When Americans visit the grocery store today, they know that things aren’t what they used to be. Food inflation is killing family budgets and shocking shoppers. In The Wall Street Journal, Stephanie Stamm and Jesse Newman take a look at food inflation over the last few years. They write:

In grocery stores, a Benjamin just isn’t what it used to be.

Grocery prices were up 1% in February from a year earlier, Labor Department data show. They were up 10.2% in February 2023 versus a year earlier, and were up 1.2% in February 2019 from a year earlier.

Prices for hundreds of grocery items have increased more than 50% since 2019 as food companies raised their prices. Executives have said that higher prices were needed to offset their own rising costs for ingredients, transportation and labor. Some U.S. lawmakers and the Biden administration have criticized food companies for using tactics such as shrinkflation, in which companies shrink their products—but not their prices.

Inflation-weary consumers have pushed back, and food makers have begun offering more deals or reducing the prices of goods such as coffee and margarine.

Consumers have also become creative to cope with a stretch of record food inflation. Sharon Faelten, a 74-year-old retiree from Underhill, Vt., said that instead of a wallet-punishing ordeal, she tries to think of trips to the store like procurement raids depicted in apocalyptic novels, where the goal is to stock her fridge, freezer and pantry for as little money as possible.

“Chicken is always on sale somewhere,” Faelten said. She has managed to keep her grocery bills to prepandemic levels, she said, but it takes a lot of work.

The price of food and household staples continues to weigh heavier on consumers’ minds than other economic concerns, although survey data indicate that those fears are ebbing. Some food-company executives have said that shoppers will adjust over time to higher prices, as they have in the past.

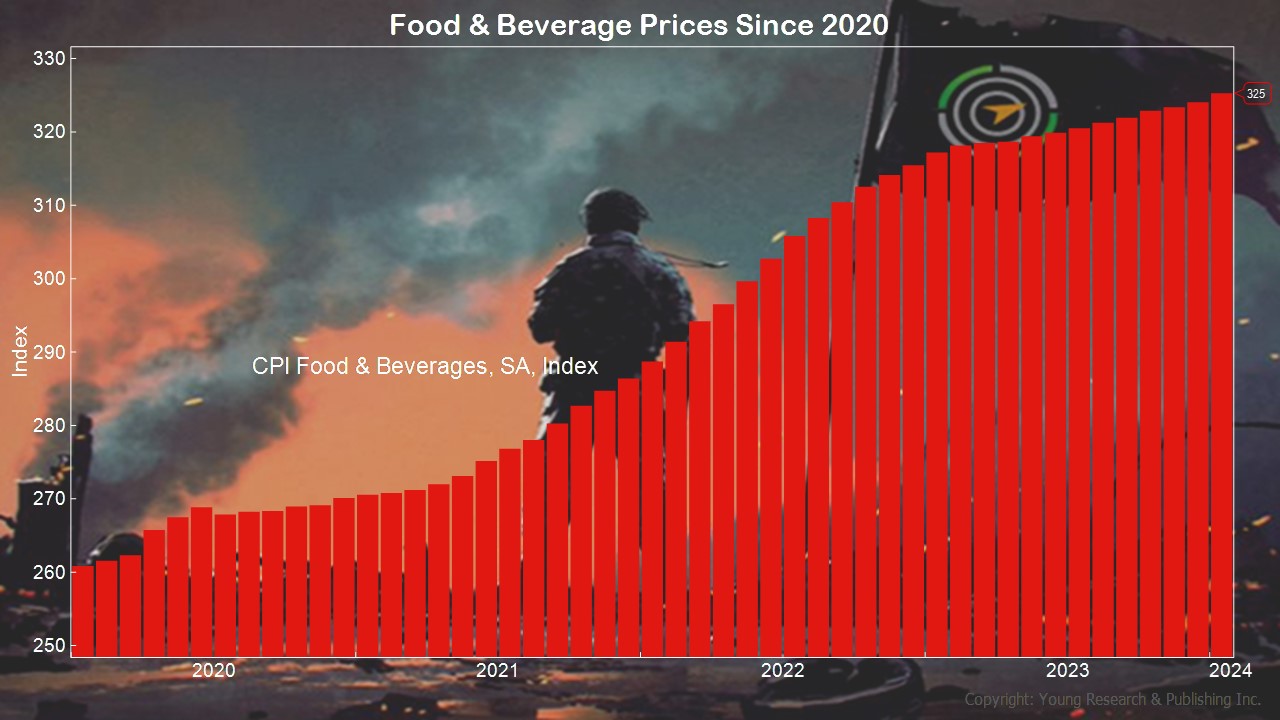

Just take a look at the Food & Beverage CPI since 2020. Prices are nearly 25% higher today than they were in January 2020.

Action Line: It’s hardest to avoid the pain of food inflation when you no longer bring home a paycheck. Once you retire, inflation is a bigger concern. When you want to talk about inflation and your investment portfolio, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy’s Atlantic Crossing - May 2, 2024

- Is the Fed Campaigning for Biden? - May 2, 2024

- Are You Prepared to Protect Yourself Abroad? - May 2, 2024

- Survive and Thrive April 2024: Our Dog Louis Passed Away on April 17th - May 1, 2024

- Dear Retired, or Soon to Be Retired, Investor - May 1, 2024