If you haven’t constructed your bond portfolio yet, then what are you waiting for? Once you’re in your 50s, the time has come to own some bonds. Consider bonds your anchor to windward. Determining how much you, not your neighbor, needs in bonds is a most personal equation. Only you and your spouse and hopefully your advisor know the right mix for you. Period. Unfortunately, those well into their golden years who put off bonds paid a devastating price in the two stock market crashes so far this century. So what are you waiting for? Imagine how you’ll feel in the third stock market … [Read more...]

Your Retirement Life: Fishing Block Island

It’s hard to beat the striped bass fishing off Block Island. In this video you see the voyage from Newport, RI to the Block for some late Summer striped bass fishing. Don Smith explains more about fishing around Block Island at On The Water: Block Island earned its reputation as a legendary striper-fishing destination many years ago. These days, her waters draw numerous charter boats and recreational fishermen, who troll, jig and drift for stripers. At the height of the season, it’s not unusual to see a hundred boats working the waters near Southwest Ledge at one time. Once the sun … [Read more...]

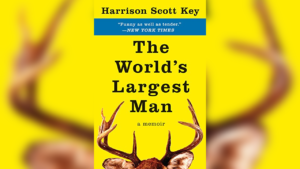

Your Retirement Life: The World’s Largest Man

Looking for a good summer read? Check out The World's Largest Man, which I wrote about here back on April 5, 2018. “E.J., Here is a little taste of Mississippi life. Enjoy!” That was the note from a client written on the inside cover of the funny as well as tender memoir, The World’s Largest Man, by Harrison Scott Key. Turns out, some parts of growing up in Mississippi aren’t that much different from any town USA. In one excerpt Key writes about how his father would read the telephone bill like some Old Testament scholar with a gift for high blood pressure. “Who called 734-908-4560?” he … [Read more...]

Your Retirement Life: Roaming the Earth

You don’t need an EarthRoamer to see America. But it would be cool if you had one. Imagine where you could go. Save your money, learn a few tricks from the experts, and create your own expedition. What are you waiting for? … [Read more...]

Your Retirement Life: Seeking Higher Yields?

You can thank low interest rates for the temptation to seek higher returns. Don’t think for a minute that risk/reward no longer applies to you. Like gravity, it’s always there, even if you can’t see it. Unfortunately it’s never fair when those with good intentions get burned. But it happens all the time. In The Wall Street Journal, Jean Eaglesham reports on a scam that duped investors for $100 million. She writes: Scott Kohn, a 64-year-old felon, ran a company from a Nevada strip-mall mailbox that investors claim took them for more than $100 million in losses. Mr. Kohn’s company, Future … [Read more...]

Your Retirement Life: The International Tennis Hall of Fame

There’s a couple of ways to get in to the International Tennis Hall of Fame: Dedicate your life to the sport and realize incredible success or, cross Bellevue Avenue from my office and enter the historic complex by foot. This week, as is tradition following Wimbledon, competitors are in town for the Dell Technologies Hall of Fame Open. It’s a wonderful time to be in Newport for players and fans alike as both mingle about town enjoying what Newport has to offer. If you’re a tennis fan and have questions about your investments, swing by for some coffee before heading across the street for the … [Read more...]

Your Retirement Life: 1972 DeTomaso Pantera, A Coyote in Wolf’s Clothing

Here’s a wonderful story about my friend Marty Quadland and the rebirth of his 1972 DeTomaso Pantera: “A Coyote in Wolf’s Clothing,” featured this month in Hot Rod: Following retirement, Quadland realized a dream of his and moved west to the mountains of Wyoming. In preparation, he downsized considerably, selling his SCCA race cars, several motorcycles, and a late-model exotic, and, for the first time, he considered selling the Pantera. His son intervened, however. “I saw the look on my son’s face when I told him I might sell it,” he recalls. “He thought the Pantera would be his someday. I … [Read more...]

Your Retirement Life: How Do You Know Where to Live in Retirement?

If you are like many soon-to-be-retirees in America, you're looking forward to getting away from your cold, northern, probably-high-tax state and settling down in retirement in a southern locale with low taxes and warm winters. But, how can you know where you'll like it best in your Golden Years? (for information on choosing a low-tax state, see the Richardcyoung.com Liberty & Freedom Map here). Last month I encouraged you to do some A/B testing. Live short-term or spend a vacation in some of the places you'd potentially move to during retirement. Without actually staying there for a … [Read more...]

Your Retirement Life: A Simple Way to Retire where You want to Live

You want to make sure your retirement plans are right for you. As I wrote to you yesterday, testing or experimenting by actually living in your chosen destination, for at least one season makes sense to me. You could also see what it’s like to be retired by taking a prolonged vacation. Put yourself in that retirement mindset. In other words, you are in charge of your retirement. It’s no secret retirees are moving to places where their money is treated with respect. But it’s beginning to become pretty crowded in certain spots. Take Nashville, TN for example. Cameron McWhirter reports at The … [Read more...]

Your Retirement Life: Live like a Billionaire Here

Originally posted on April 30, 2018. You don’t have to be a billionaire to live like one. In Montana, there are billionaires who own ranches that seem like they're the size of Rhode Island, but they don’t have a monopoly on: camping, hiking, bike riding, kayaking, fishing or skiing. Nature can be enjoyed by one and all. As an aside, you know what’s interesting about that rural life? It is alive and well. The same is true of the suburbs. Not everyone wants to live or retire to the city life. The resurgence by Millennials moving to the burbs is proof of that. For young families, there … [Read more...]