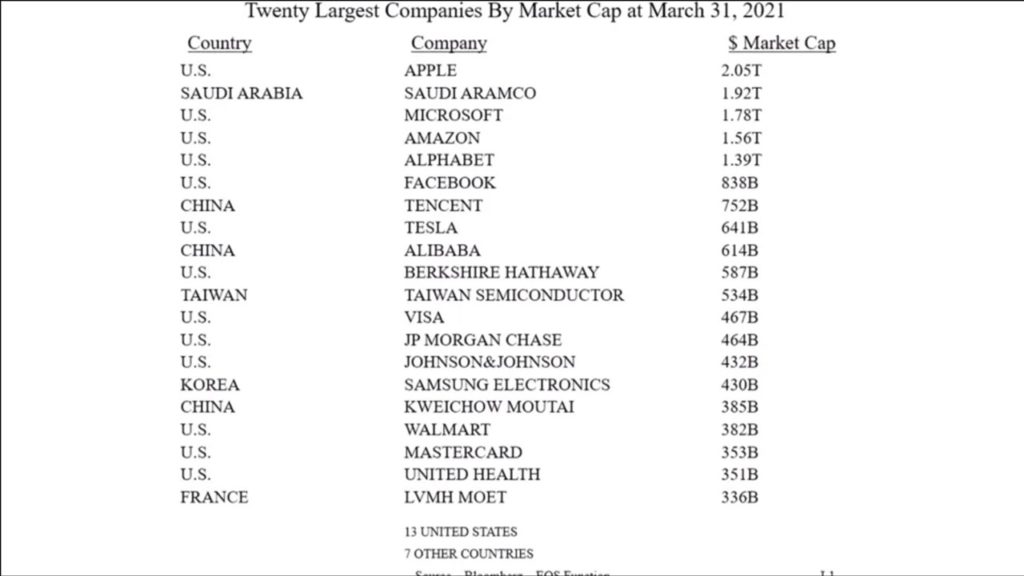

To illustrate the difficulty of achieving success when stock-picking, Buffett first shared a list of 20 stocks with the largest market capitalization as of March – which included Apple, Saudi Aramco, Microsoft, Amazon, Alphabet and Facebook.

He asked the audience which of those stocks they predict would remain in 30 years.

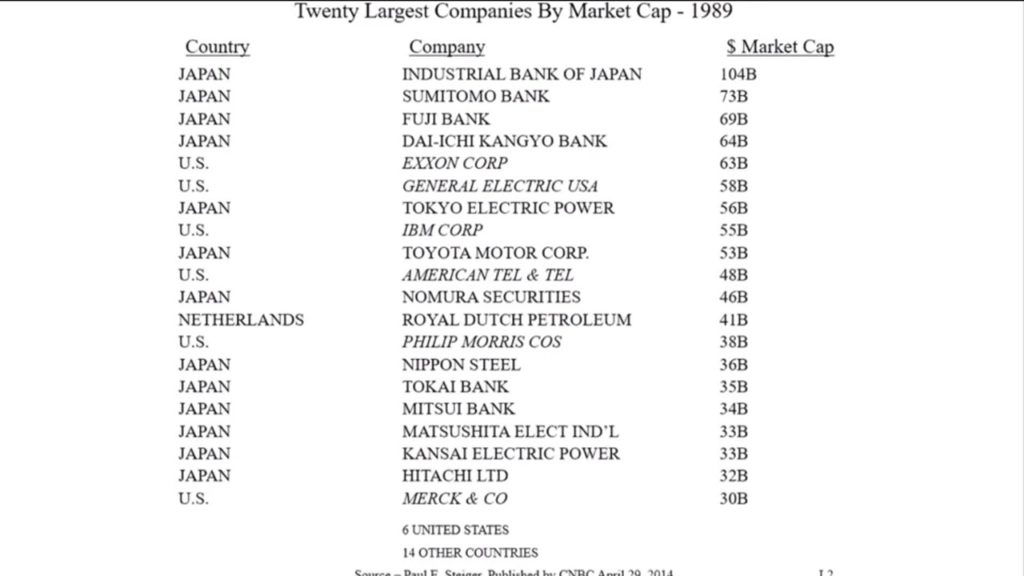

Buffett then shared the top 20 companies by market cap in 1989; it included Japanese firms, Exxon, GE, Merck and IBM.

