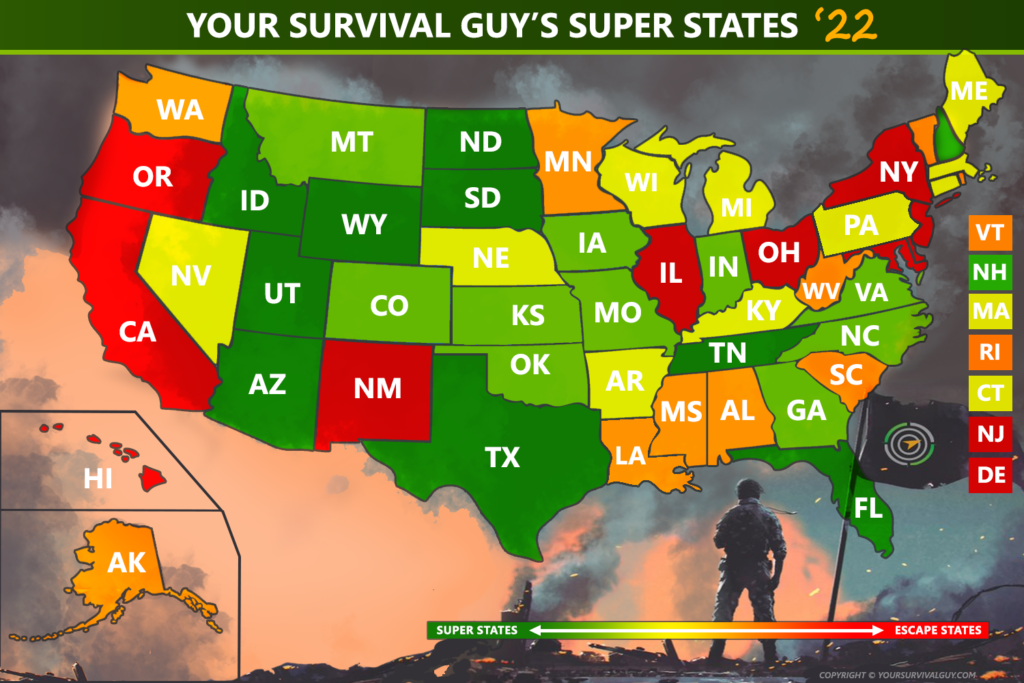

You can see with your own eyes the separation of states. This isn’t Lincoln’s Civil War; it’s the virtual war of our times. Never in our lifetime has the crossing of borders from blue state to red meant so much for one’s freedom. Look at the outcomes from COVID and how it was handled across red states vs. blue. The red states won by a landslide. The Wall Street Journal’s editorial board writes:

