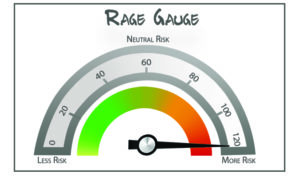

Your Survival Guy’s August Rage Gauge™ is in, and it seems to me like the calm before the storm. That’s why my reading remains full tilt to more risk. It’s a mixed bag as background checks are down, gold is way off, stock yields are lower, as is the unemployment rate.

But when you look around and see what’s going on in your neck of the woods, you’re telling me a different story. Things still don’t feel the same, and maybe they never will you say. We’ll see.

Anecdotal for sure, but a recent visit to a local restaurant was telling in that, it wasn’t fully staffed, wasn’t fully occupied, and it just felt different. My takeaway: “Just staying open” is the name of the game for the service industry for Summer ‘21.

Anecdotal for sure, but a recent visit to a local restaurant was telling in that, it wasn’t fully staffed, wasn’t fully occupied, and it just felt different. My takeaway: “Just staying open” is the name of the game for the service industry for Summer ‘21.

Action Line: Understand that every dollar you save is worth a couple hundred when interest rates are this low. What do I mean? Well if rates are half a percent, how much would you need to invest to earn a dollar? $200. Work as long as you can, put off retirement if you can handle the thought, and save ‘til it hurts, because this market’s making me uneasy. And yes, your summer’s worth fighting for.

