“A sucker is born every minute, and Warren Buffett just proved it. He agreed to spend an undisclosed sum of his shareholders’ money to buy a controlling stake in Pilot Flying J, the truck-stop chain that sells food, coffee and diesel fuel to truckers”, writes Holman Jenkins, Jr. in his WSJ column. “After all, aren’t truckers about to be replaced by robots, and diesel by battery power?” Not so fast he continues, “The sucker in this scenario, we add, is anyone who believed such futuristic forecasts in the first place”

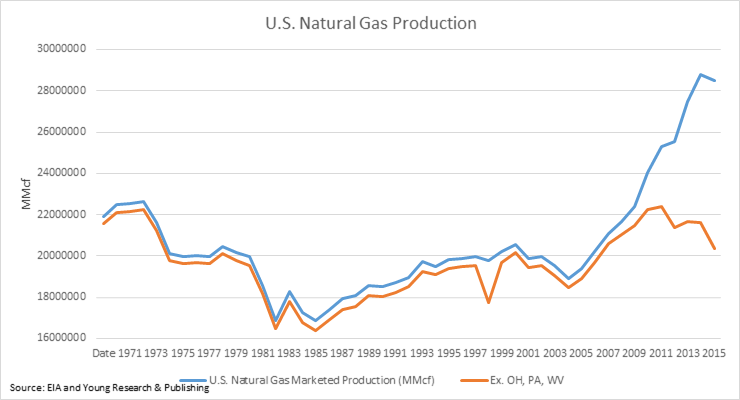

Changing gears, I had a discussion about natural gas this week with a client who is in business in the Marcellus formation—estimated by some to contain more than 410 trillion cubic feet of natural gas. The core of the Marcellus is in three states Ohio, Pennsylvania, and West Virginia. My client was telling me that natural gas production with and without these three states, is simply mind blowing (see the chart for yourself).

He told me, with the excess supply coming from the Marcellus, prices are in the tank, so to speak. It’s hard to justify ‘drill, baby drill’ when you’re guaranteed to lose money.

Natural gas prices, like real estate, fluctuate from region to region. It’s all about supply. There are only so many houses in the best location, location, location. Houses that go for $350,000 in West Virginia might fetch $1.3 million in Palo Alto. But it’s not like you can simply pick up a house and move it.

Which brings me to the $39 billion in bonds Saudi Arabia has floated over the past 12 months to recover from the crash in oil prices in 2014-2015 (too much supply). Their desperate bond issue is an attempt to bring an economy stuck in the middle ages into the 21st century. And diversify away from oil. Good luck with that. Unlike those regional natural gas markets, the oil prices Saudi Arabia relies on to pay its bills are global. And the same types of folks drilling for natural gas in the Marcellus are working hard in the Permian, the Williston and the Eagle Ford. The oil they are pumping is setting the market price and even with OPEC behind it, Saudi Arabia is having trouble dealing with that new reality.

The Marcellus is open for business, along with America’s other shale oil and gas plays. The distribution, eh, not quite yet. Does anyone like benefitting from a cheap commodity more than Buffett? As Mr. Jenkins points out “Gasoline- and diesel-powered cars will remain the vehicles of choice for many uses for decades to come. And Mr. Buffett (and his heirs) will be plying their drivers with pancakes, coffee and fill-ups.” They may even be saying “fill-er up with natural gas.”

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024

- Investing Is Math - April 25, 2024

- Breaking: New Rules on Trillions in IRAs and 401(k)s - April 24, 2024

- When You’re in Control, You Have Opportunities - April 24, 2024