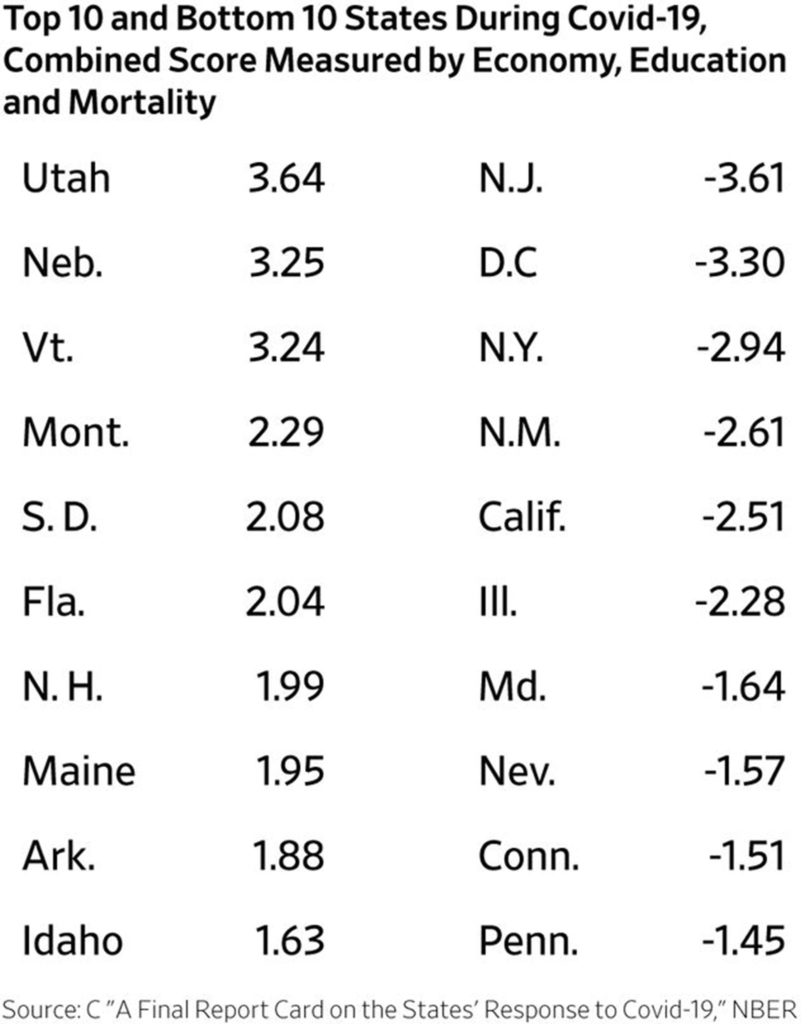

The nearby table shows the state ranking based on a combined score of the three variables. Utah ranks first by a considerable margin over Nebraska and Vermont. The Beehive State scored well across all three categories: fourth on the economy, fifth in education (as measured by lost days in school), and eighth in Covid mortality adjusted for a state population’s age and the prevalence of obesity and diabetes (leading co-morbidities for Covid deaths). The authors used a regression analysis for the economy that adjusted for state industry composition.

The top 10 in the rankings are smaller states with the notable exception of Florida, which ranks sixth. Recall how the Sunshine State’s decision to open itself relatively soon after the first lockdowns was derided as cruel and destructive. Gov. Ron DeSantis was called “Governor DeathSentence.”

The study ranks Florida 28th in mortality, in the middle off the pack and about the same as California, which ranks 27th despite its far more stringent lockdowns and school closures. But Florida ranks third for the least education loss and 13th in economic performance. California ranks 47th overall because its shutdowns crushed the economy (40th) and in-person school (50th).

In other words, Florida did about average on mortality as other states, but it did far better in protecting its citizens from severe economic harm and its children from lost schooling. “The correlation between health and economy scores is essentially zero,” say the authors, “which suggests that states that withdrew the most from economic activity did not significantly improve health by doing so.”

The NBER working paper presents the data straight without policy conclusions, but here’s one of ours: The severe lockdown states suffered much more on overall social well-being in return for relatively little comparative benefit on health.

The most extreme example of this tradeoff is Hawaii, an isolated island state with an economy heavily dependent on tourism. The state came closest of any to imposing a version of China’s zero-Covid policy as it shut down travel to the islands. The result was a stellar performance on mortality—first by a big margin. But it finished last in economic performance and 46th in education.

The bottom 10 are dominated by states and D.C. that had the most stringent lockdowns and were among the last to reopen schools. Their economies are for the most part still behind most others in recovering from the pandemic.

New York, whose former Governor Andrew Cuomo was celebrated as a Covid hero, ranks 49th. Albany’s severe and overlong economic shutdown (48th) had no payoff in mortality (47th). New Jersey ranks last with a miserable performance across the board. Gov. Phil Murphy didn’t save lives, but he did savage the economy and punish students as he followed the teachers union demands on school closures to rank 41st on education.

Another lesson we’d draw that the authors don’t in their paper: Thank the U.S. Constitution for our federalist system of government. States were largely able to implement their own policies. The outcomes would have been much worse had Washington imposed a single national policy as dictated by the federal bureaucracy.

And now Americans, especially retired savers, suffer from the stealth tax of a wave of inflation created by a reckless expansion of the money supply. That expansion has lined the pockets of the wealthy and created a false sense of wealth in others by paying them not to work. And now they want more free money. It’s a thirst that will never be quenched. They’re led by those believing government deserves a seat at the head of your table. Clearly, it does not.