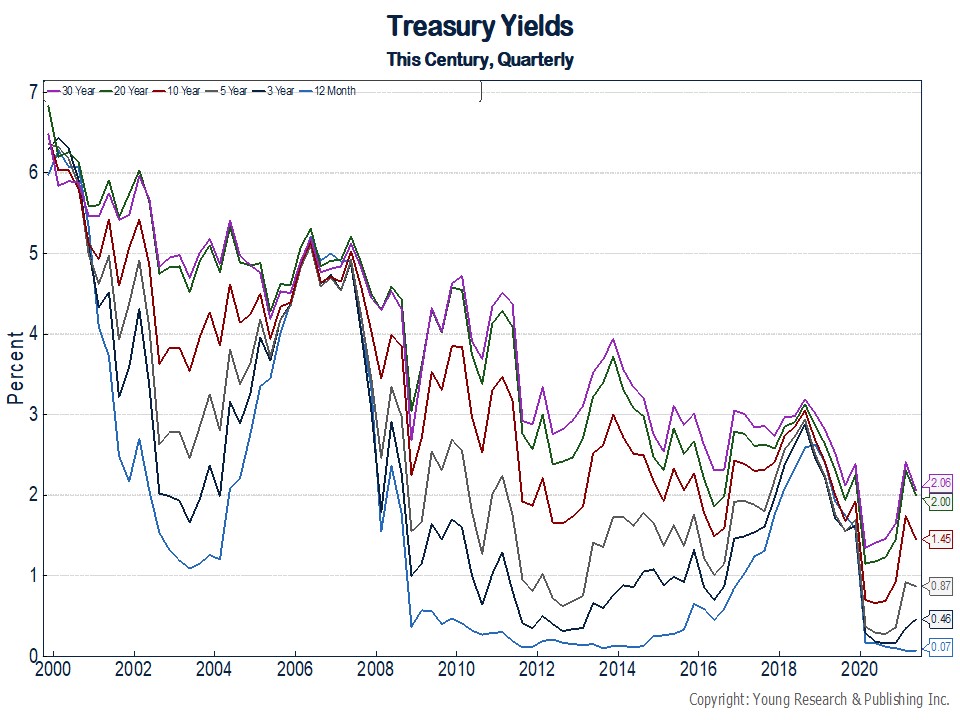

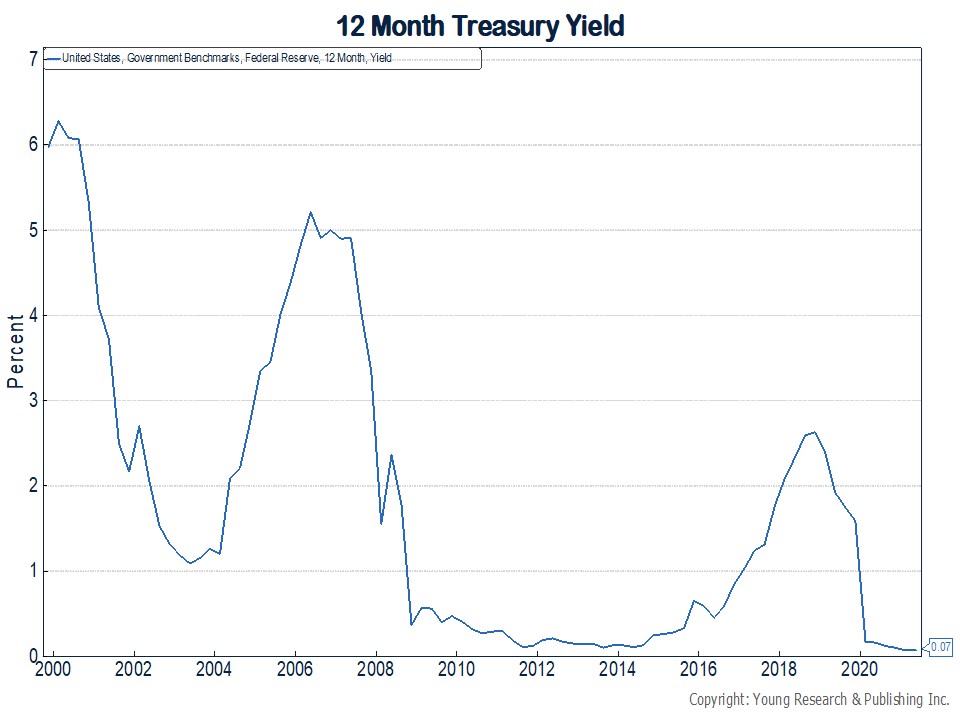

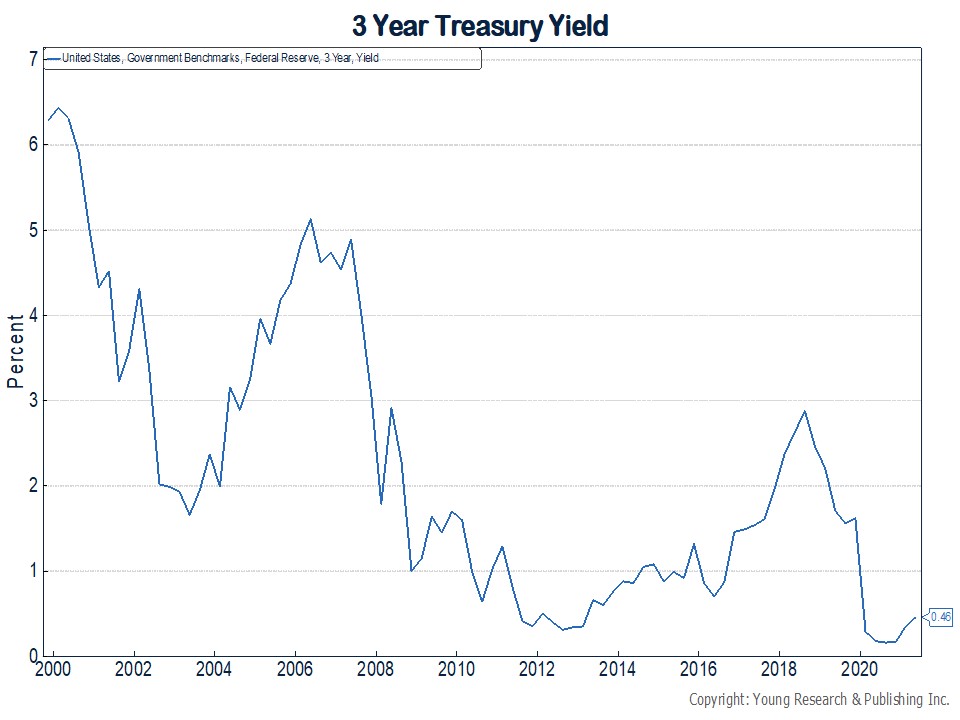

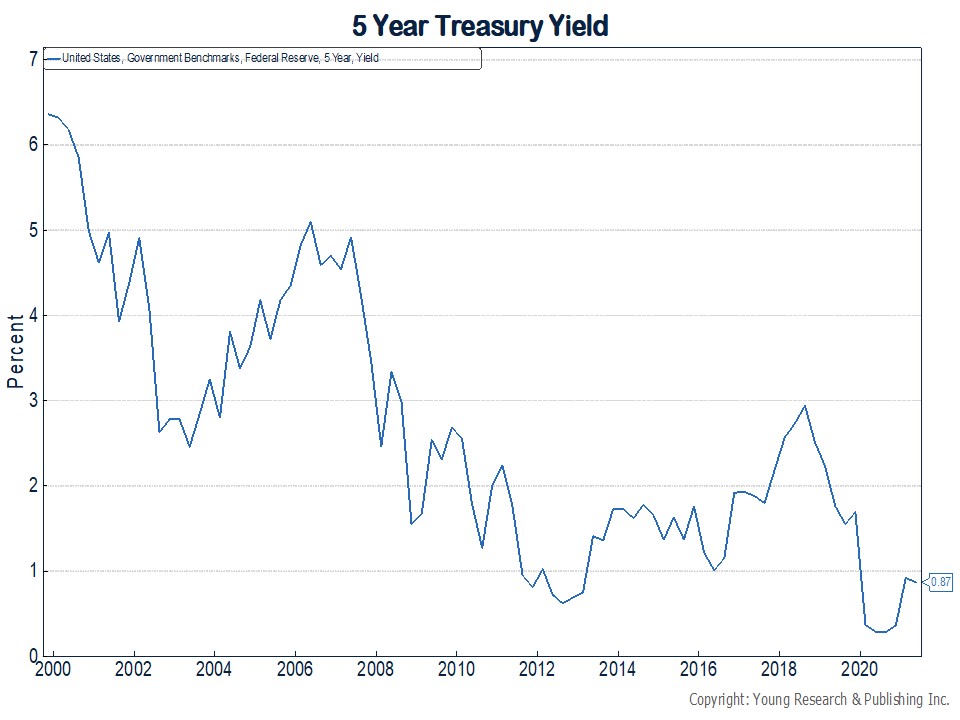

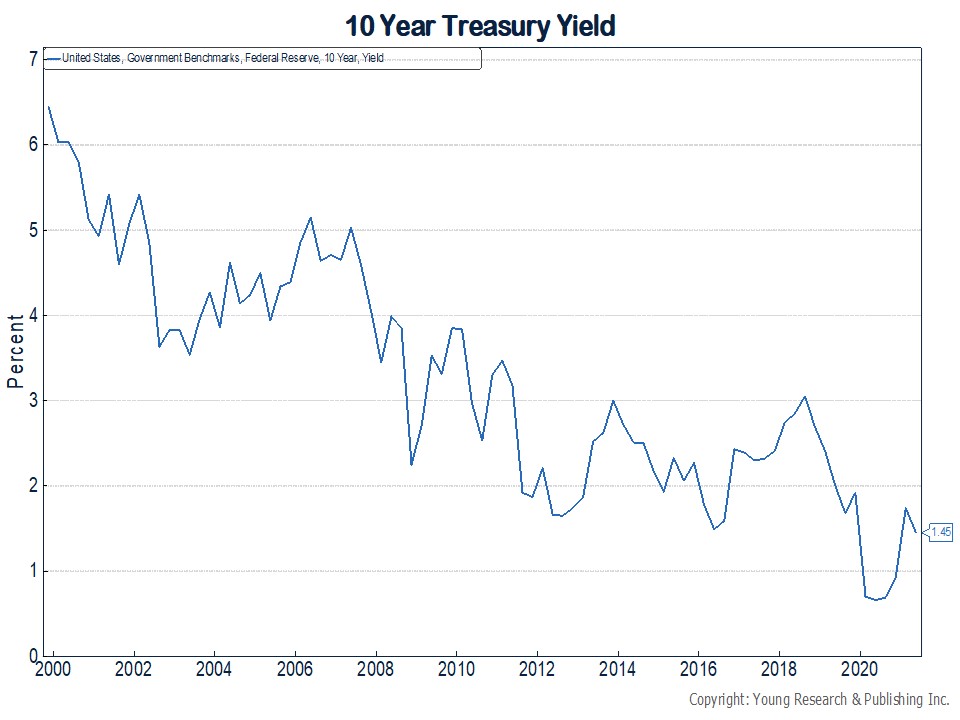

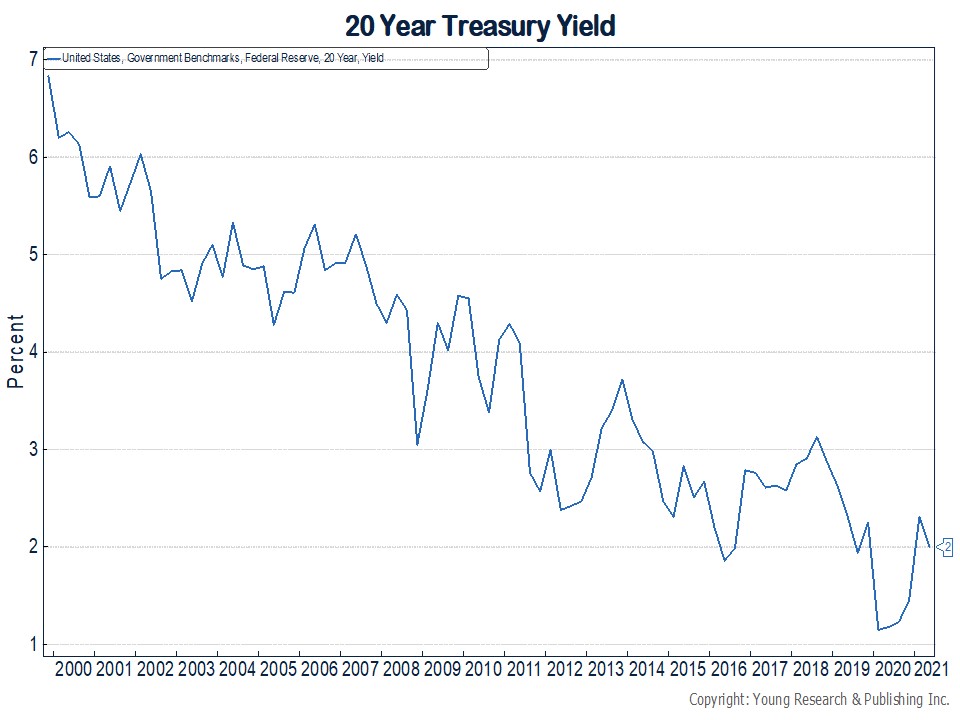

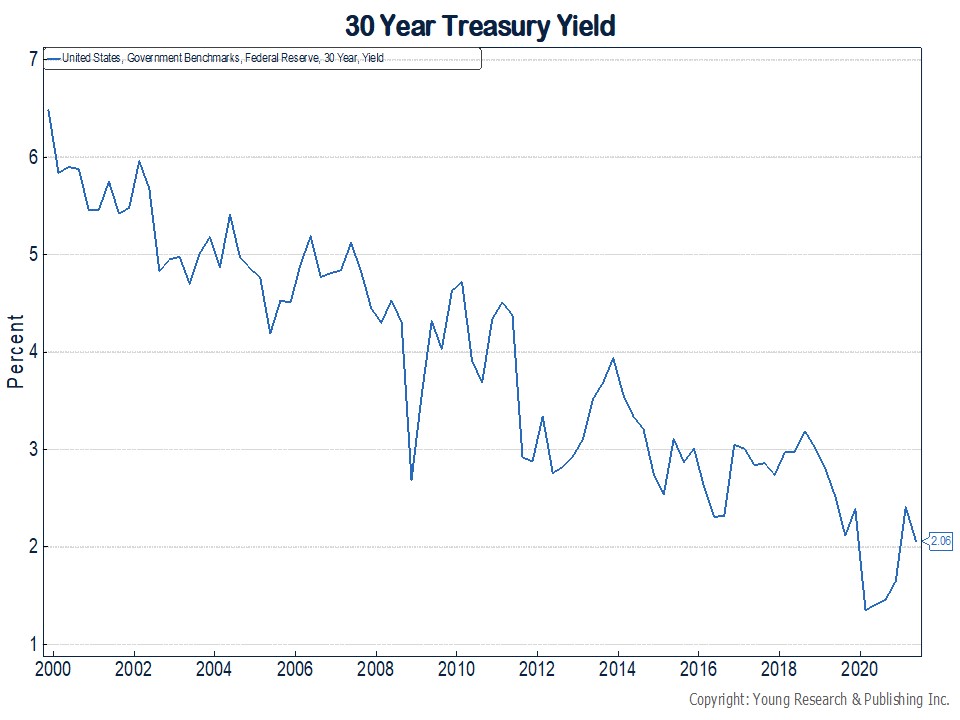

