What is purchasing power? Well, if you bought your house in the 60s or 70s, you know exactly what it’s not today—it’s not power. It’s more like weakness.

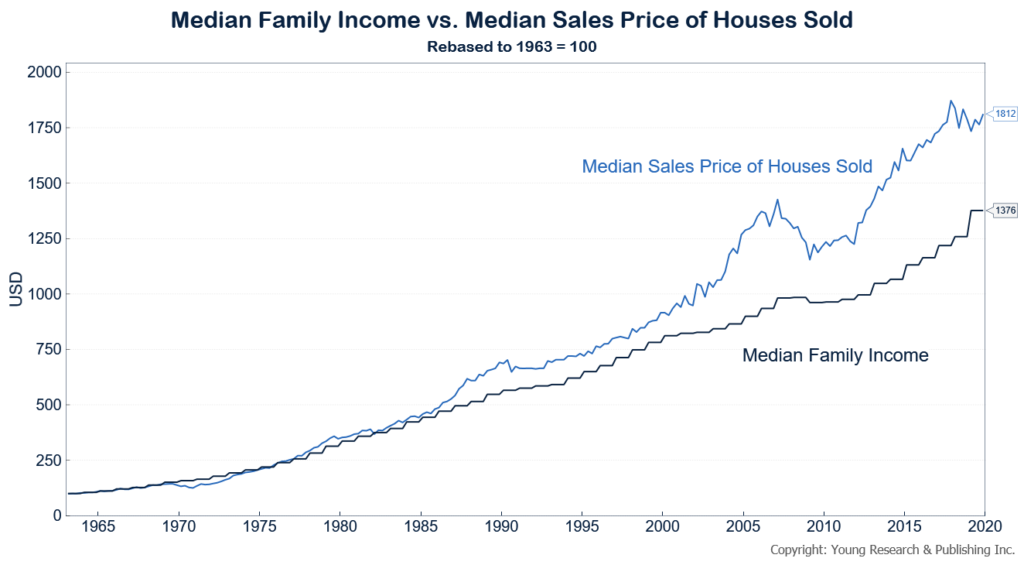

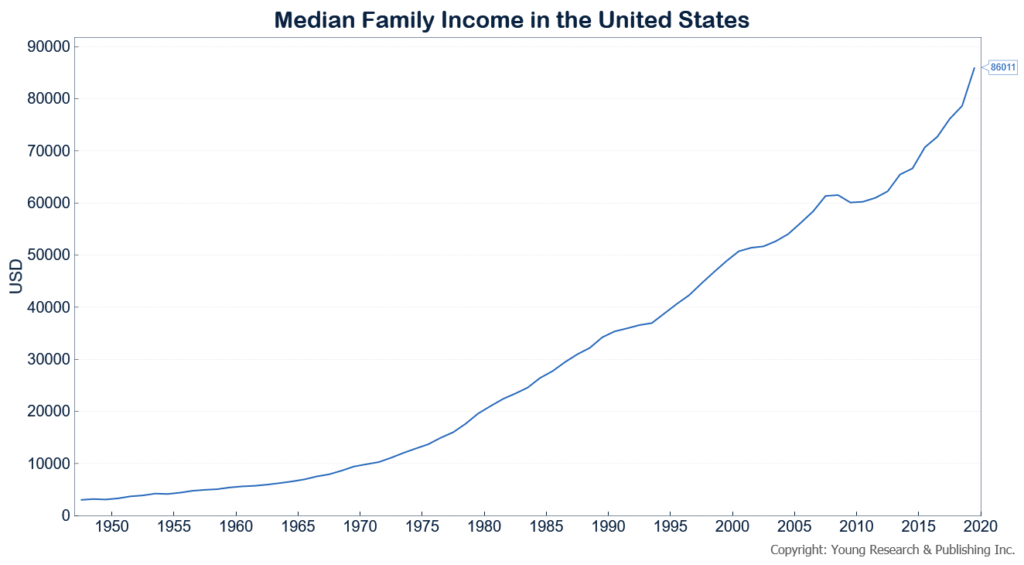

Take a look at the median income and median real estate sales through the years, and you tell me what’s happened to purchasing power (weakness). Remember, the “median” eliminates the big outliers that can skew the average. Median is the middle number. For example, in a sample of 30 houses, the 15th house is the median.

You can see on the chart that from 1963 on, the growth of the median price of a house has outpaced the growth of the median family income. By the end of 2019 (last data available for median family income), the growth of the price of the median house sold had outpaced income by 32% since 1963.

The price-to-income ratio is getting higher and higher, a trend that will eventually price many Americans out of owning a home

Action Line: This is a trend that I don’t see the Fed wanting to stop. Plan accordingly.

Warm regards,

Your Survival Guy

P.S. Dick Young recently wrote:

The U.S. government must finally wise up and put an immediate end to the insane double taxation of dividends.

