By Monkey Business Images @ Shutterstock.com

You are probably familiar with Your Survival Guy’s Super States. In 2023, my top 10 Super States included:

Rank State

- New Hampshire

- Florida

- Utah

- South Carolina

- Arizona

- Texas

- South Dakota

- Montana

- Idaho

- Wyoming

But do you know about the Escape States? Those are the ten worst-ranked states on Your Survival Guy’s annual Super States list. In 2023’s rankings, that included:

- Connecticut

- Rhode Island

- Massachusetts

- Maryland

- New Mexico

- Hawaii

- New York

- Illinois

- California

- New Jersey

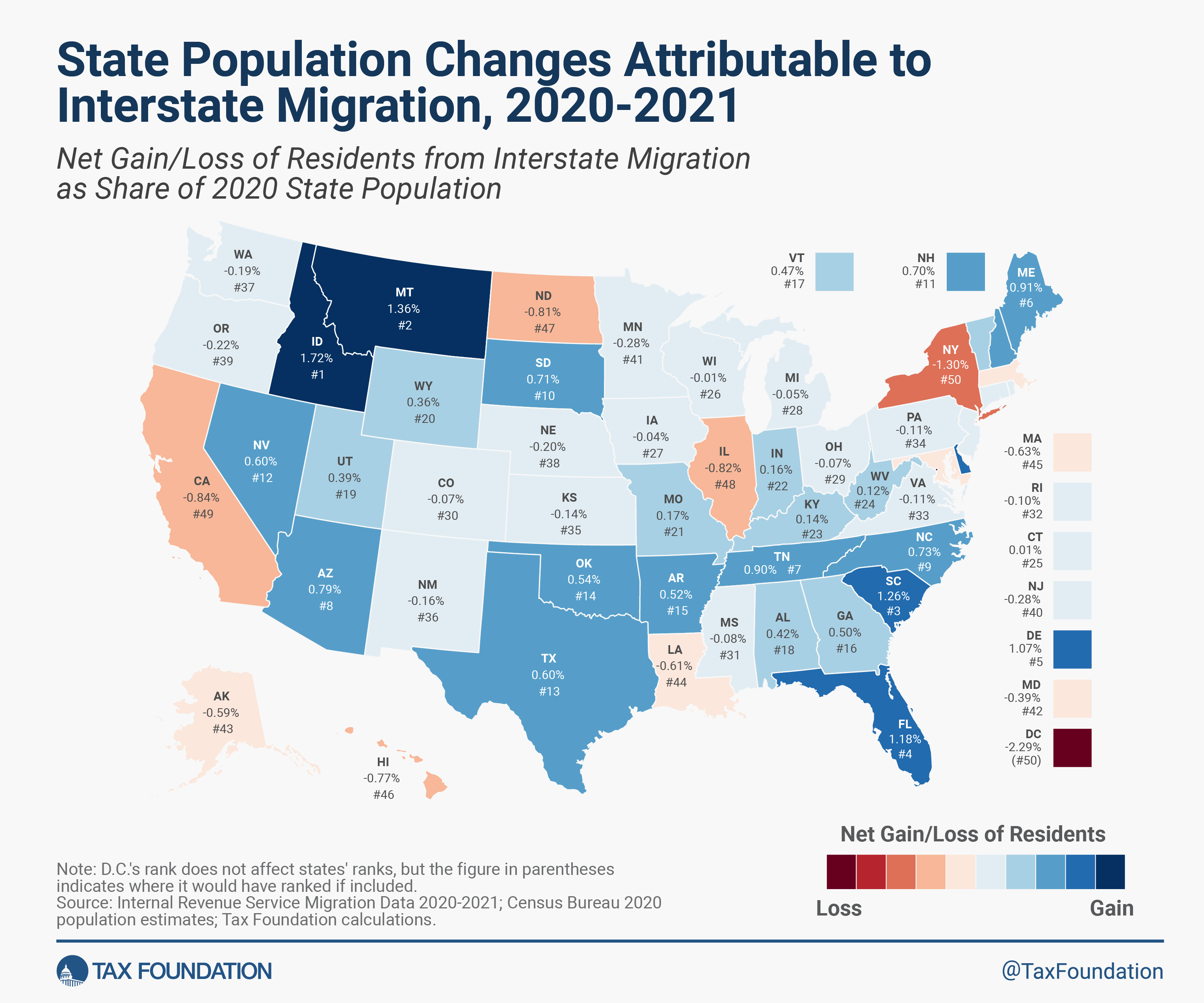

New IRS data analyzed by the Tax Foundation shows that Americans fled the Escape States in droves during the height of the Covid pandemic in 2020-2021. Andrey Tushkov and Katherine Loughead explain:

The IRS data show that between 2020 and 2021, 26 states experienced a net gain in income tax filers from interstate migration—led by Florida (+128,228), Texas (+82,842), North Carolina (+40,828), Arizona (+32,636), and Tennessee (+30,292)—while 24 states and the District of Columbia experienced a net loss—led by California (-158,220), New York (-142,109), Illinois (-53,910), Massachusetts (-25,029), and Louisiana (-14,113).

When all individuals associated with each tax return are accounted for, including spouses and dependents, 25 states experienced a net gain in individuals while 25 states and D.C. experienced a net loss. Only one state, Connecticut, saw a loss in tax returns attributable to interstate migration but a gain in individuals associated with the returns of those who moved in. Washington and Colorado, in contrast, saw a gain in tax returns but a loss in the total number of individuals on those returns.

States with the highest net AGI gains included Florida at $39.2 billion, Texas at $10.9 billion, and several states (North Carolina, Arizona, Tennessee, South Carolina, and Nevada) at around $4 billion each. States with the highest net AGI losses included California at -$29.1 billion, New York at -$24.5 billion, Illinois at -$10.8 billion, and Massachusetts at -$4.3 billion.

The map and table below show states’ gains and losses in resident population, income tax returns filed, and AGI attributable to interstate migration.

Many factors influence an individual’s or family’s decision to move from one state to another—employment or educational opportunities, proximity to family or friends, and geographic and lifestyle preferences like weather, natural landscape, and population density, to name a few. Cost-of-living considerations, including tax differentials, may not be the primary reason for an interstate move, but they are often one of several factors people consider when deciding whether—and where—to move.

More Americans Moved to States with Lower Taxes and Sound Tax Structures

Consistent with last year’s version of this publication, it is clear from the 2020-2021 IRS migration data that there is a strong positive relationship between state tax competitiveness and net migration. Overall, states with lower taxes and sound tax structures experienced stronger inbound migration than states with higher taxes and more burdensome tax structures.

Of the 10 states that experienced the largest gains in income taxpayers, four do not levy individual income taxes on wage or salary income at all. Additionally, eight of the top 10 states either forgo individual income taxes on wage and salary income, have a flat income tax, or are moving to a flat income tax.

Action Line: Get the latest updates about the Super States, and the Escape States, by clicking here to subscribe to Your Survival Guy’s monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024