When you hear the screams in the night in the city canyons of Shanghai—all from the vicious lockdowns and malnourishment created by a socialist regime—you wonder: How far is America from something like this happening again? Not far, only next time will be different. It always is.

Look at how big, blue cities locked residents down, allowing crime to fester, destroying your freedom, your way of life, your business, in the name of the “science.” Stupid decisions to, for example, send the sick to the nursing homes—leadership at its absolute worst.

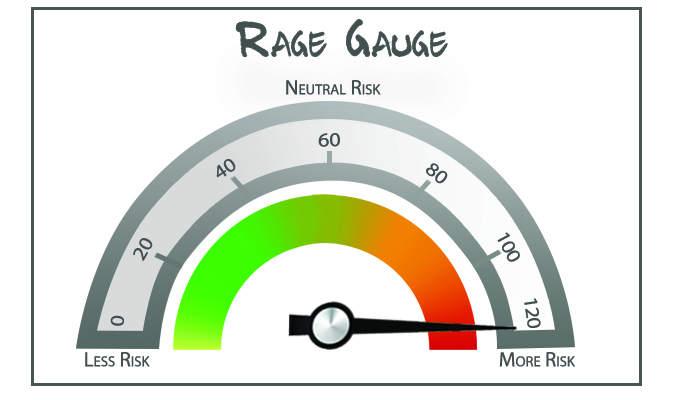

The ease with which the government took over Americans’ lives is breathtaking. This is still America, right? When I look at this month’s RAGE Gauge, dissatisfaction with the country is sky high, and inflation is running hot. This is no time to bet the farm on something that doesn’t pay you to invest. It’s time to continue to hunker down and protect what you’ve made. Keep the faith. Keep your dividend religion.

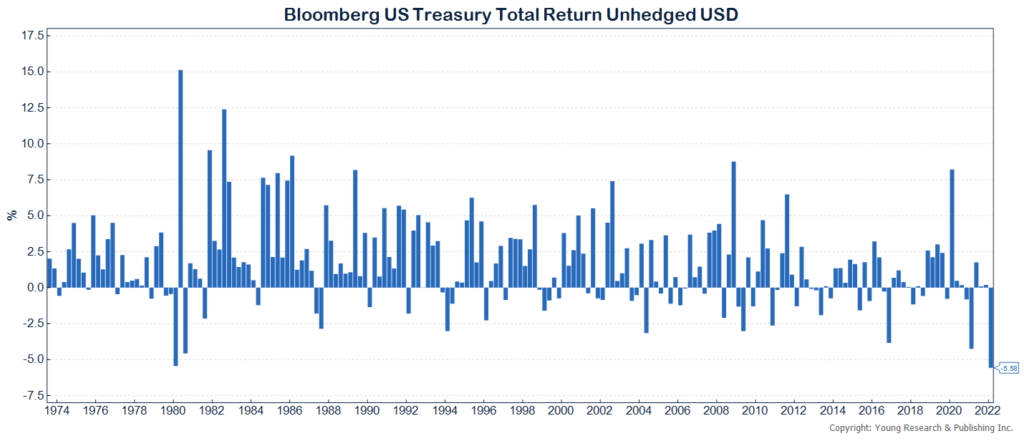

Prices, like predictions, are a qualitative signal, not quantitative. Look at this illustration below. This has been one of the worst quarters for bonds in 50-years, and it’s based on expectations. Will the Fed have the conviction to raise rates another half-dozen times or so? We’ll see…

P.S. Despite the applause from the pliant media, lockdown states didn’t do any better than the others. Fox News reports:

“The study verifies other studies which have found that locking down businesses, stores, churches, schools, and restaurants had almost no impact on health outcomes across states,” the report determined. “States with strict lockdowns had virtually no better performance in COVID death rates than states that remained mostly open for business.”

Throughout the first two years of the pandemic, liberal states were widely applauded for their restrictions while conservative states were lambasted.