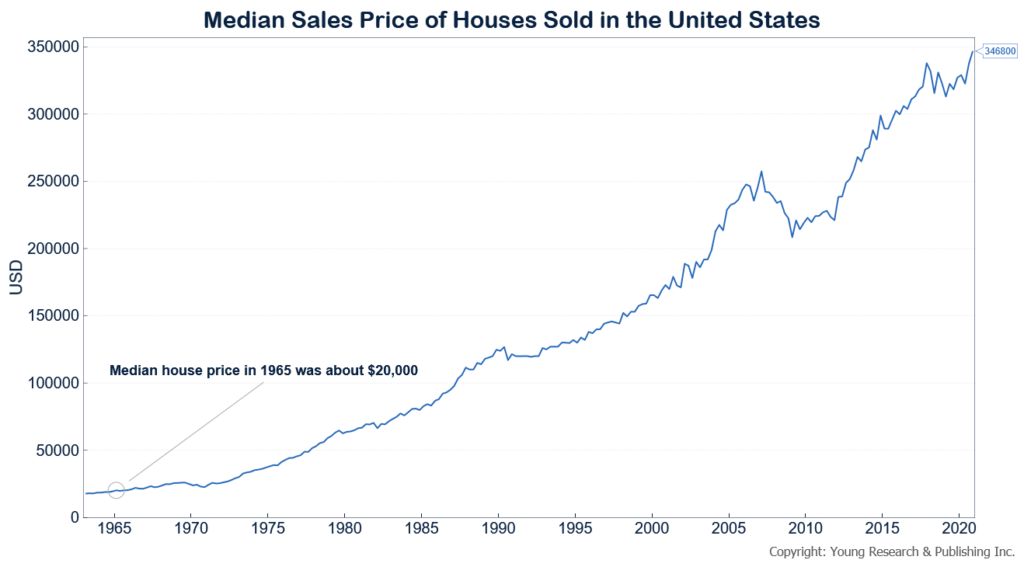

The government, facilitated by the Fed, is in an ongoing war to destroy the value of the dollar by printing money beyond any reasonable rate of expansion. Simply take a look at real estate prices to witness the explosion in liquidity.

Do not let the government destroy the value of your retirement. Demand that the government ends the double taxation of dividends!

Originally posted October 17, 2017.

With the exception of the large sums of money that I invested in zero-coupon treasuries (Benham Target Funds) in the 1980s and 1990s, I have never invested based on how much money I expected to make. I work to make money. And I save to keep every dime of the money I have worked a lifetime to earn. There was a day when I had darn few of those dimes. Those days made an indelible impression on me, and will so forever.

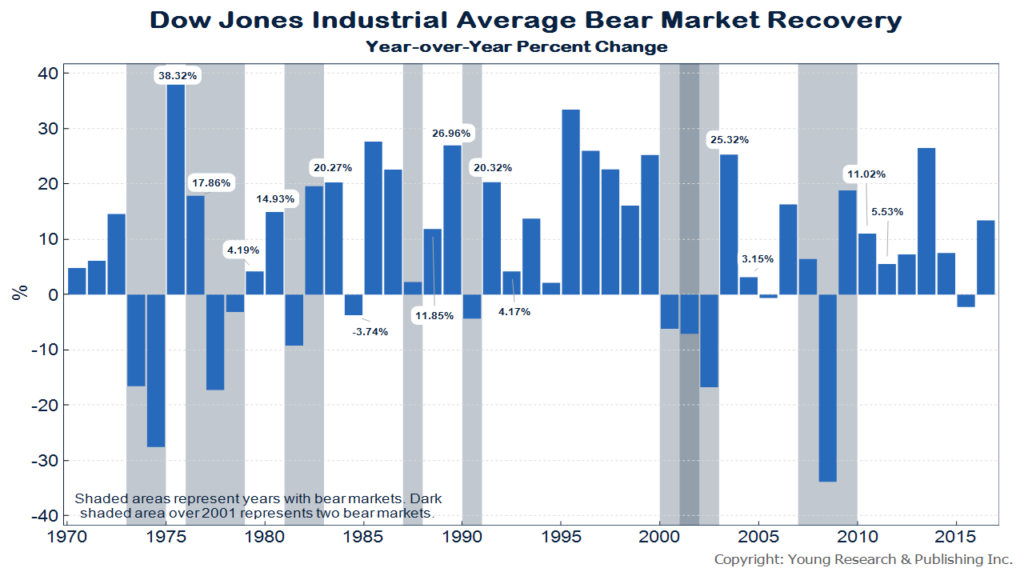

I invest with a rolling 10-year average annual return portfolio target of a balanced 4+%. This modest target is based on the normalized annual portfolio draw I advise for retired investors. Long-term balanced targets include surviving through agonizing periods of negative returns for the stock market in general. I remember like it was yesterday the tortuous 16-year bear market of 1965 through 1981. This period encompassed my entire career in the institutional research and trading business. It terminated with the Dow down 10% from where it began. Had I not emphasized 100% fixed income in my own account and in our college savings program for Matt and Becky, my goose would have been cooked. It never pays to be an investing know-it-all.

