Have you been living in a big blue blob city and thinking, “Get me outta here!” each day? Americans face a choice between living in states and cities where politicians protect their freedoms and seek to minimize government’s burden on their lives, and places where politicians seek to use the power of government to bend residents—and their wallets—to the will of their own political agendas. Many states are digging residents and future residents deeper into debt, and raising the tax burden in order to fund politicians’ dream projects.

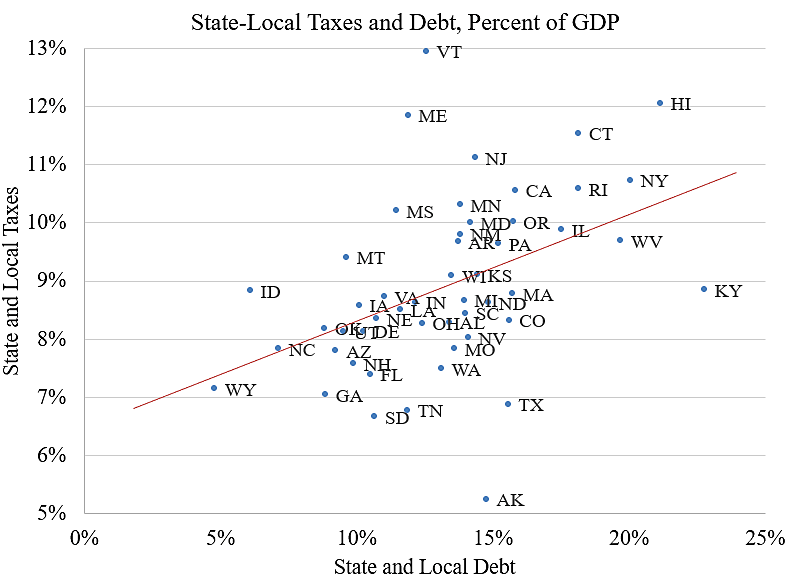

At the Cato Institute, Chris Edwards has exposed the “fiscal illusion” used by many states to mask the cost of their spending. By comparing state and local taxes and state and local debt to the state’s GDP, Edwards has created a regression that puts states’ real fiscal positions into perspective. In the lower left quadrant of Edwards’s chart are states that have low debt and taxes compared to their GDP, while the upper right quadrant is populated by states using more debt and higher taxes to fund spending. Note that Your Survival Guy’s top ten Super States of 2023 largely fall in the lower left quadrant. Edwards writes:

Government legislators pursue spending increases because they believe that spending solves problems in society and benefits their constituents. However, they use methods of fiscal illusion to try to hide the costs of spending. One method is debt. By borrowing, legislators push the costs down the road for future legislators and taxpayers to deal with.

Spendthrift legislators can get away with borrowing more and taxing less in the short run, but in the long run taxes will rise to cover the higher interest costs on the accumulating debt. Relative to state gross domestic product, state and local taxes tend to be higher in states that have higher state and local debt, as shown in the chart below. The tax and debt data are from the Census Bureau for 2021.

The chart includes a fitted regression line showing the strong positive correlation between taxes and debt. Perhaps states that borrow more end up raising taxes to cover the rising interest costs. Or perhaps states that favor higher spending tend to pursue it with both taxes and debt. There are some outliers—Kentucky has high debt and average taxes, whereas Maine and Vermont have high taxes and average debt.

People living in the top‐right states should be asking questions. Residents of Vermont, Maine, and Hawaii should be asking why their tax burdens are almost twice as high as the burdens in the lowest‐tax states. And residents of Kentucky, West Virginia, New York, and Hawaii should be asking why their states have racked up debt burdens three or four times higher than the burdens in the lowest‐debt states. And all of us should be asking why the federal government is vastly more irresponsible with debt than the worst‐run states.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- The Grid Pushed to Its Limits - May 8, 2024

- How Will America Fill Its Data Center Power Gap? - May 8, 2024

- Which States Tax Social Security? - May 8, 2024

- The People’s Chemist and Your Survival Guy - May 7, 2024

- RIP Charlie Munger: Keeping It Simple Never Goes out of Style - May 7, 2024