Having dinner last night, my father-in-law Dick Young asked, “Survival Guy, what’s investing mistake #1?” “I don’t know yet,” I said. “Let me tell you about living off your portfolio. It’s hard,” he said. “I’ve been writing about this my entire adult life. I didn’t expect how tough it would be to generate income. It’s expensive staying at Le Bristol, so you better figure out a way to make it work. I’m just getting comfortable. How’s your dinner?” … Part of my inspiration for this series came from reading past issues of Richard C. Young’s Intelligence Report. Each issue was packed … [Read more...]

Investing Mistakes to Avoid: #11 FOG

Your Survival Guy knows a thing or two about getting stuck in the fog. When I was a kid sailing with my family, we were heading home after a weeklong trip, and about halfway through Buzzards Bay, we were engulfed in fog. We held our course and, before long, entered a mooring field holding no boats that we recognized. Realizing land wasn’t far, and that we were in the wrong harbor, we decided not to press our luck. We tossed out the hook and spent a comfortable night right there. The next morning, after the fog cleared, we learned we were a few harbors west of our own. Not long after, a … [Read more...]

Investing Mistakes to Avoid: #2 Tomorrowland

When I was a kid, some of my favorite memories were vacations to Walt Disney World and going on Space Mountain—repeatedly. Then after every ride, I’d stand on the conveyor belt and look at Tomorrowland and think about how cool it would be to someday live in space. That’s a long time ago now, and here I am writing to you from Earth, still wondering if that will ever happen. Maybe. But a lot of investing days and years have passed since then, and if we could time travel from the 70s, investing in stocks would have been a good move if—and that’s a big if—you had time. Just … [Read more...]

Investing Mistakes to Avoid: #3 Back 40 Back

Your Survival Guy and Gal saw Luke Combs on Saturday night at Gillette Stadium in Foxborough, Massachusetts. The song I can’t get out of my head is “Back 40 Back.” Combs didn’t play it (it’s not the song to keep a stadium on its feet), but it’s a reminder of the way life used to be—when there was a back 40 of land or open space that has too often now been replaced by a concrete jungle. I’ve been thinking about when I was a kid, going to Fenway Park to see Jim Rice, Dwight Evans, Carl Yastrzemski, and Fred Lynn. The old Boston Garden, where you could hear and smell the game. Memories of … [Read more...]

Investing Mistakes to Avoid: #4 Mr. Happy Yappy

Like in school, investors should get rapped on the knuckles for not keeping their eyes on their own portfolios. But investors are sensitive to the "other" guy. Investors hate missing the boat. Nothing irks them more. They're fine hearing that someone else is doing worse. But when someone else is smiling carefree and yappin' away about their good fortune, that makes investors' blood boil. Nothing makes the phone ring more than a down quarter. In my conversations with you, we spend time talking about how you, not anyone else, got to where you are. We talk about why you're looking for an … [Read more...]

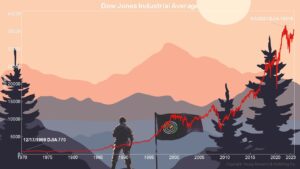

Investing Mistakes to Avoid: #5 History

When Becky and I were married 25 years ago, we were 26 years old. If you add up our ages, we had 52 years of life experience. Then, we had our first child, and all that experience was kicked to the curb. And then, just when we thought we had everything pretty much under control, we decided it would be a good idea to have another one. Going from one to two isn’t linear. Two kids are many multiples more difficult. Which brings me to my next investing mistake to avoid: Kids. Kidding. They read this. No, the investing mistake to avoid: #5 is History. Don’t think just because you know a few … [Read more...]

Investing Mistakes to Avoid: #6 3X QQQ

If you live in New England, you know how unpredictable the weather has been this summer. Just the other day, we were cruising back from lunch in Edgartown, MA, through Vineyard Sound and, before reaching Woods Hole, were engulfed in a fog bank. Your Survival Guy has radar, but even with that, I worry about the speed and actions of other boaters I can’t control. I throttled back, making our marks slowly, and in less than 20 minutes, we were in clear air moving through the Hole. It happens that fast. Which leads me to my next investing mistake to avoid: Don’t be in a rush to make money. Time … [Read more...]

Investing Mistakes to Avoid: #7 DEI DOA

Your Survival Guy puts in a solid effort to recycle his trash weekly. Rolling out the blue bin to the curb makes me feel good and a bit anxious, wondering if they can track me down for misallocated debris. But, when it comes to my money, I don’t want ESG (environmental, social, and governance) or DEI (diversity, equity, and inclusion) separated from the fiduciary responsibilities. Sure, ESG and DEI might feel good and provide good copy during PowerPoint presentations. But it’s more sizzle than steak. And what about their job as fiduciaries? It’s why I look at all this ESG and DEI as dead on … [Read more...]

Investing Mistakes to Avoid: #8 “Get Back”

Last year (2022) was brutal for the major averages (not including dividends): Nasdaq -33.1%, Russell 2000 -21.6%, S&P 500 -19.4%, and the Dow Jones Industrial Average -8.8%. But not all investors hung around to see things through. And you know this song: Markets are back up this year. Let’s rewind. When the going gets tough, the capitulation begins. And in my observation, a breaking point is reached when a portfolio goes below a certain number. It has nothing to do with the major averages per se. It has everything to do with dollar signs. Will we have enough to live on? And the … [Read more...]

Investing Mistakes to Avoid: #9 Hobbyist or Hobbit?

“We are plain quiet folk and have no use for adventures. Nasty disturbing uncomfortable things! Make you late for dinner!” said Bilbo Baggins to Gandalf in The Hobbit. Which leads me to “Investing Mistakes to Avoid: #9 Hobbyist or Hobbit?” This is a story about a recently retired investor. The hobbyist investor. The most dangerous one of all. You see, it’s the recently retired investor who, with a fresh outlook on life, thinks he doesn’t need “experts” to guide him. Who yearns for one more bite of the apple. Who imagines himself scoring with artificial intelligence or high-yield … [Read more...]