With all the talk this week about stock market darlings, I thought it would be a good idea to talk about losses. Because losses can be temporary, just like gains, but losses tend to leave a scar. What’s amazing is how quickly losses are forgotten by investors, and the cycle repeats. Because, wait for it, “it’s different this time.” No, it’s not.

Not to ruin your Friday, but emotionalism, greed, fear, and “hey, look how much that guy’s worth” have been around since the beginning of time. And it’s been shown by psychologists Daniel Kahneman and Amos Tversky that the pain from stock market losses is twice as intense as the pleasure of an equivalent gain.

Want to make a million bucks in tech stocks? Start with two million. Because at prices like these, where prices are priced for perfection, we all know we live in an imperfect world.

We live in a casino, and everyone likes to talk about their wins. Investors hate pain. They avoid it at all costs. Which is why they buy the stocks that are winning today. Except winning today doesn’t mean winning forever. Prices of today and yesterday come and go, as do investors. As soon as they take a shot across the bow and lose 50%, it’s “see you later.” They don’t stick around for the next chapter. And that might be a good thing because the math of it is you can lose 50% a year forever and never get to $0.00. Too many portfolios are littered with these scabs.

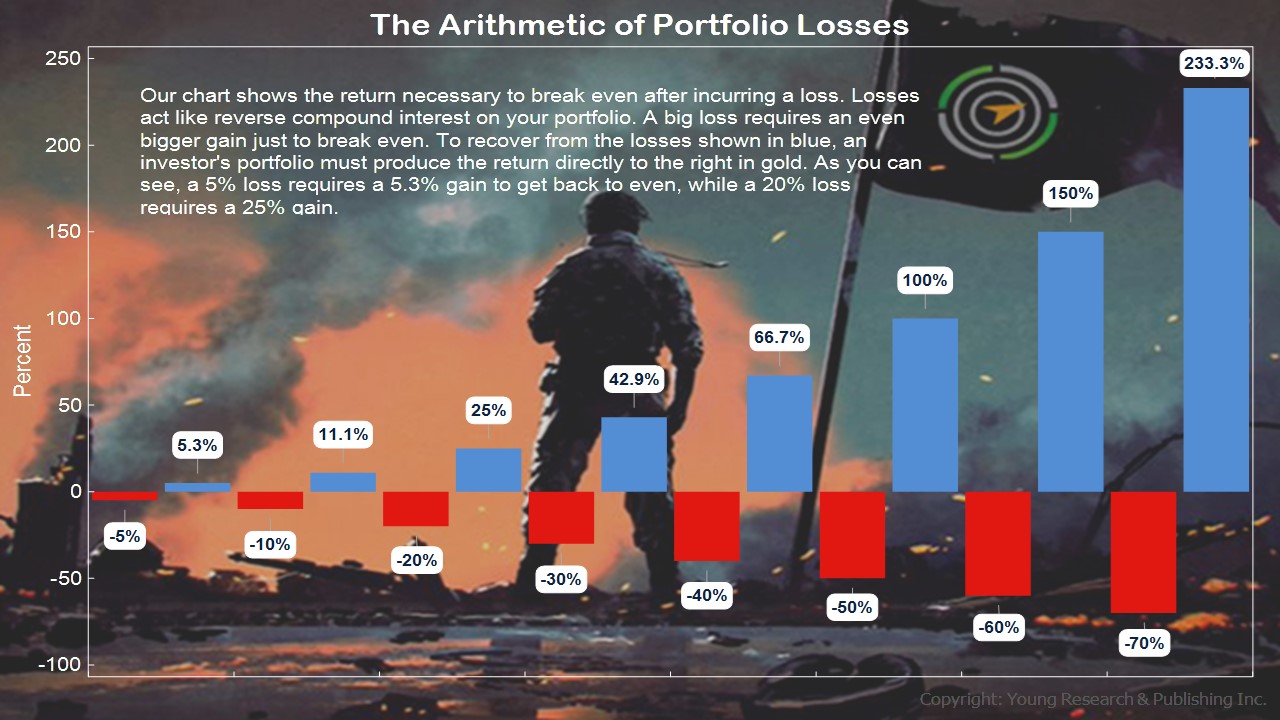

Remember the math of losses. To simply get back to even after losing 50%, one needs a gain of 100%. And we know that a 50% loss feels twice as bad as the good feeling you get from gains or about the equivalent emotional strength of a 100% gain. That’s the psychological math of losses vs. gains. It’s where the quantitative equals the qualitative. I don’t like those numbers. Stick with me.

Action Line: Keep it simple. Don’t lose money. You don’t need to be a hero in this market. When you want to talk about the losses and gains, I’m here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Your Survival Guy’s Rich Advisor, Poor Advisor - May 14, 2024

- Americans Are Worried about Their Grocery Bills - May 14, 2024

- Why Blue City Progressives Are Buying Guns - May 14, 2024

- Revisiting Rich Man, Poor Man - May 13, 2024

- Dick Young to Your Survival Guy: “Diversification Is Discipline” - May 13, 2024