Your Survival Guy’s not a big fan of municipal bonds. States with the highest taxes and the highest debt don’t seem like great investment partners to me. And with the social antipathy towards the investing class, who’s to say these states won’t change their promises? If you are undeterred by the idea of partnering with some of the least effective governments in America, Oyin Adedoyin explains the basics of municipal bond buying in The Wall Street Journal, writing:

Want to get a tax-free return on your money? Put sewers and subway systems in your portfolio.

The municipal bonds that state and local governments sell to pay for unsexy-sounding infrastructure projects are offering their highest yields in more than a decade. New bond investors snapped up Treasurys after interest rates surged this year, but the special tax advantages of muni bonds make them also worth a look, financial advisers say.

Munis, like all bonds, are debt. Local governments sell them to get money for funding big projects. Investors who hold munis generally don’t have to pay federal tax on the interest they earn, unlike their gains from savings accounts or certificates of deposit. Better still, when investors buy bonds issued in their home state, they typically don’t have to pay state taxes on that interest either. Advisers say these tax advantages often give muni bonds an edge over other investments.

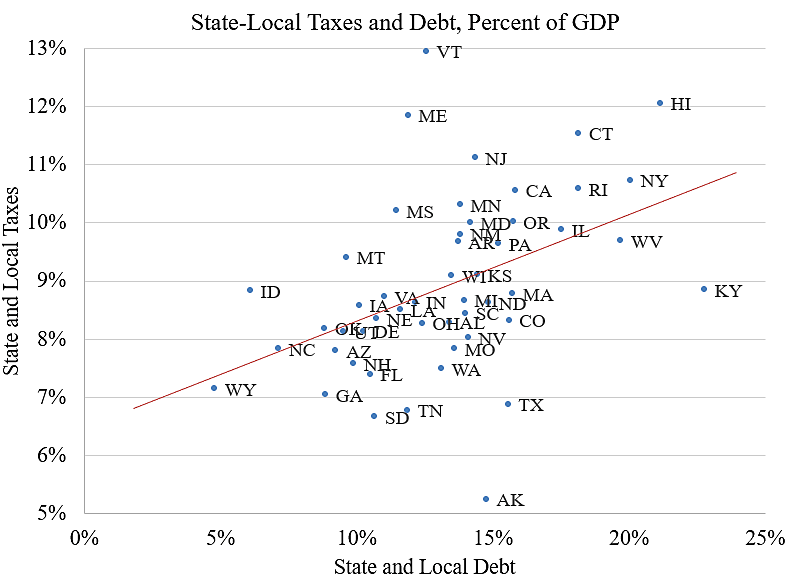

At the Cato Institute, Chris Edwards has exposed the “fiscal illusion” used by many states to mask the cost of their spending. By comparing state and local taxes and state and local debt to the state’s GDP, Edwards has created a regression that puts states’ real fiscal positions into perspective. In the lower left quadrant of Edwards’s chart are states that have low debt and taxes compared to their GDP, while the upper right quadrant is populated by states using more debt and higher taxes to fund spending. Note that Your Survival Guy’s top ten Super States of 2023 largely fall in the lower left quadrant. Edwards writes:

Government legislators pursue spending increases because they believe that spending solves problems in society and benefits their constituents. However, they use methods of fiscal illusion to try to hide the costs of spending. One method is debt. By borrowing, legislators push the costs down the road for future legislators and taxpayers to deal with.

Spendthrift legislators can get away with borrowing more and taxing less in the short run, but in the long run taxes will rise to cover the higher interest costs on the accumulating debt. Relative to state gross domestic product, state and local taxes tend to be higher in states that have higher state and local debt, as shown in the chart below. The tax and debt data are from the Census Bureau for 2021.

The chart includes a fitted regression line showing the strong positive correlation between taxes and debt. Perhaps states that borrow more end up raising taxes to cover the rising interest costs. Or perhaps states that favor higher spending tend to pursue it with both taxes and debt. There are some outliers—Kentucky has high debt and average taxes, whereas Maine and Vermont have high taxes and average debt.

People living in the top‐right states should be asking questions. Residents of Vermont, Maine, and Hawaii should be asking why their tax burdens are almost twice as high as the burdens in the lowest‐tax states. And residents of Kentucky, West Virginia, New York, and Hawaii should be asking why their states have racked up debt burdens three or four times higher than the burdens in the lowest‐debt states. And all of us should be asking why the federal government is vastly more irresponsible with debt than the worst‐run states.

Action Line: When you’re ready to talk about building a plan for your investments, I’m here.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Cheers from London - May 17, 2024

- Will AI Cause a Nuclear Renaissance? - May 17, 2024

- INFLATION: “Lower Doesn’t Mean Solved” - May 17, 2024

- Richard C. Young’s Intelligence Report: Beat Inertia - May 16, 2024

- Will Americans Ignore Joe Biden’s Inflation? - May 16, 2024