Time flies when you’re having fun. But don’t tell that to the investors who got crushed last year. All of a sudden they’re seeing the light—the wisdom in a balanced portfolio.

As Ben Graham taught us, you need to have some balance in your portfolio whether it’s 30-70 or 70-30 or something in between. I’m reading now how investors need to think about 60-40 after all the hand-wringing about the approach last year.

Look, stocks go up, stocks go down. I want you to get paid along the way. The same is true for bonds but with a finish line, especially for individual bonds, in the form of a set maturity date.

Action Line: For me, my long-term investing success has been about patience and compound interest. And it always will be. If you need help with your retirement plan, let’s talk.

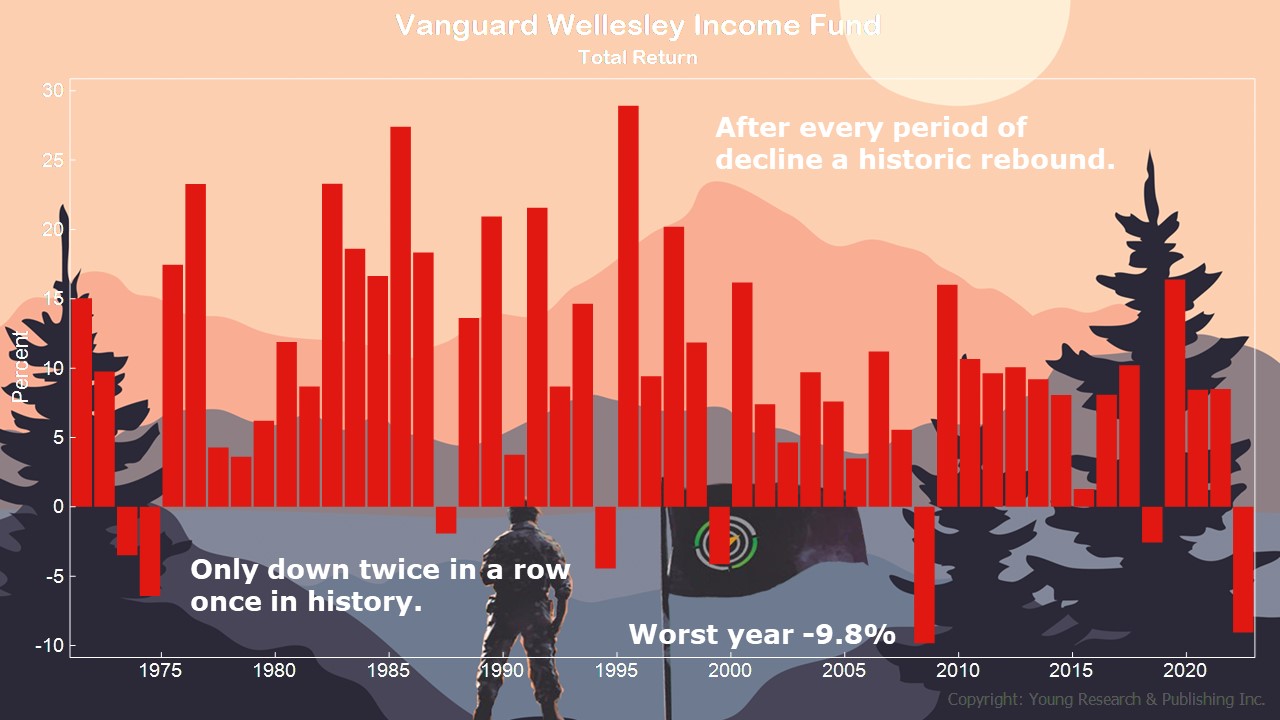

P.S. For an example of a balanced portfolio, take a look at the Vanguard Wellesley Income Fund below. I explain this balanced portfolio approach more here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Our Dog Louis Passed Away on April 17th - April 29, 2024

- The Burger and Fry Economy - April 29, 2024

- Less Is More at Work - April 29, 2024

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024