P.P.S. Now the Biden administration wants you to believe it’s all Vladimir Putin’s fault, despite the problems beginning much earlier. The desperation in Press Secretary Jen Psaki’s voice as she murmurs “Putin Price Hike” over and over like an incantation shows you exactly why she’s abandoning ship and heading for MSNBC with all haste.

Got a bum education,

double-digit inflation

Can’t take the train to the job,

there’s a strike at the station.— Raheem J. Kassam (@RaheemKassam) April 11, 2022

Inflation has now hit a four-decade high, with prices rising 8.%% from a year ago. The WSJ reports:

U.S. inflation rose to a new four-decade peak of 8.5% in March from the same month a year ago, driven by skyrocketing energy and food costs, supply constraints and strong consumer demand.

The Labor Department on Tuesday said the consumer-price index—which measures what consumers pay for goods and services—in March rose at its fastest annual pace since December 1981, when it was on a recession-induced downswing after the Federal Reserve aggressively tightened monetary policy. That marks the sixth straight month for inflation above 6% and put it above February’s 7.9% annual rate–well above the Federal Reserve’s target.

The so-called core price index, which excludes the often-volatile categories of food and energy, increased 6.5% in March from a year earlier—up from February’s 6.4% rise, and sharpest 12-month rise since August 1982.

On a monthly basis, the CPI accelerated at a seasonally adjusted 1.2% last month, from 0.8% in February, and the fastest one-month increase since 2005.

P.P.P.S. Leaders of cities from which wealthy residents are fleeing are frantically trying to deny the reality, that they’ve screwed up big. The NY Post reports:

Wall Street giants began opening offices in places like Florida and Texas with no state income tax, and the rush for the exits continued. Census figures through 2019 show that millionaires have been leaving New York at an alarming pace.

As E.J. McMahon of the Manhattan Institute recently wrote: “In 2019, according to just-released data from the Internal Revenue Service, the number of New York tax filers with adjusted gross incomes above $1 million dropped to 55,100 from 57,210 in 2018. That 3.7% decrease came even as the number of millionaire filers nationally was growing to 554,340 from 541,410, an increase of 2.4%.”

And that was before the pandemic hit.

Who made it worse?

Of course, during COVID, de Blasio made things even worse. He shuttered the city and turned Manhattan into a playground for criminals and the criminally insane homeless, from which it still hasn’t recovered even under new Mayor Eric Adams. That caused many more rich New Yorkers to seek shelter outside the state.

Yet bean counters like State Budget Director Robert Mujica are still trying to spin what’s happening before our eyes as a nothing-burger to a compliant, left-leaning media. The rich are leaving not because of high taxes or high crime, as if the Census number are lying.

But there’s a place where reality can’t easily be spun, and that’s the municipal-bond market.

A little background on munis: They don’t often follow the same set of rules as other types of debt, which rise and fall based on broad economic trends and interest rates.

That’s because municipal bonds are a tax haven. Even when rates rise and other bonds fall, rich people in high-taxed places (i.e. New York) can often be counted on to keep buying city and state debt.

That appeal is now eroding, traders and investment bankers who specialize in New York State and City bonds tell me. The most logical explanation isn’t simply too much supply or higher interest rates. The appetite from millionaires should still be there: City and state taxes continue to hit the wealthy harder than ever.

Plus there’s no immediate worry of budget shortfalls and bond-rating downgrades that depress prices because both city and state coffers are flush with federal COVID-relief money.

Less need for NY munis

The only explanation, market professionals tell me, is a growing number of rich people who no longer need to seek New York munis as a tax haven — because they now live in Florida.

The Bear Traps Report, a research platform, crunched some numbers for me and came up with the following: Yields on Florida munis have often been higher than those from New York because there was more demand for the Empire State debt and less demand for tax-free bonds in a low-tax state like Florida.

That began to shift over the years, but most significantly in early February of this year. Now New York bond yields are higher than Florida’s just as the Empire State’s rich-resident tax base has significantly thinned.

Action Line: Stick with me. You can’t afford to have your head in the sand. I’ll keep you on track with my weekly email. Sign up here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024