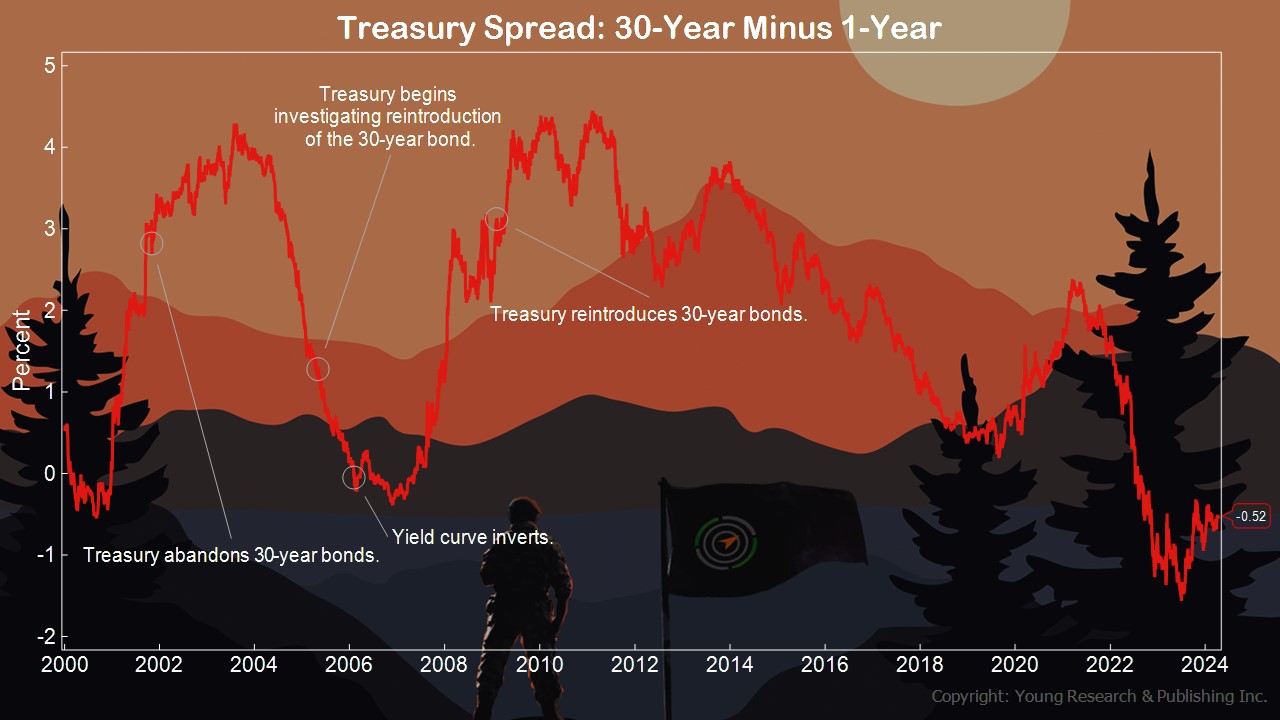

In October of 2001, Under Secretary for Domestic Finance at the Treasury Department, Peter Fisher, explained that the United States would stop issuing bonds in 30-year maturities because short-term debt was so much cheaper. At the end of Q3 2001, 30-year Treasuries had a yield of 5.42%, while 10-year bonds yielded 4.6%, and and the government could borrow for 12 months at 2.49%. The spread between 30-year and 12-month Treasuries was 2.93%. CNN Money reported at the time:

NEW YORK (CNNmoney) – The U.S. government said Wednesday it no longer will issue 30-year Treasury bonds because they don’t meet the government’s cash needs and discontinuing them will save U.S. taxpayers money.

“We do not need the 30-year bond to meet the government’s current financing needs, nor those that we expect to face in coming years,” Peter Fisher, the Treasury Department’s Under Secretary for Domestic Finance, said in prepared remarks.

Fisher said the decision would cut borrowing costs, since the government currently pays a higher interest rate for long-term bonds than for short-term bonds.

“They’ve been moving in this direction for a couple of years, reducing the size and frequency of 30-year auctions,” said Bill Hornbarger, bond analyst at A.G. Edwards. “The big surprise is the timing, not the act itself. It happens in front of a couple of years where it looks like we’ll be running deficits.”

The price of the 30-year bond soared 5-10/32 points to 107-28/32 after the announcement, pushing its yield, which moves inversely to the price, down to 4.87 percent, the lowest in nearly three years, from 5.21 percent late Tuesday.

By the second quarter of 2006, the spread between 12-year and 30-year Treasuries was -0.02%—an inverted yield curve—and the government could borrow for 30 years for less than it could borrow for one. As the rates were closing in on each other in 2005, Treasury began investigating the idea of borrowing for 30-years again. The New York Times reported on May 4, 2005:

In a surprise announcement that roiled the bond market and cost some traders and investors millions of dollars in losses, the Treasury Department announced today that it was considering whether to resume selling the 30-year bond, the one-time benchmark of the world’s largest bond market.

The resurrection of the 30-year bond, which the Treasury stopped issuing in October 2001, comes as the Treasury confronts the enormous borrowing needs to cover the federal budget deficit. Treasury officials said today that the bond would help them be more flexible in their borrowing, which would lower costs for taxpayers.

In February of 2009, the Treasury Department reintroduced the 30-year bond. By the first quarter of 2009, the spread between 30-year bonds and 12-month bonds had expanded to 2.99%, a wider spread than when Peter Fisher explained that the 30-years were too expensive compared to short-term debt. The point of this history lesson is, never underestimate the government’s ability to make absolutely no sense whatsoever.

Action Line: Prepare your portfolio with risk in mind. Government is one of those risks. When you want to talk about risk in your portfolio, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Our Dog Louis Passed Away on April 17th - April 29, 2024

- The Burger and Fry Economy - April 29, 2024

- Less Is More at Work - April 29, 2024

- Rule #1: Don’t Lose Money - April 26, 2024

- How Investing in AI Speaks Volumes about You - April 26, 2024