None of those remain in the top 20 today.

“I would guess that very few of you would have said zero, and I don’t think it will be, but it’s a reminder of what extraordinary things can happen,” Buffett said. “We were just as sure of ourselves, and Wall Street was, in 1989 as we are today. But the world can change in very, very dramatic ways.”

After all, ”[there’s] a lot more to picking stocks than figuring out what’s going to be a wonderful industry in the future.”

Julia La Roche also reported on the meeting for Yahoo! Finance, writing:

Billionaire investing icon Warren Buffett kicked off Berkshire Hathaway’s (BRK-B, BRK-A) annual meeting of shareholders by sharing some lessons for new investors.

“I’ll have one or two very short lessons for perhaps the new investors who are not necessarily in Berkshire Hathaway, but people who have entered the stock market in the last year, and … I think there has been a record number enter the stock market. I’ll have a couple of little examples for them,” Buffett said in his opening remarks.

A wave of new investors has flooded the stock market, with lockdowns, no-fee trading, and stimulus checks making it easier to open up a brokerage account and start trading.

The 90-year-old “Oracle of Omaha” told this generation of first-time investors: “it’s not as easy as it sounds.”

The famed investor shared two items for new entrants to the stock market “to ponder a bit before they try to do 30 or 40 trades a day to profit from what looks like a very easy game.”

To illustrate his point, Buffett showed a slide of the 20 largest companies by market capitalization as of March 31, 2021, which includes Apple (AAPL), Saudi Aramco, Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG, GOOGL), Facebook (FB), Tencent, Tesla (TSLA), Alibaba (BABA), and Berkshire Hathaway (BRK-A, BRK-B) in the top ten.

Warren Buffett slide showing the 30 biggest companies by market cap in 2021.

Highlighting that five of the top six companies are American, Buffett reiterated his bullish message on the U.S., noting it’s “not an accident” and it’s a system that’s worked “unbelievably well.”

Referencing the list, Buffett urged new investors to make their own guess as to “how many of those companies are going to be on the list 30 years from now?”

“What would you guess? Think about that yourself…Would you put on five, eight, whatever it might be?”

Buffett then juxtaposed a slide of the top 20 companies from 1989 from market cap, which only included six U.S. companies, which are noticeably absent from the 2021 list.

Buffett’s slide of the 20 biggest companies by market cap in 1989

“It is a reminder of what extraordinary things can happen. Things that seem obvious to you,” Buffett said, later adding, “The world can change, and very very dramatic ways.”

Buffett said this is a “great argument for index funds,” to own a diversified group of U.S. equities over a long period. Buffett has long argued that investors — both small and large — would be better off putting money in low-cost index funds, and thereby avoiding fees shelled out to active managers to pick “the place to be,” from IPOs to SPACs these days.

“I could tell you their best ideas in 1989 did not necessarily do that well,” Buffett said.

To further his point, Buffett shared that in 1903, the year his father was born, automobiles were the exciting industry. “Everybody started car companies just like everybody’s starting something now that can be where you can get money from people.”

Buffett shows a list of defunct car makers starting with the letter “M.”

“But in any event, there were at least 2,000 companies that entered the auto business, because it clearly had this incredible future. And of course, you remember that in 2009, there were three left, two of which went bankrupt. So, there is a lot more to picking stocks than figuring out what’s going to be a wonderful industry in the future,” Buffett said, adding that “very, very, very few people the picked the winner.”

Buffett joined his long-time friend and partner Charlie Munger, 97, for a virtual shareholders meeting held in Los Angeles, instead of Omaha, Nebraska. Munger has lived in Southern California for nearly 60 years.

“So I just want to tell you,” Buffett told new investors, “it’s not as easy as it sounds.”

Action Line: Examine your portfolio and consider how much of Buffett’s advice could apply to your situation. Remember, your goals may be different than those of a billionaire from Nebraska, but it’s wise to consider all the strategies available to you before you make your decisions.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024