At CreditNews, Sam Bourgi warns that experts are sounding the alarm on America’s debt. Your Survival Guy has been regularly warning about the increasing debt burden America’s politicians are placing on its future generations. Bourgi writes:

At current rates, the national debt is growing by roughly $1 trillion every 100 days—a pattern that first emerged in mid-2023. Before that, it took roughly eight months to add $1 trillion.

The debt surpassed $34 trillion on Jan. 4 and is currently clocking in at $34.6 trillion.

With growing debt servicing costs due to higher interest rates, Moody’s Analytics has lowered the U.S. government’s credit rating outlook from “stable” to “negative.”

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,” the rating agency said in November. “Moody’s expects that the U.S.’ fiscal deficits will remain very large, significantly weakening debt affordability.”

Fitch, another credit rating agency, said Washington’s fiscal deficit will continue to grow ahead of the presidential elections—a time when policymakers attempt to shore up public support with new spending initiatives.

Earlier in March, President Biden outlined a $7.3 trillion budget to kickstart his second presidential term. The budget includes new spending programs to assist Americans struggling with high housing and childcare costs.

While experts say the measures are unlikely to be adopted in their current form, the budget reaffirms the president’s plan to increase spending if he’s re-elected.

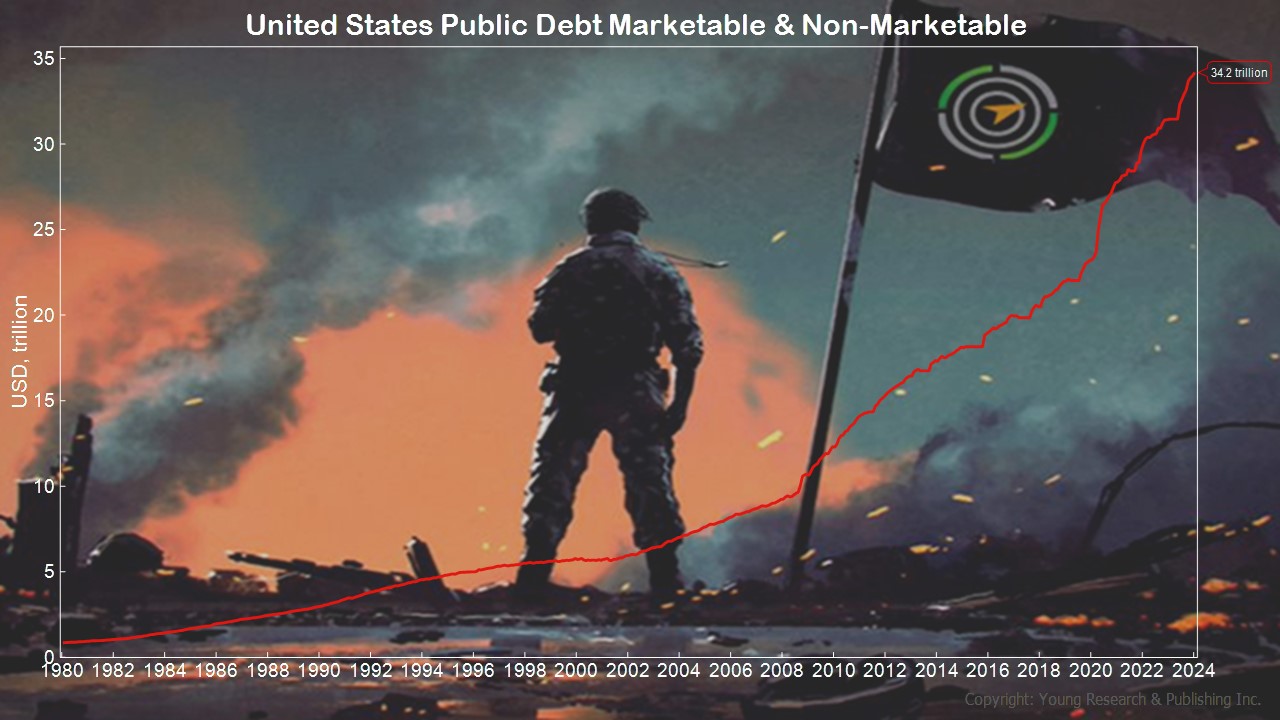

Action Line: Just look at that chart above of America’s debt, and you get a feel for the grim future America is facing. Read more about the debt crisis facing America below. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

- Staggering U.S. Debt Growth: $1 Trillion Every 100 Days

- A Plan to Prevent an American Debt Crisis

- Does Anyone Remember the National Debt?

- America’s Debt Downgraded, Again

- Will Biden Repeat Obama with US Debt Downgrade?

- Government Debt Service a Growing Burden for Americans

- America’s Unprecedented Debt Problem

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- The Grid Pushed to Its Limits - May 8, 2024

- How Will America Fill Its Data Center Power Gap? - May 8, 2024

- Which States Tax Social Security? - May 8, 2024

- The People’s Chemist and Your Survival Guy - May 7, 2024

- RIP Charlie Munger: Keeping It Simple Never Goes out of Style - May 7, 2024