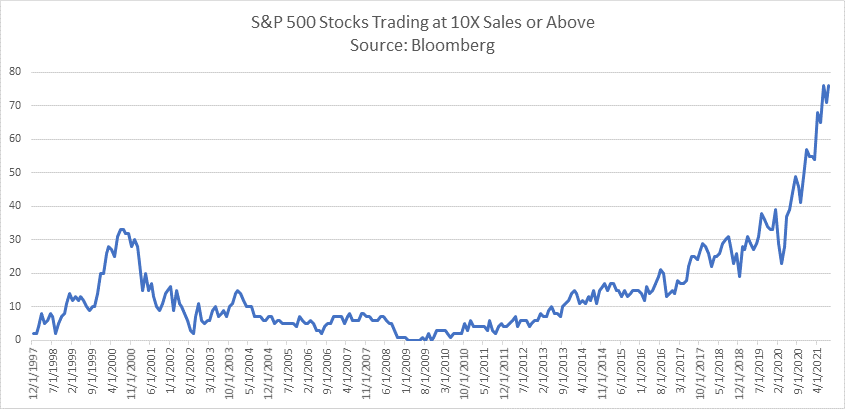

Check out the number of S&P 500 stocks trading at more than ten times their sales. I’m not talking about ten times earnings. This is sales. You know, the price you pay for your house, your groceries, your heating bill—not the profit the company selling to you hopes to make. Imagine if the world you and I live in was priced this way? It would make inflation look like a drop in the bucket. Well, that’s how these companies that index funds are buying hand-over-fist are priced.

Look at the number of S&P 500 stocks trading for more than ten times their annual sales on the chart below. The number today is over double that of the peak of the Dot Com era.

Here’s why mutual funds no longer work for your retirement. Dick Young writes:

My recent study covers four of the most widely owned equity-based mutual funds.

- Vanguard Equity Income

- Vanguard Dividend Growth

- T. Rowe Price Dividend Growth

- Fidelity Dividend Growth

Here’s the 10-year compounded growth rate for each:

- T. Rowe Price Dividend Growth 12.0%

- Vanguard Dividend Growth 12.0%,

- Vanguard Equity Income 11.7%

- Fidelity Dividend Growth 10.0%.

Today, each of these four multi-billion dollar funds has become far too big to allow crafting a portfolio with a suitable number of stocks that would meet my criteria. There are simply not enough publicly owned candidates.

Note how the long-term returns for all four of these funds are basically the same. In fact, the numbers for two are precisely the same.

Given these insurmountable roadblocks, your proper option is to stick with individual stocks.

For over three decades my family-owned investment firm has managed individual retirement portfolios (both current and future), comprising individual stocks (as well as bonds) meeting the rigorous dividend criteria I have written about since the early 1970s.

Each hand selected stock must pass my dividend tests of quality, seasoning, and liquidity.

Action Line: The clear path forward is to construct a portfolio with individual stocks that are carefully selected rather than just part of an index fund. If you need help, I would love to talk with you.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024