You know that measurements of inflation have been creeping up for months, higher and higher. But now you can probably can “feel” inflation, as it eats away at your savings and paycheck. That’s the feeling many Americans are experiencing today. The Wall Street Journal’s Julia Carpenter reports:

The highest inflation in four decades became real for Matthew Rivera when he ordered a plate of chicken wings last month at a restaurant in the Catskill Mountains. He normally pays $8-10, and this time it was $20. The old, lower price was crossed out on the menu.

“ ‘Inflation,’ ” was the explanation from the waitress, he said. He ordered wings for his children but pledged not to do it again. “It wasn’t worth it.”

Inflation has been a fixture of news headlines for months, as prices ballooned for food, utilities and energy. Many people say the escalations are just now hitting home in their everyday lives. For some, it’s sticker shock while filling up at the pump. For others, it’s the higher price of their morning joe at Starbucks, or the cost of strawberries at the local grocery store.

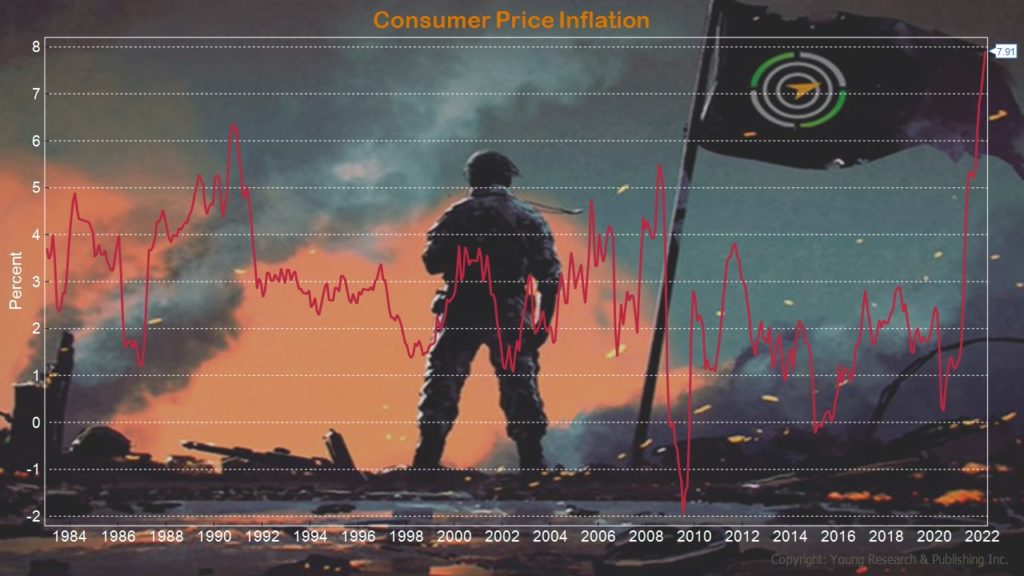

More such moments are likely in the coming weeks. Cost pressures are expected to build as the West responds to the Ukraine crisis with sanctions against Moscow and a new pandemic lockdown in China further roils battered global supply chains. The Labor Department recently reported the February Consumer Price Index, a monthly measure of the cost of different goods and services, reached its highest level since 1982. On Wednesday, the Federal Reserve said it would combat inflation by raising interest rates for the first time since 2018.

“A lot of people have heard it in the media for a while: ‘Oh, inflation, inflation,’ ” said Charlotte Geletka, managing partner and owner at Silver Penny Financial, a financial advisory firm in Atlanta. “But they didn’t have the ‘Aha!’ moment until it got to something that affects their everyday lives.”

Plenty are having that experience while filling their gas tanks, opening a utility bill or looking for a place to live. The national average price for gasoline recently climbed above $4, hitting its highest point since July 2008. Electricity bills climbed more than 4% in 2021 and are up again this year, sparking complaints on social networks such as Nextdoor. The average cost of a one-bedroom apartment is up nearly 25% year over year, according to Rent.com’s latest report. Home-lending costs are also rising; the average rate for a 30-year fixed mortgage topped 4% for the first time since May 2019, Freddie Mac said Thursday.

People expect their purchasing power to weaken further, according to a University of Michigan measure of consumer confidence that fell to its lowest level in a decade last month. For Americans under 40, this is the highest inflation they have seen in their lifetimes.

Americans know that the worst inflation in forty years is still going to get worse, the Biden administration even told them so. The inflation Americans are experiencing under Joe Biden is eating away at any wage gains they may have gotten under the Trump administration. Now many Americans are wondering if the Fed had simply lost the will to fight inflation, and just how much of their savings will be burned up. Perhaps hardest hit are retirees on a fixed income. With no ability to make more money, they are facing the hardest road ahead.

Action Line: Inflation is a stealth tax on your retirement and your standard of living, and if you don’t plan for it, life can become very difficult. If you’re retired or soon to be retired, you need to build your investment portfolio with inflation in mind. If you need help, I would love to talk with you. If you would like to get to know me before we talk on the phone, there’s no better way than signing up for my free monthly Survive & Thrive letter. In the letter each month, I encourage and push you to achieve the personal and financial security goals you’ve set for your family. Click here to subscribe. We’ll get to know each other, and get serious about your future success.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024