My investments today, for me and for all our clients, combine a mix of intermediate and short fixed-income securities and portfolios of dividend-paying stocks. Annual dividend increases are always at the forefront of my investment process. Ben Graham advocated a portfolio mix of 75/25—25/75 fixed income and equities. Ben. eschewed moving outside of this range, and I’ve never come across evidence that supports otherwise.

Since my earliest investing days in the 60s, I have relied upon the ground rules and reference material I studied while an investment major at Babson College. It was based wholly on the advice given in my Graham & Dodd textbook and my studies in Dr. Wilson Payne’s investment seminars. Decades later, I’ve not changed my philosophy.

Through the years, I’ve had the privilege of influencing the investment thought process of thousands of individual and corporate investors around the globe. Many have been my management clients since I started Richard C. Young & Co., Ltd. in the late 80s, and the majority would likely agree with me that I am perhaps the most consistently boring, prudent, patient investment advisor on the planet. I certainly hope this is so. Like The Hobbit, I view adventures (in this case investing adventures) as “nasty disturbing uncomfortable things” that “make you late for dinner.”

I am ultraconservative in my daily affairs of life, which includes personal security preparation, and I see no purpose in not applying the same protection to financial security.

I modeled our family company after the old-line investment counseling family-run firms that populated Boston’s financial district along State, Federal, Milk, and Congress streets in the sixties—a harking back to a more gentrified era in investing. Many of these fine old white-shoe firms were my clients when I was associated with the internationally focused Model Roland & Co., where I was involved in institutional research and trading.

My clients, such as the venerable Boston Safe Deposit & Trust, State Street Bank & Trust, and First National Bank of Boston, built their foundation on The Prudent Man Rule.

The Prudent Man Rule directs trustees “to observe how men of prudence, discretion and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.”

These are the conservative principles our family investment council firm practices. Our firm’s focus from the beginning was, and today is, based on The Prudent Man Rule along with the theories of dividends and compounding pioneered by Ben Graham.

Over the decades, I’ve learned that most individuals do not possess the requisite patience and discipline to excel as successful long-term investors. The patience-deprived universe tends to be what I think of as needy hip-hop investors. They look for the financial markets to either bail them out of past investing indiscretions or, worse yet, to produce rewards far beyond reasonable levels of commensurate risk. Our family investment management firm does not offer the type of environment suitable for the needy or greedy.

The needy and greedy tend to possess an investor twitch that requires action—lots of action. This crowd looks to market timing, second-guessing, and what-if-ing. Most of the big moves in any investment cycle come in the year or two after the exact bottom of a cyclical bear market.

Well, market timers most often sell out late in bear cycles, and then are too afraid to get back into the market in time to catch the initial upsurge. The needy/greedy tend to miss the big gains every time.

At Richard C. Young & Co. Ltd., our goal is to remain balanced as well as fully invested. This repetitive plan, definitely counter-intuitive to many investors, ensures never missing the big moves. It also requires never participating in any meaningful way in the bubble or blow-off stage of over-priced markets that are on the precipice of cratering and wiping out a lifetime of savings along the way. No thanks. I long ago learned this bedrock principle.

Today’s investment landscapes and processes have become so difficult that for most individuals going it alone, especially while preparing for a safe and secure retirement, is no longer comforting or attractive. Many of the old standby bastions of investing are no longer an option. I am referring to the vast majority of all-managed equities mutual funds and a wide swathe of the indexing ETF universe. The fund industry has simply outgrown its skin. Funds have grown too big, and their options in dividend-paying common stocks are too few, due to size constraints for massive funds. This is only common sense.

With minor exceptions, I no longer advise these out-of-phase funds. Rather, stocks of individual dividend-paying companies including smaller concerns and foreign securities, are our focus for clients. At our management company, we craft what we label Retirement Compounders portfolios.

Investing in foreign securities is not the province of the individual investor or, for that matter, most advisors. Having been directly involved in researching and trading in foreign securities since 1971, I can ensure you that process presents a sticky wicket best left to experienced hands. Markets are thin, currency valuations enter the picture, and macro events often call the tune in foreign securities investing.

I travel to Europe frequently. Decades of on-the-ground anecdotal evidence gathering and personal contacts allow me to form the direct knowledge imperative in the decision making of investing in foreign securities. With the exception of my old stomping grounds in Boston, I am more comfortable today in Paris, by example, than any big U.S. city. More international decision-makers and event making potentates visit Paris annually than any other city in the world. On each new visit, I gather a wealth of intelligence to support my global investment strategy. This boots-on-the-ground anecdotal evidence gathering, in conjunction with my decades of daily inference reading, allows our firm to offer clients a distinct perspective on the international investing landscape.

I sincerely hope you and your family benefit from many worthy insights into the myriad factors that allow conservative, retirement-thinking investors like you to find a warm and comforting home base for retirement planning and investing at Richard C. Young & Co., Ltd. My best wishes to you for success. Welcome to the family.

Warm regards,

Dick

This post was originally featured on Youngsworldmoneyforecast.com.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024