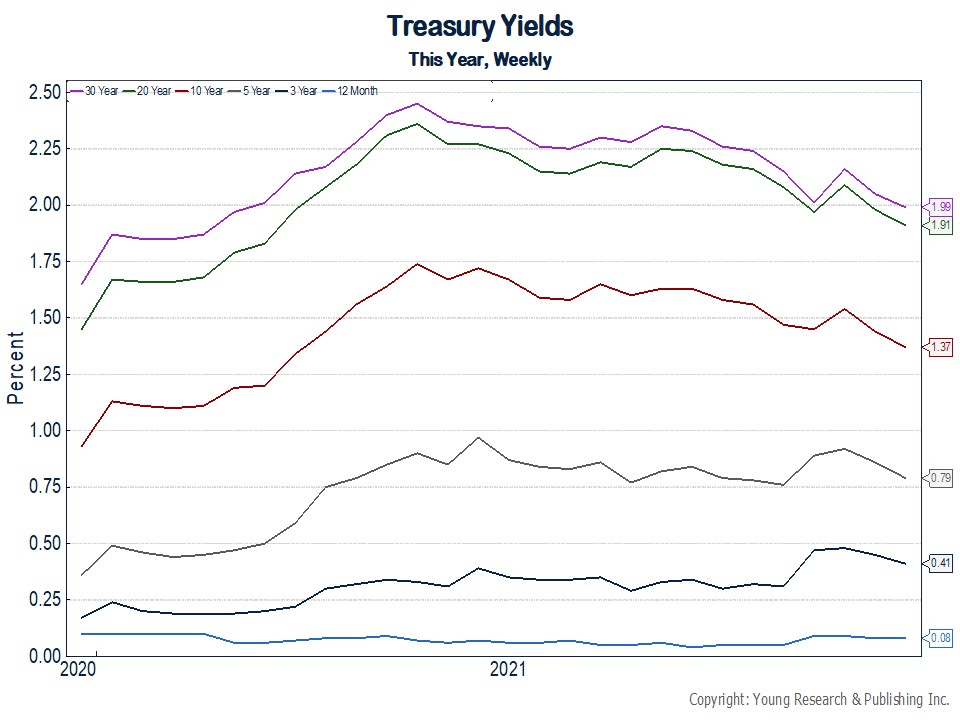

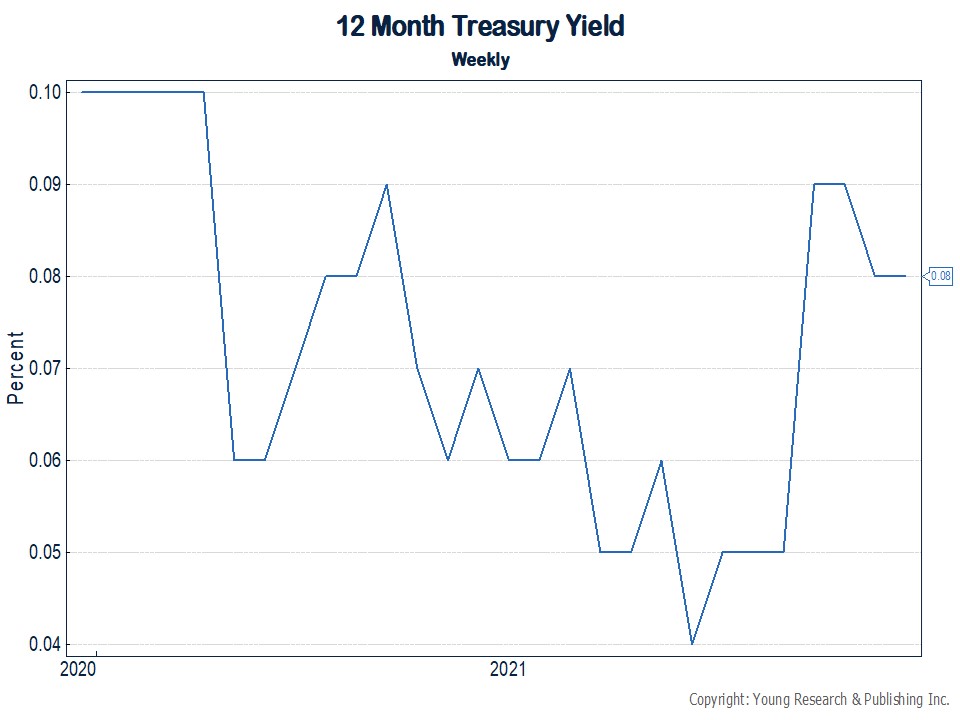

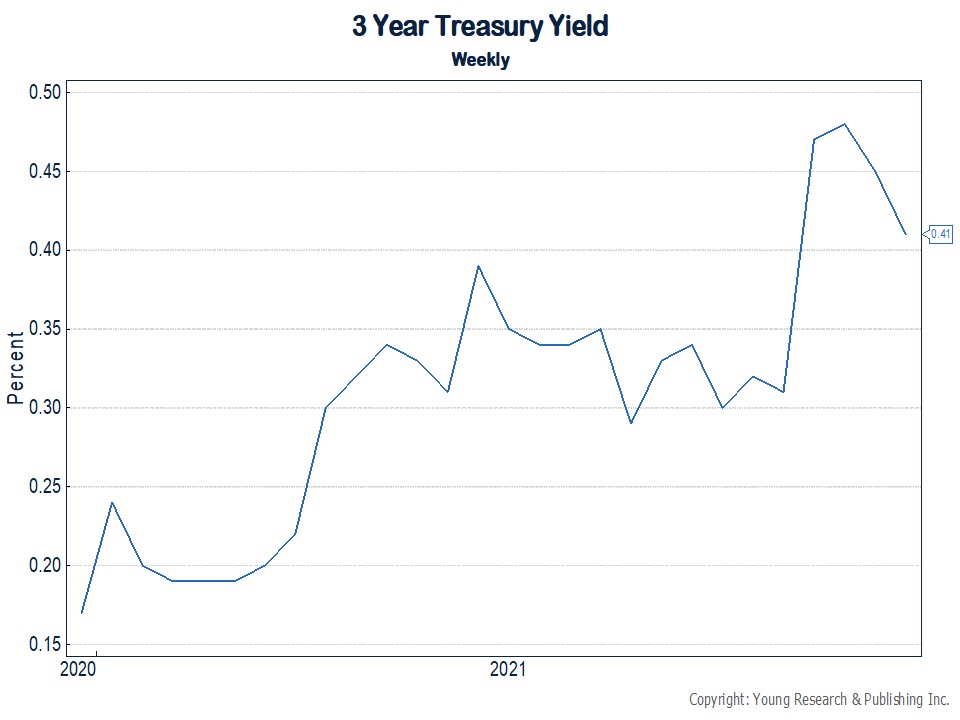

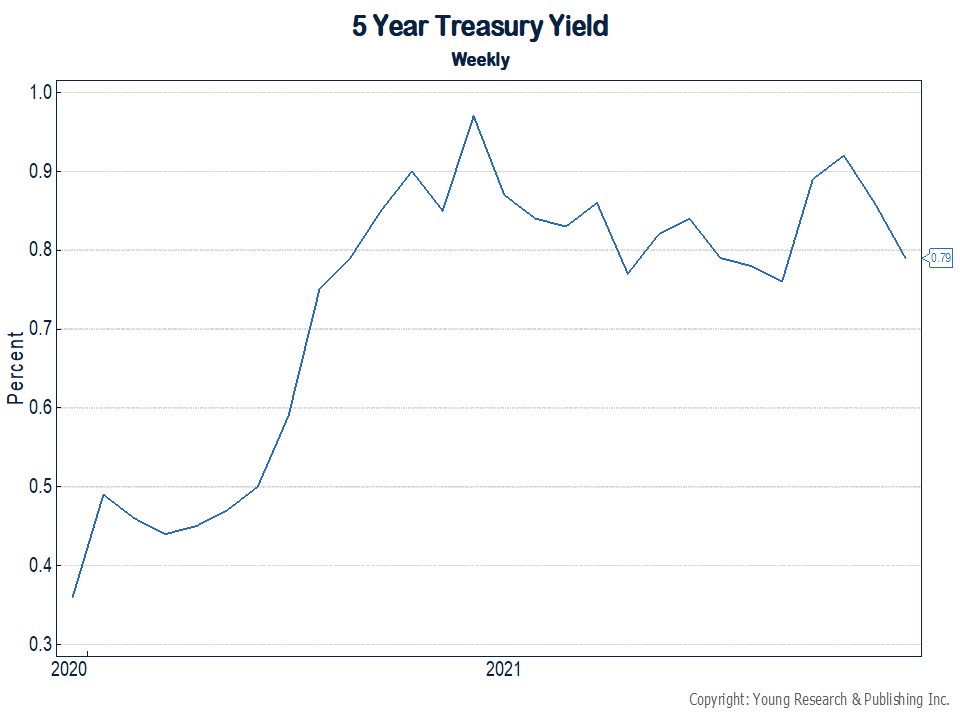

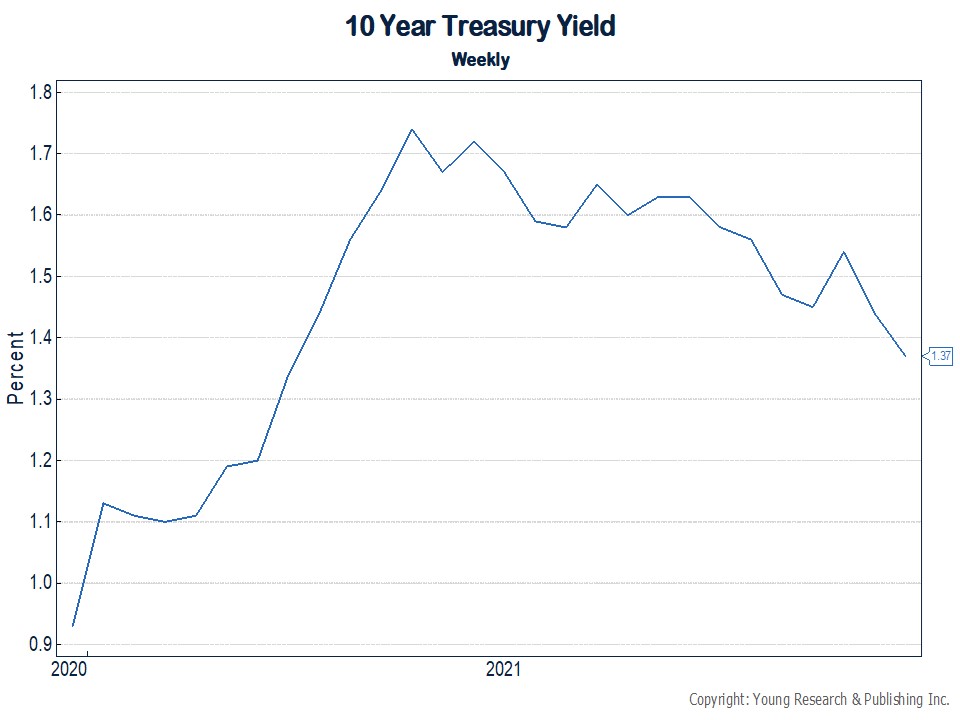

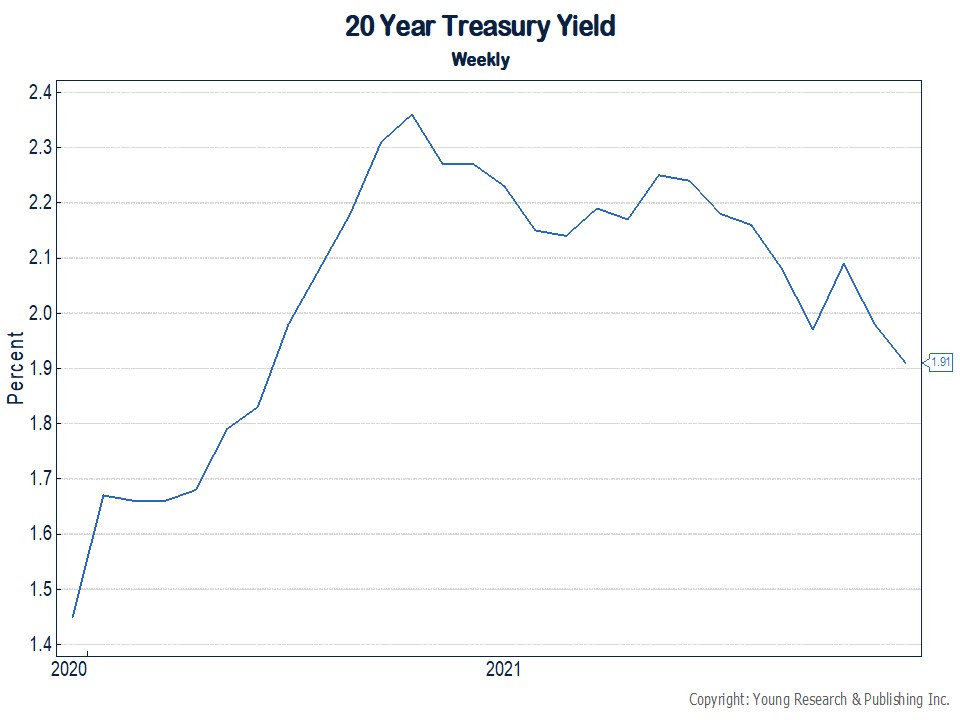

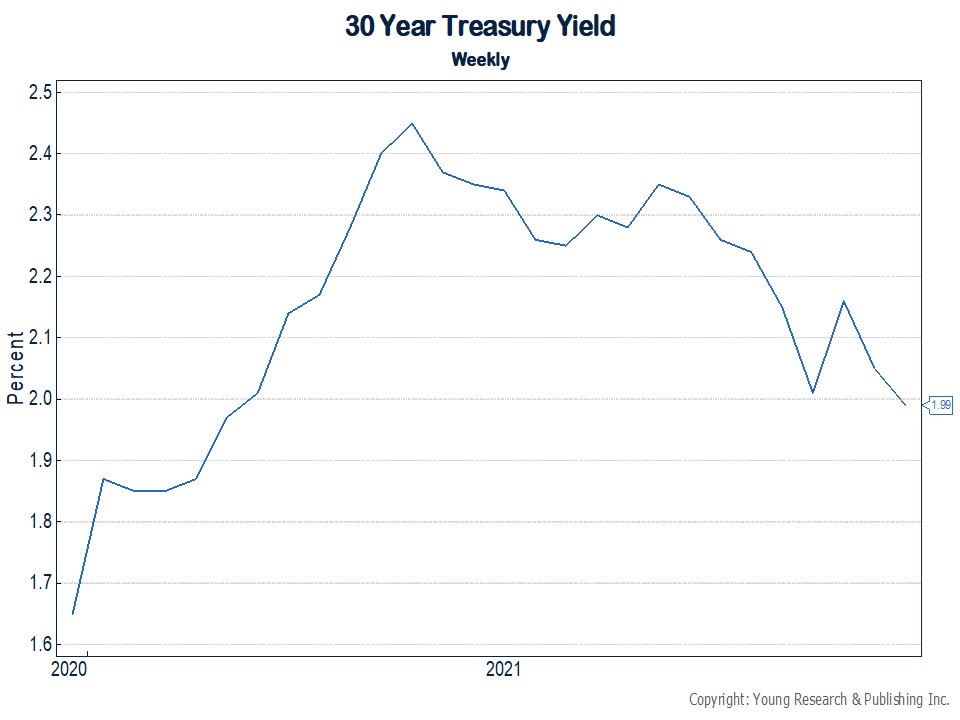

As I wrote to you yesterday, Your Survival Guy recently received a chart package that leaves a lot to be desired. I’m talking about the desperate state of the yield on Treasuries thanks to three nasty cracks in the stock market so far this century. Note: When stocks fall, Treasury prices usually rise as investors flee to the full faith and credit pledge of U.S. government bonds, for whatever that’s worth. Take a minute to see how low yields are (which move in the opposite direction of bond prices).

The series of charts below runs from the beginning of this century and displays maturities from as short as 12-months to as long as 30-years. The first set of charts shows you each maturity individually so far this century.

This next series narrows in, like a magnifying glass, to just this year. See below:

Clearly, the big pictures shows how the Fed has run out of room to cut rates and, if it needs to come to the rescue again, it will need to be “creative.” In other words, we’re in uncharted territory where government officials operate “on the fly.” What could possibly go wrong?

And, in the magnified look, you can see the volatility and the carnage created by the daily swings, especially with the longer maturities.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024

- Microsoft Earnings Jump on AI - April 26, 2024

- Your Survival Guy Breaks Down Boxes, Do You? - April 25, 2024

- Oracle’s Vision for the Future—Larry Ellison Keynote - April 25, 2024